Bitcoin’s decline reflects liquidity stress, not structural weakness

Bitcoin has returned to the center of market attention after a sharp sell-off to $72,800, the lowest level since November 2024. The move followed a broader pullback across high-risk assets and reflects more than short-term price volatility. Instead, it highlights the interaction between liquidity conditions, investor positioning, and ongoing macroeconomic uncertainty.

More than $705 million in leveraged crypto positions were liquidated.

Outflows approximately $1.7 billion exited Bitcoin and broader digital asset.

The pressure on Bitcoin should not be interpreted as a loss of confidence in the asset itself.

This move appears corrective rather than directional.

Liquidations and liquidity outflows

One of the primary drivers behind the recent decline in Bitcoin has been the rapid unwinding of leveraged positions. As prices moved lower, liquidation thresholds were triggered across derivatives markets, creating cascading sell orders that accelerated the downside movement. More than $705 million in leveraged crypto positions were liquidated in a short period, underscoring how crowded positioning and excessive leverage left the market vulnerable. These forced liquidations were mechanical rather than discretionary, intensifying volatility and pushing prices lower regardless of underlying conviction.

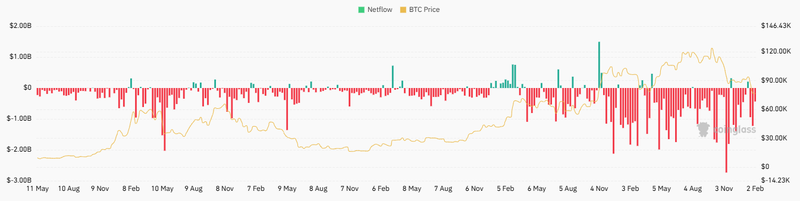

Source: Coinglass

Liquidity outflows

Alongside forced liquidations, Bitcoin also faced sustained capital outflows from investment vehicles. Approximately $1.7 billion exited Bitcoin and broader digital asset funds during the same period, indicating a clear shift in investor behavior from reinvestment toward liquidity preservation. Unlike liquidations, which are triggered by market mechanics, these outflows reflect deliberate decisions by investors to reduce exposure. Together, fund withdrawals and forced selling created a feedback loop, draining liquidity from the market and amplifying price pressure in an already fragile environment.

Source: Coinglass

Risk-off rotation

The pressure on Bitcoin should not be interpreted as a loss of confidence in the asset itself. Instead, it fits a broader risk-off rotation across global markets. During periods of tightening financial conditions, investors typically reduce exposure to assets that are both volatile and liquid. Recent profit-taking in gold, silver, and equities reinforces this pattern. Bitcoin’s decline reflects its role as a high-beta asset that investors use to raise liquidity quickly, rather than a reassessment of its long-term relevance.

Repricing in a tighter environment

Bitcoin’s recent decline reflects a necessary repricing as markets transition from expansion to capital preservation. Volatility may persist in the near term, but the current phase appears cyclical rather than structural. Once liquidity conditions stabilize and macro uncertainty fades, Bitcoin historically tends to reassert itself more decisively, suggesting that the longer-term narrative remains intact despite near-term turbulence.

Short-term rebound, not a trend reversal

While Bitcoin has shown signs of stabilization, including a rebound above $77,500 following the initial sell-off, this move appears corrective rather than directional. Price action remains consistent with a technical rebound within a broader consolidation phase. A sustained recovery is likely to require clearer signs of easing financial conditions or renewed risk appetite at the macro level.