The silver rout was not about demand

Silver’s recent move has been less than about a single shock, 47% drop in positioning and exposure reflects more than caution; it reflects frustration. When silver failed to respond to supportive narratives around inflation, geopolitics, or supply constraints, capital began to exit in size.

The initial spark that lit the fuse was the nomination of Kevin Warsh.

CME Group took aggressive step of raising margin requirements for silver.

iShares Silver Trust inflow $3.5 billion in a single day.

Fed regime change

The initial catalyst was the nomination of Kevin Warsh as the next Federal Reserve Chair. For months, markets had been positioned for a continuation of accommodative policy and eventual rate cuts. Warsh’s reputation as a firm inflation hawk shattered that assumption. His nomination was read as a signal that monetary policy would remain restrictive for longer than expected.

The U.S. dollar reacted immediately, surging higher. For silver, this was decisive. As a dollar-denominated asset often used as a hedge against currency debasement, silver suddenly lost its macro support. Positions built on a weaker-dollar thesis were forced to unwind quickly, accelerating the downside.

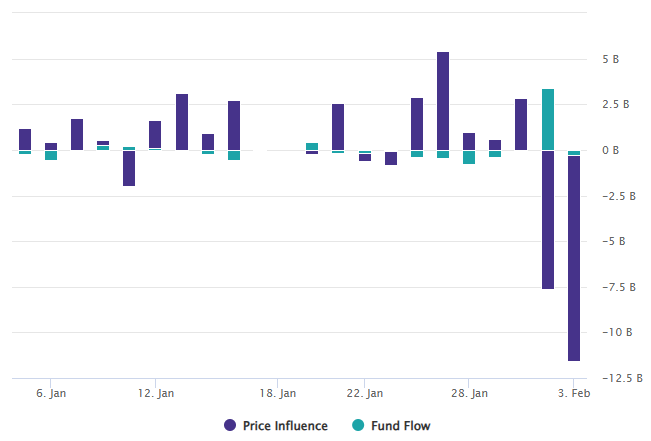

ETF large inflow and price lead the flow

iShares Silver Trust (SLV) absorbed massive inflows, including an extraordinary $3.5 billion in a single day. These flows appeared bullish on the surface, but they masked a structural vulnerability.

When prices began to fall, the mechanics of the ETF worked in reverse. Large-scale redemptions forced authorized participants to sell physical silver into an already declining market. What had been a demand surge quickly turned into a source of automated supply. Selling pressure fed on itself, creating a feedback loop where falling prices triggered more redemptions, and more redemptions pushed prices lower.

Source: ETFdb

Price leading flow

As prices collapsed, price-influenced flows plunged deep into negative territory, exceeding $11 billion. Institutional investors used the late-stage retail inflows as exit liquidity. While public money was still entering ETF, futures markets were already breaking down. The divergence was stark: retail buying met institutional selling, and the risk was quietly transferred before the market fully unraveled.

Source: ETFdb

Options trap and the CME margin squeeze

The final acceleration came from market infrastructure itself. As volatility spiked, the CME raised silver margin requirements from 11% to 15%. Traders using leverage were forced to post additional capital or liquidate immediately. Most sold.

At the same time, the options market flipped into negative gamma. Dealers who had hedged large call positions were forced to unwind those hedges as prices fell. That selling added to futures pressure, completing the cascade.