US 10-year yields market repricing

US 10-year Treasury yields moved decisively higher in post-holiday trading, pushing above the 4.25% level and marking the highest yield seen since early September. The upcoming PCE inflation readings are especially critical, as they represent the Federal Reserve’s preferred inflation gauge. evidence of cooling inflation or weakening consumer demand could stabilize yields.

Rise in yields has taken on a risk-premium character.

Balance between treasury supply and foreign demand.

4.40–4.50% emerging as a stress-zone.

Confidence shock hits treasuries

US 10-year Treasury yields moved decisively higher in post-holiday trading, pushing above the 4.25% level and marking the highest yield seen since early September. The move reflected a combination of thin liquidity conditions and a deterioration in investor confidence tied to rising geopolitical and trade-related tensions between the United States and Europe. Rather than a classic inflation-driven selloff, the rise in yields has taken on a risk-premium character, with investors demanding higher compensation for holding long-dated US assets.

Bond markets reacted to growing uncertainty surrounding transatlantic relations, with fears that trade disputes could spill over into capital flows. Analysts have highlighted Europe’s substantial exposure to US financial markets, estimated near $10 trillion across bonds and equities as a potential vulnerability if tensions escalate. Even the perception that foreign official or institutional investors might reassess US exposure is enough to pressure Treasury prices, particularly at the long end of the curve.

Rising term premium

European investors, including public institutions, remain among the largest holders of US Treasuries. While large-scale liquidation is unlikely, even a slowdown in reinvestment or hedging behavior can materially affect long-end pricing. This dynamic has contributed to a rising term premium, as investors demand additional compensation for holding longer maturities amid political and fiscal uncertainty. Unlike traditional inflation-driven selloffs, this repricing reflects concern over who will fund US deficits and at what cost.

Inflation back in focus

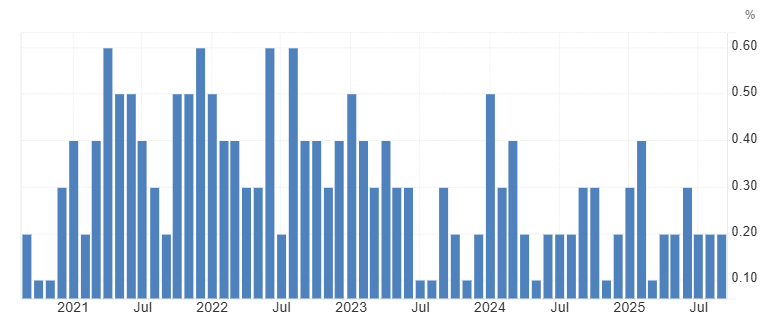

Core PCE would reinforce the case for yields remaining elevated, particularly if recent disinflation momentum shows signs of stalling. Notably, since April 2021, when monthly core PCE last printed at 0.6%, inflation has failed to register a similarly elevated reading, underscoring how much price pressures have moderated from their post-pandemic peak.

More recently, inflation progress has shown signs of leveling off. Core PCE printed at 0.2% for three consecutive months in July, August, and September 2025, indicating stability rather than continued deceleration. While these readings are consistent with the Fed’s longer-term target, the lack of further improvement has increased sensitivity to any upside deviation. Even a move toward 0.3% would be interpreted by markets as a potential warning that inflation is proving stickier than expected.

Source: U.S. Bureau of Economic Analysis

What keeps the yields elevated

Looking ahead, the sustainability of yields above 4.25% depends less on domestic growth and more on confidence and capital flows. Escalating trade tensions with Europe introduce a non-traditional risk: the possibility that foreign holders reassess their exposure to US assets.

Yields are likely to remain range-bound but biased higher, with 4.20% acting as near-term support and 4.40–4.50% emerging as a stress-zone if geopolitical or inflation risks intensify. A meaningful decline in yields would require clear evidence of inflation undershooting expectations or a de-escalation in trade rhetoric that restores confidence in US asset stability. Until then, the 10-year Treasury is likely to trade less as a defensive safe haven and more as a barometer of political risk and global trust in US policy direction.

Source: Trading economics