UK macro data suggests sterling may struggle through early 2026

The British pound enjoyed a strong 2025, rising roughly 7.5% against the US dollar, yet recent macro releases indicate that under the surface the UK economy is softening, which may limit further appreciation and challenge market consensus on GBP strength.

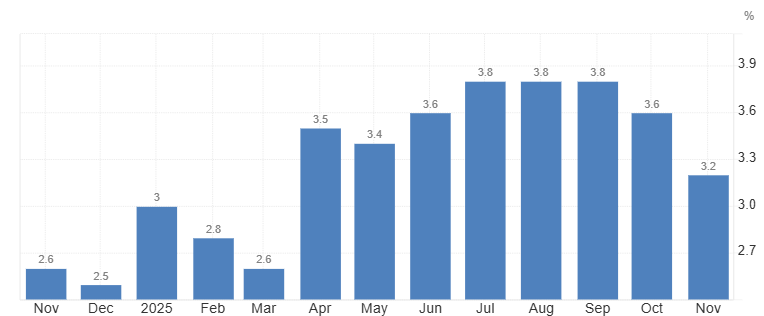

CPI around 3.2–3.6% well above the BoE’s 2% target.

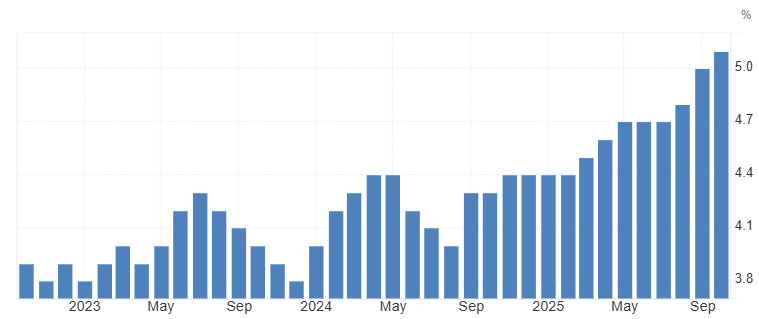

Unemployment has drifted toward 5%, and wage growth expectations have eased.

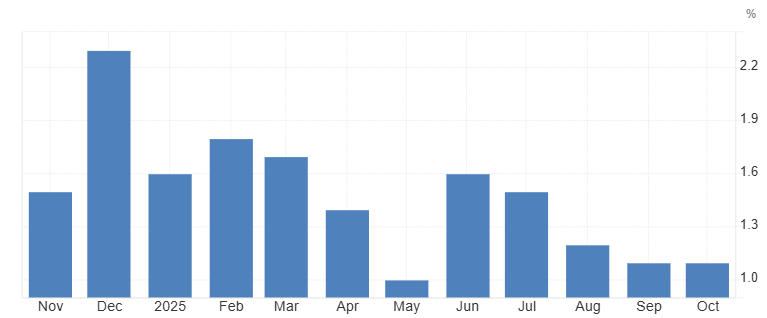

UK GDP may only expand around 1.0–1.2% in 2026.

Inflation & consumer spending

Latest UK inflation data and business surveys indicate that inflation remains elevated, with headline CPI holding around 3.2–3.6%, well above the Bank of England’s 2% target. Firms’ wage and price expectations remain high, signaling that cost pressures are still embedded across sectors. This stickiness has already led the BoE to slow the pace of rate cuts, with the Bank Rate trimmed to 3.75% in December. Given the persistence of inflation, markets now price only one to two additional cuts in 2026, suggesting the BoE is likely to adopt a measured, data-dependent approach in Q1, avoiding aggressive easing unless inflation surprises to the downside.

Consumer and activity indicators paint a similarly cautious picture. Retail sales and household spending softened over the festive season, and major retailers reported weaker discretionary demand. At the same time, consumer credit growth remains near multi-year highs, implying households are sustaining consumption through borrowing rather than real income growth. Taking together, these dynamics suggest that in Q1 the BoE is likely to prioritize price stability overgrowth support, proceeding with small, carefully timed adjustments while monitoring whether easing financial conditions begin to stimulate spending without reigniting inflation.

Source: Office for National Statistics

Labour market & wages

Unemployment has drifted toward 5%, while wage growth expectations have eased modestly from mid‑2025 highs. This indicates that the labour market, while not weakening sharply, is softening enough to dampen household income growth and limit upward pressure on inflation from wages. Combined with soft retail sales, constrained discretionary spending, and elevated consumer credit use, these labour trends suggest that the Bank of England is likely to adopt a measured, data-dependent approach in Q1 2026, prioritizing the control of sticky inflation over aggressive stimulus.

Small, carefully timed rate adjustments may be implemented if inflation shows signs of easing, but the BoE is unlikely to accelerate cuts without further evidence of broad-based economic weakness. For sterling, this muted wage and employment momentum implies limited upside from domestic fundamentals, supporting a scenario of sideways or mildly weaker GBP performance against major peers during the first quarter, with any gains likely capped by persistent inflationary stickiness and cautious monetary policy.

Source: Office for National Statistics

GDP & growth outlook

UK GDP growth is projected to remain subdued, with expansion likely limited to around 1.0–1.2% in 2026. This reflects weaker domestic demand, soft household spending, and modest business investment, despite pockets of strength in energy transition and technology sectors. The sluggish growth trajectory reinforces the Bank of England’s cautious, data-driven approach, suggesting that any interest rate adjustments in Q1 will be measured and targeted rather than aggressive.

For sterling, this slow growth backdrop, combined with sticky inflation and elevated borrowing, implies constrained upside, supporting a scenario of sideways or modestly weaker GBP performance against major currencies in the first quarter, with market attention focused on BoE communication and incoming macro releases.

Source: Office for National Statistics