U.S. Dollar between delayed PCE and initial jobless claims

U.S. dollar is holding its ground as markets digest a strong signal from the labour market while positioning cautiously ahead of the delayed Personal Consumption Expenditures (PCE) inflation report.

Initial jobless claims fell to their lowest level in roughly three years.

Policymakers have little pressure to rush toward easing aggressive policy.

DXY remains supported by this uncertainty.

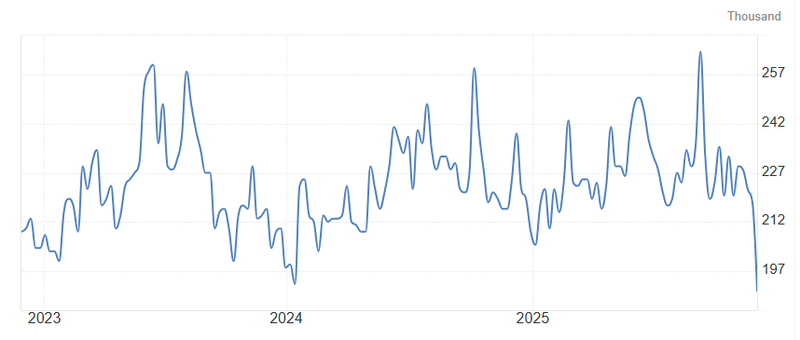

Initial jobless claims

Treasury yields remain solid and short-term rate expectations balanced, price action across FX reflects a market unwilling to commit aggressively in either direction until fresh inflation evidence arrives. Yesterday initial jobless claims report reinforced the message that the U.S. labour market remains tight. New data fell to their lowest level in roughly three years. This strength in employment continues to reduce the immediate risk of a sharp economic slowdown. For the Federal Reserve, the persistence of labour market strength remains a central challenge.

Source: U.S. Department of Labor

Uncertainty is still dividing the Fed camp

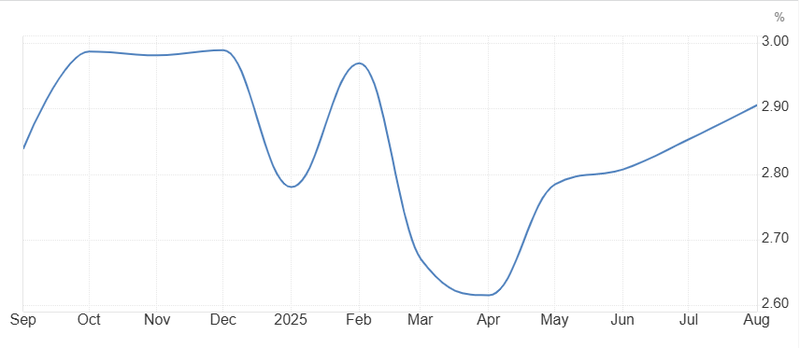

Policymakers have little pressure to rush toward easing aggressive policy but focus now shifts to the postponed PCE inflation report, PCE captures a broader consumer spending basket and better reflects shifts in behaviour. This makes it particularly important at a stage when policymakers are trying to determine whether disinflation is becoming firmly entrenched or stabilizing at an uncomfortably high level. Markets have increasingly priced in a policy shift toward easing, but that expectation has been built more on forward-looking sentiment indicators and soft survey data rather than on a decisive downtrend in core inflation. Today PCE reading therefore carries unusual weight. A soft print would reinforce confidence that inflation is moving back toward target and could strengthen expectations for a near-term rate cut. upward surprising print would quickly revive “higher-for-longer” concerns.

Source: U.S. Bureau of Economic Analysis

DXY at a turning point

DXY remains supported by this uncertainty. Elevated long-term yields continue to offer attractive carry, especially against currencies where central banks are already more decisive toward easing. At the same time, markets cannot confidently price a rapid sequence of rate cuts without confirmation from inflation data. From a bigger perspective, the dollar reflects an unstable and uncertainty unusual macro mix: slowing inflation but solid growth; restrictive rates but a labour market that refuses to weaken materially. This combination keeps U.S. assets attractive on a relative basis and sustains defensive demand for the dollar. The next directional move for DXY is likely to be decided on whether today PCE data confirms that inflation is decelerating enough to give policymakers genuine room to ease.