Crypto market stabilizes after global selloff

Bitcoin and altcoins recover ground after a global equity rout sent markets tumbling. Despite regulatory pressure and geopolitical fears, crypto shows signs of resilience as sentiment cautiously shifts.

Bitcoin bounces to $79,700+ after dipping below $75,000.

Altcoins like Solana and Cardano lead the rebound.

Global market selloff drags crypto, but BTC shows relative stability.

Market overview

- Total Market Cap: $2.55 trillion (↑ 1.55%)

- 24h Trading Volume: $200.99 billion (↑ 89.81%)

- Bitcoin Dominance: 62.63% (↑ 0.04%)

The crypto market stabilized on April 8, 2025, after a volatile start to the week. Rising volumes indicate renewed engagement despite ongoing global uncertainty.

Bitcoin’s performance after market shakeout

Bitcoin (BTC) dropped to an intraday low of $74,561 on Monday but rebounded sharply and now trades around $79,781, up 3.8% from the previous day.

- BTC intraday high: $80,936

- BTC Intraday low: $74,561

This resilience comes after one of the most dramatic global selloffs in recent years, with investors rebalancing risk amid tariff tensions and shifting macro conditions.

Altcoins recover alongside BTC

Major altcoins followed Bitcoin’s bounce:

- Ethereum (ETH): $1,587.62 (↑ 2.91%)

- XRP: $1.89 (↑ 6.18%)

- Solana (SOL): $110.36 (↑ 8.67%)

- Cardano (ADA): $0.5916 (↑ 7.15%)

The rebound in altcoins suggests renewed risk appetite, especially in projects with strong institutional interest and ecosystem development.

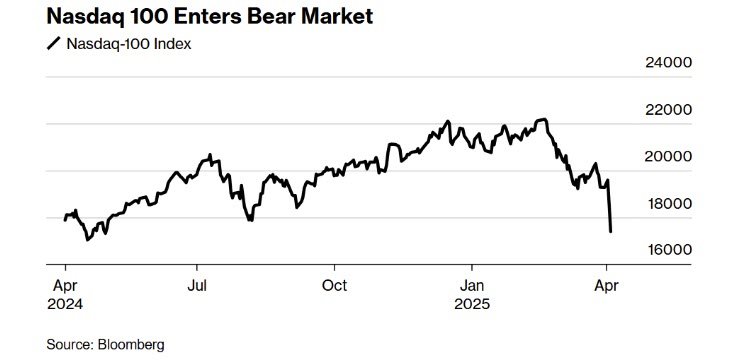

Bitcoin’s resilience amid global market turmoil

Bitcoin initially held steady while global equities saw a $5 trillion wipeout over two sessions—one of the worst selloffs since the 1987 crash. But as recession fears mounted due to new U.S. tariffs and retaliatory trade moves from China, Bitcoin lost over 7% and briefly fell below $75K.

Despite the pullback, BTC’s volatility remained lower than traditional risk assets. Long-term holders stayed calm, with the previous week marking one of the most stable price periods in months.

While gold and treasuries saw safe-haven demand, Bitcoin hovered at a crossroads—seen by some as digital gold, by others as a speculative asset vulnerable to broader macro shifts.

Market looks ahead to potential Q3/Q4 recovery

After one of crypto’s weakest quarters since 2022, many investors now expect conditions to improve in the second half of the year. A combination of liquidity stabilization, renewed institutional flows, and macro clarity could set the stage for a bullish reversal later in 2025.

This expectation is also fueling accumulation during dips, particularly in Bitcoin and large-cap altcoins.

Regulatory scrutiny increases across jurisdictions

Recent pressure on exchanges and crypto stocks intensified after President Trump’s new tariff announcements. While not directly targeting digital assets, the wider market reaction showed how sensitive crypto remains to global policy shifts.

U.S.-listed crypto firms like Coinbase (-6%), MicroStrategy (-7%), and Robinhood (-4%) all suffered sharp declines Monday, tracking broader sentiment.

Market participants continue to monitor regulatory narratives closely as they weigh the impact on capital flows and platform compliance.

Crypto markets are showing resilience despite external stressors. Bitcoin’s strong recovery from below $75K and the synchronized rebound in altcoins underscore investor confidence in long-term value.

If macro risks ease and regulatory clarity improves, the stage may be set for a new bullish phase as early as Q3. Until then, expect consolidation, selective accumulation, and a focus on quality projects and infrastructure growth.