Venezuelan oil claims clouded as Maduro’s fall reshapes the energy outlook

The fate of billions of barrels of Venezuelan oil claimed by foreign companies has been thrown into uncertainty after the US capture of President Nicolás Maduro, reopening questions over ownership, production recovery and the country’s role in global oil markets.

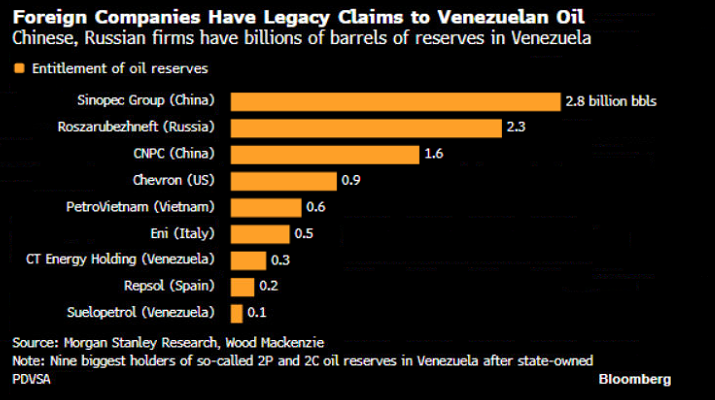

Chinese and Russian state firms hold the largest foreign claims on Venezuelan oil reserves.

Political transition could unlock higher production but also disrupt existing contracts.

Oil markets are weighing long-term supply upside against near-term instability.

Debt, geopolitics and investment rules will shape Venezuela’s post-Maduro trajectory.

Foreign oil claims enter uncharted territory

The future of Venezuelan oil entitlements held by foreign companies has become uncertain following Washington’s capture of Nicolás Maduro. Existing agreements that grant overseas partners access to billions of barrels are now under scrutiny as the political balance shifts and questions emerge over who will honor past contracts.

According to Morgan Stanley, state-owned Chinese and Russian firms account for the largest external claims, though these remain small relative to the vast reserves controlled by Petróleos de Venezuela SA. The issue is less about geology and more about governance: who controls production decisions, export flows and contractual continuity.

Source: Bloomberg

China and Russia hold the biggest stakes

Among foreign players, China Petroleum & Chemical Corp. is entitled to roughly 2.8 billion barrels, followed by Roszarubezhneft and China National Petroleum Corp. Smaller claims are held by European and Asian firms, including Chevron, Eni and PetroVietnam, alongside Indian state companies with more limited exposure.

Analysts note that Beijing and Moscow are likely to adopt a wait-and-see approach. Short-term disruptions to flows and assets are possible, but history suggests both countries may seek a path back into Venezuela if a new political framework stabilizes.

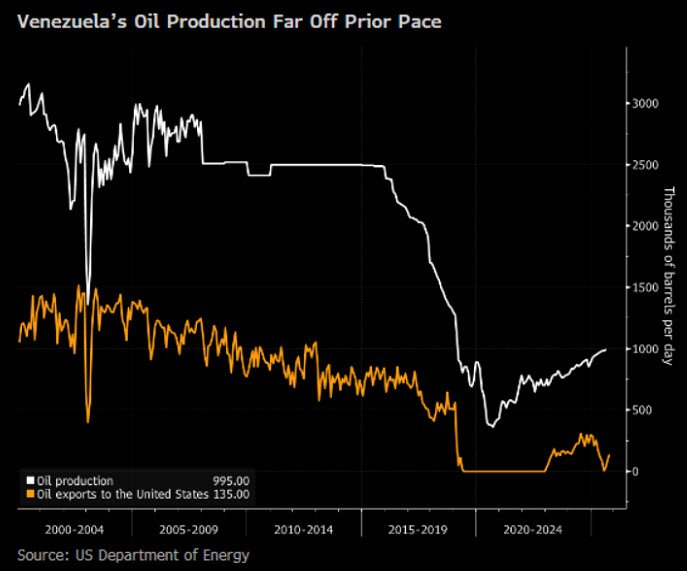

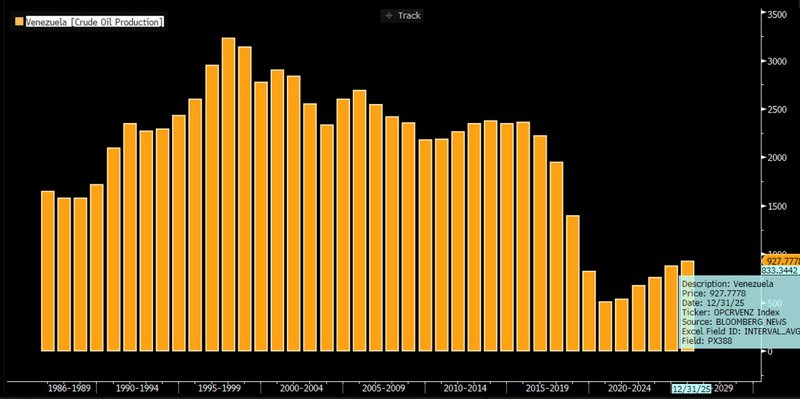

Production outlook tilts upward — eventually

The central question for markets is what happens next to Venezuelan oil output. From a purely technical and resource perspective, analysts argue that medium-term risks to production are skewed to the upside. Years of underinvestment and mismanagement have left significant spare potential, assuming sanctions ease and foreign capital returns.

Source: Bloomberg

Bloomberg Economics estimates that a credible transition government could set the stage for a multi-year recovery toward production of around 2.5 million barrels a day, compared with less than one million currently. Such a rebound, if realized, could shave as much as 4% off global oil prices over time, adding to an already fragile supply-demand balance.

Source: Bloomberg

Two diverging scenarios for markets

In a positive scenario, Venezuela moves quickly toward a caretaker administration committed to elections and economic normalization. That path could trigger a rally in defaulted sovereign bonds, open the door to debt restructuring and gradually reintroduce Venezuelan crude to global markets.

Source: Bloomberg

A darker scenario involves a power vacuum, internal conflict and prolonged instability. In that case, oil output would likely remain constrained, foreign claims unresolved and the humanitarian crisis deepened — with limited immediate impact on global oil prices, which already reflect strict US enforcement.

Wider geopolitical implications

Beyond energy markets, the episode carries broader consequences. A smooth transition could ease migration pressures across Latin America and enhance US influence in the region under Donald Trump’s administration. Failure, however, risks legitimizing unilateral intervention by major powers at a time when the global order is already under strain.

For oil traders and policymakers alike, Venezuela has returned to the center of the map — not as a short-term supply shock, but as a long-duration variable with the potential to reshape regional politics, debt markets and global crude balances for years to come.