Today CPI report could shape Fed’s next move and your wallet

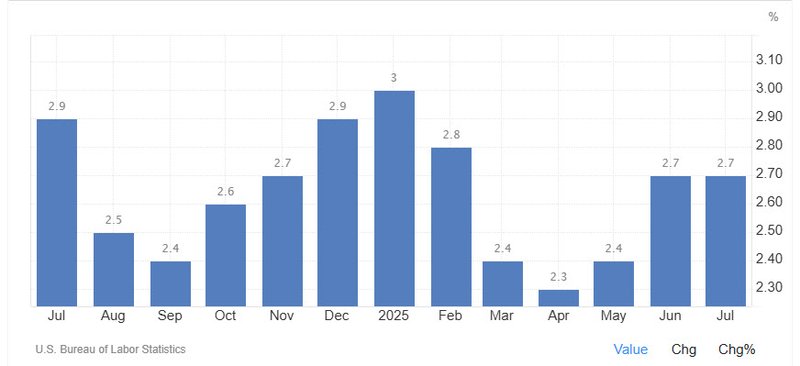

The August Consumer Price Index, due Thursday, is one of the year’s most pivotal inflation updates. With prices expected to climb 2.9% year-over-year, inflation remains stubbornly above target even as unemployment ticks higher. The report will heavily influence how quickly borrowing costs come down—and how much relief households can expect.

CPI expected at 2.9% y/y, up from 2.7% in June and July.

Producer Price Index rose 2.6% y/y, signaling continued cost pressures.

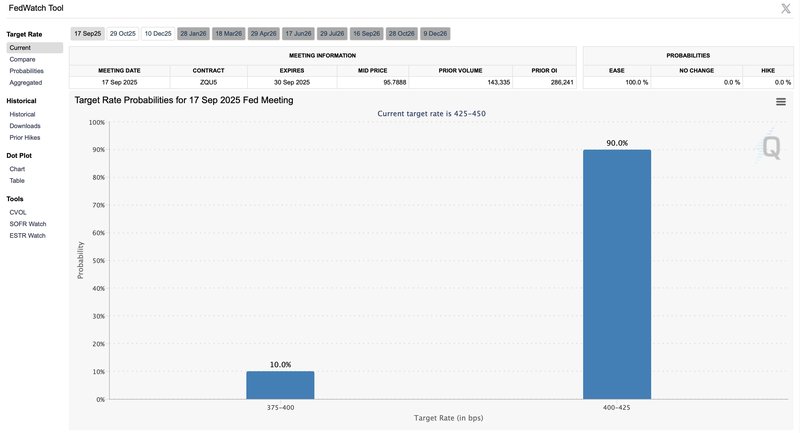

Fed meeting on Sept. 17 likely to deliver a 25 bps rate cut.

Borrowing costs for credit cards, auto loans, and personal loans may fall modestly in the coming months.

Sticky inflation in essentials like food, rent, and utilities could complicate the Fed’s path.

Inflation pressures remain stubborn

The August CPI release will provide fresh evidence on whether inflation is cooling quickly enough to satisfy the Federal Reserve. Forecasts point to a 2.9% rise compared to last year, slightly hotter than the 2.7% recorded in June and July. Together with producer prices advancing 2.6% in August, the data suggests that while inflation has eased from its 2022 peak, price growth remains too strong for comfort.

Despite progress, Americans are still paying nearly 9% more for goods and services than they did two years ago. Essentials like groceries, electricity, and healthcare continue to climb, putting sustained pressure on household budgets even as wage growth shows signs of slowing.

The Fed’s balancing act

The timing of the report could not be more critical. It arrives just days before the Fed’s September 17 policy meeting, when officials are widely expected to deliver the first interest rate cut of the year.

The central bank faces a difficult trade-off. Job gains are slowing, unemployment is edging up, and the labor force participation rate has weakened. At the same time, wages remain elevated, raising the risk of a wage–price feedback loop that could reignite inflation. The Fed must decide whether the greater risk lies in cutting too soon or holding rates too high as the economy cools.

Rate cuts on the horizon

Markets are almost certain that a quarter-point cut is coming, which would bring the Fed funds rate down to 4%–4.25%. The move would be aimed at easing financial conditions and preventing the labor market slowdown from turning into a sharper downturn.

For households, the effects will be gradual. Credit card rates may dip within a billing cycle or two, auto and personal loan costs could decline over the course of a few months, and mortgage rates will depend more on long-term bond yields. Initial savings will be modest—perhaps only a few dollars a month on revolving credit—but could grow if further cuts follow later this year.

The risks ahead

Even if September delivers a cut, the Fed’s path forward is far from certain. Inflation remains above target, and any string of hotter-than-expected reports could quickly shift the focus back to controlling price growth rather than supporting employment.

Tariffs, rising wage costs, and persistent strength in services inflation add to the uncertainty. While a one-time rate reduction looks almost assured, a series of cuts is not guaranteed unless inflation continues to cool steadily.

The August CPI report is not just another data release—it is a defining moment for the Fed’s policy path and for household finances. Inflation has eased from its extremes but remains elevated, while the labor market is clearly losing momentum.

For now, a September rate cut looks locked in. The real question is whether this marks the beginning of a broader easing cycle, or just a cautious adjustment in an economy still struggling to tame price pressures.