Bitcoin stalls near $90k as traders brace for the Fed

BTC is range-bound ahead of the Fed, with spot ETF flows tilting defensive and a fresh Strategy buy underscoring demand under the surface. Macro week keeps crypto on a short leash.

BTC holds $90k–$92k in thin trade

U.S. spot BTC ETFs see ~$60.5M net outflow

ETH and XRP spot ETFs attract ~$35.5M and ~$38.0M

“Strategy” adds 10,624 BTC at ~$90,615 average

Market overview: tight range, tighter nerves

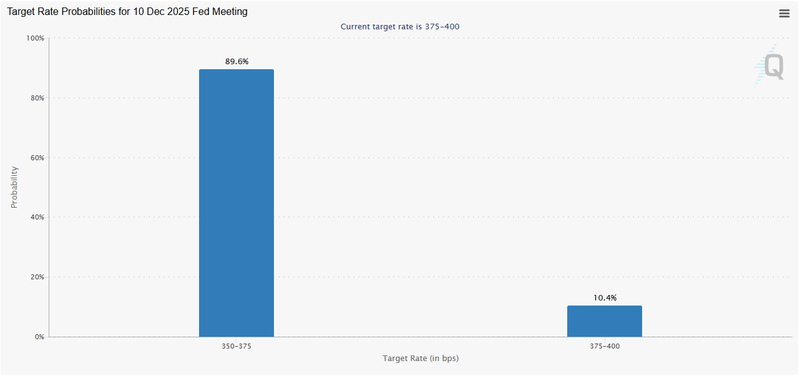

Bitcoin hovered between $90k and $92k early Tuesday as risk appetite stayed muted into the Fed decision window. With headline risk elevated, intraday direction leaned on ETF prints and cross-asset signals rather than outright trend. As markets price 89% possibility of interest rate cut in Wednesday meeting.

Source: CME Group

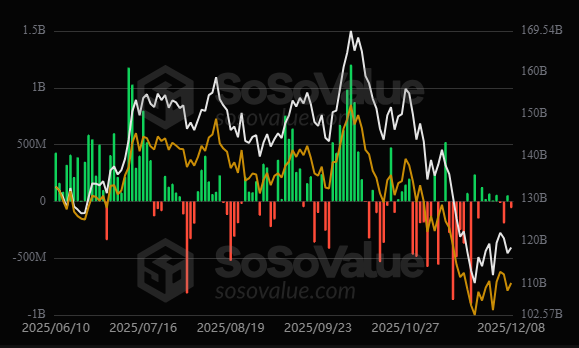

Flows: Bitcoin ETF bleeds, ETH/XRP inflows higher

U.S. spot Bitcoin ETFs posted a combined ~$60.5M net outflow on Dec 8 (ET). Under the hood, IBIT notched modest inflows, but redemptions elsewhere outweighed buys. By contrast, spot Ethereum ETFs drew roughly ~$35.5M and spot XRP ETFs added about ~$38.0M, hinting at a rotational bid within large-cap crypto rather than fresh net demand.

Source: SosoValue

Corporate bid: Strategy buys the dip

Strategy (formerly MicroStrategy) disclosed the purchase of 10,624 BTC for ~$962.7M at an average price of ~$90,615. The move lifts treasury holdings and signals ongoing balance-sheet demand despite elevated volatility—an anchor for spot liquidity when retail and leveraged interest fades.

Source: SaylorTracker

Macro watch: central-bank week sets the tone

The Reserve Bank of Australia held rates and warned on sticky inflation. The yen firmed after an earthquake headline and into a dense policy calendar. Markets broadly expect the Fed to cut, but positioning across risk assets—including crypto—remains cautious, capping momentum until guidance lands.

Context: 2025’s correlation hasn’t vanished

Tariffs, AI-equity swings, and shifting policy expectations have defined the year’s beta; BTC sits near $90k and risks a down year without a late flow turn. Near-term, watch:

- Fed statement and labour-risk language versus inflation persistence

- Day-two ETF flows for confirmation of rotation or renewed outflows

- Funding, perp basis, and options skew around the $85k–$92k band