Bitcoin ETF investors fall into losses as price slips below the $89,600 mark

Bitcoin’s slide below the key $89,600 threshold has pushed the entire cohort of spot-Bitcoin ETF investors into collective losses for the first time since the products launched. After a record-breaking October, the market’s sharp reversal is testing investor conviction as nearly $3 billion exits the ETFs in November.

Average ETF cost basis sits near $89,600 — now underwater

Bitcoin has dropped more than 30% from its October peak

November outflows from U.S. spot bitcoin ETFs exceed $2.8 billion

Long-term profits remain for inflows made between $40k–$70k

Bitcoin’s ETF boom turns into a stress test

The wave of enthusiasm that carried bitcoin to fresh records in early October has flipped just as quickly into a market-wide drawdown. the easy-access, wall-street-friendly ETFs that helped accelerate bitcoin’s ascent are now showing their first broad losses.

Flow data compiled by Glassnode shows that the average cost basis for all U.S. spot bitcoin ETF inflows is roughly $89,600. with bitcoin sliding below that level on Tuesday, the entire ETF investor base—retail and institutional—is officially in the red.

Source: Coinmarketcap

The figure represents a flow-weighted average: the deeper bitcoin trades below that line, the more psychological pressure ETF holders face. The shift comes fast on the heels of October’s euphoria, when institutional flows surged following Donald Trump’s presidential victory and expectations of more crypto-friendly policy.

A sharp reversal shakes confidence

Bitcoin is now down more than 30% from its highs, a selloff driven by a cocktail of risk aversion, profit-taking by long-term holders, and tightening liquidity conditions globally.

the downturn has blindsided parts of wall street that viewed etfs as a stabilizing anchor for crypto flows, assuming steady institutional participation would dampen volatility.

Instead, the market has delivered a blunt reminder that bitcoin’s volatility does not disappear simply because the wrapper is regulated.

While early-cycle buyers who accumulated between $40,000 and $70,000 remain comfortably in profit, more recent inflows are bearing the brunt of the decline.

Outflows intensify as sentiment flips

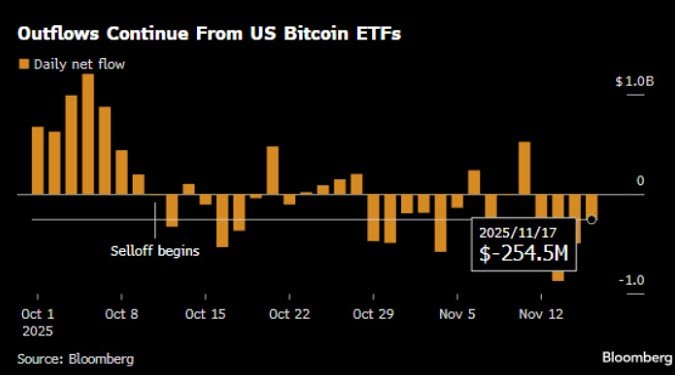

The group of 12 U.S. spot bitcoin ETFs has recorded over $2.8 billion in net outflows so far in November, according to Bloomberg data. that marks one of the heaviest withdrawal periods since the products debuted.

Source: Bloomberg

At the same time, crypto-linked ETFs have exploded in number, with more than 110 crypto-focused funds now trading in the U.S. the rapid proliferation underscores both investor appetite and the competitive pressure among issuers—yet it also magnifies the impact of sentiment swings, as flow-driven price moves can quickly accelerate.

The big question: conviction or capitulation?

With bitcoin’s price cutting through layers of support, the next moves from both retail buyers and institutional allocators will define whether this correction becomes a deeper downturn or sets the stage for the next leg higher.

For now, the breach of the $89,600 cost basis marks a psychological break point—and a real-world stress test for the credibility of bitcoin’s new institutional era.

The coming sessions will reveal whether investors see the pullback as an opportunity… or a warning sign.