Crypto market falls as Bitcoin dips below $111k and ETF flows fade

The cryptocurrency market extended its retreat on Thursday, with total capitalization falling by 1.4% to $3.88 trillion. Nearly all major coins traded lower, reflecting fading institutional demand and renewed macro pressures. Bitcoin slipped 2.2% to $110,774, while Ethereum tumbled 4.4% to $3,993. The selloff coincided with weaker ETF flows, a sharp futures deleveraging event, and a long-dormant Bitcoin wallet moving 2,000 BTC — stirring renewed caution across traders. Market sentiment has falle

Total crypto market cap down 1.4% to $3.88 trillion; trading volume at $194 billion.

Bitcoin fell 2.2% to $110,774; Ethereum down 4.4% to $3,993.

93 of top 100 cryptocurrencies declined; Solana and XRP led losses.

BTC ETFs saw $94M in outflows, signaling weaker institutional demand

Broad selloff sweeps across major tokens

Thursday’s session delivered widespread weakness across digital assets. Out of the top 100 cryptocurrencies, 93 traded in red, while nine of the top ten coins posted declines. Bitcoin shed 2.2%, sliding to $110,774, while Ethereum lost 4.4%, now hovering just below the $4,000 threshold. Solana suffered the steepest fall among large caps, dropping 6.8% to $192, followed by XRP’s 5.5% decline to $2.39.

Source: Coinmarketcap

The only green spot in the top ranks was Tron (TRX), which inched higher by 0.4% to $0.3216 — a small gain against a sea of red. Among mid-cap assets, Bittensor (TAO) led declines with a 14.2% plunge, while Aster and Story both recorded double-digit losses.

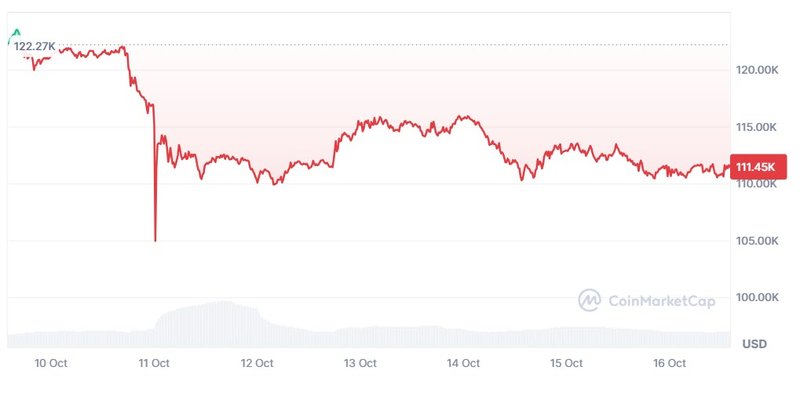

Bitcoin slides below key support zone

The latest drop pushed Bitcoin decisively below its critical $117,000–$114,000 cost-basis zone — a region that had supported top buyers throughout the past two months. his breakdown placed over 5% of total supply, mostly held by late entrants, into unrealized losses.

Source: Coinmarketcap

“Bitcoin’s rally to $126,000 reversed amid macro stress and one of the largest futures deleveraging events in history,” Glassnode reported, citing a $19 billion liquidation wave across derivatives markets. The unwind followed renewed trade tensions between the U.S. and China, which pressured risk assets broadly.

Without a renewed catalyst to lift prices above $117,100, the market risks deeper contraction toward the lower boundary of the $108,400–$117,100 range.

At press time, Bitcoin hovered around $111,120 after testing an intraday low of $110,392. Technical levels suggest resistance near $114,600, with potential upside toward $117,600. On the downside, a break below $109,500 could open the path to $100,000 — or even lower if momentum weakens further. Total crypto market cap down 1.4% to $3.88 trillion; trading volume at $194 billion.

Source: Coinmarketcap

Ethereum under pressure, miners accumulate

Ethereum mirrored the broader weakness, dropping 4.4% to $3,993. The asset has been consolidating between $3,900 and $4,700 for several months, but Thursday’s decline raised the risk of a deeper slide toward $3,700 and $3,550 if selling persists.

Source: Coinmarketcap

However, accumulation continues beneath the surface. BitMine Immersion Technologies, one of the largest institutional ETH holders, acquired another 104,336 ETH worth roughly $417 million, bringing its total holdings to 3.03 million ETH — equivalent to about $12.2 billion. The firm has stated its goal of controlling up to 5% of Ethereum’s circulating supply, signaling long-term confidence despite short-term volatility.

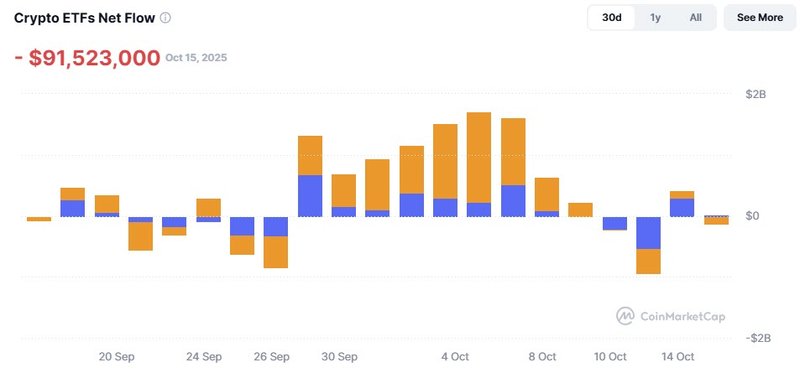

ETF flows show fading institutional appetite

Exchange-traded fund flows underscored the market’s softening tone. U.S. Bitcoin spot ETFs registered $94 million in outflows on Wednesday, erasing the prior day’s inflows. Grayscale led the withdrawals with $82.9 million, followed by $11.1 million from Invesco. Total net inflows across all BTC ETFs have now declined to $62.45 billion.

Source: Coinmarketcap

Ethereum ETFs presented a mixed picture, recording $5.32 million in inflows, primarily driven by Bitwise and Fidelity funds. Yet, the modest scale of these inflows highlights waning institutional participation as volatility returns. Analysts warned that “weaker ETF inflows signal fading demand,” particularly from professional investors who had fueled much of the rally earlier in the year.

Long-dormant bitcoin wallet reawakens

Adding intrigue to the day’s volatility, blockchain trackers observed a large, long-inactive Bitcoin wallet move 2,000 BTC — worth approximately $222 million — into 51 new addresses. While no direct exchange deposits were detected, the transfer sparked speculation that early holders may be repositioning ahead of market turbulence.

Such awakenings often coincide with shifts in market psychology, especially during periods of declining prices. On-chain analysts noted that the movement could reflect strategic reallocation rather than outright selling, but the timing added to the prevailing unease.

Sentiment slips into fear as volatility rises

The Crypto Fear and Greed Index fell to its lowest level since April, dropping deeper into the “fear” zone as traders adopt a more cautious stance. The index reflects growing uncertainty after months of volatility and diminishing ETF enthusiasm.

Analysts described the current phase as a “reset,” noting that the market remains fragile following a historic leverage flush and an overextension of bullish sentiment earlier in the year.

“Despite rapid stabilization, the market is still in a reset mode,” Glassnode’s report concluded. “Renewed ETF inflows and sustained on-chain accumulation will be key to confirming a durable recovery.”

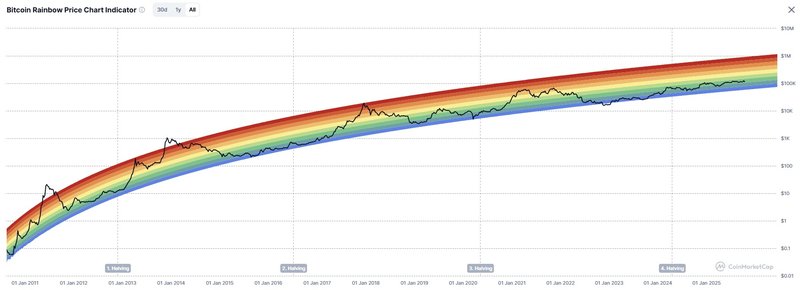

Short-term pain, long-term opportunity

For now, the crypto market remains caught between macro uncertainty and structural optimism. The near-term path likely depends on ETF inflows, macroeconomic clarity, and whether Bitcoin can reclaim the $117,000 support zone.

Still, some analysts see opportunity emerging amid the turbulence. Historically, fear-driven corrections have marked accumulation phases that precede longer bull cycles. Every major crypto rally has begun when sentiment was at its lowest — and fear was highest.