Crypto market under Trump

Since Donald Trump’s election, the crypto market has moved sharply against early optimism. Bitcoin is down roughly 13%, while Solana has lost nearly 50%, the next major inflection point for crypto may not come from elections, but from regulation. The SEC is expected to advance new legislative measures.

Bitcoin is down 13%.

The SEC is expected to advance new legislative and enforcement frameworks.

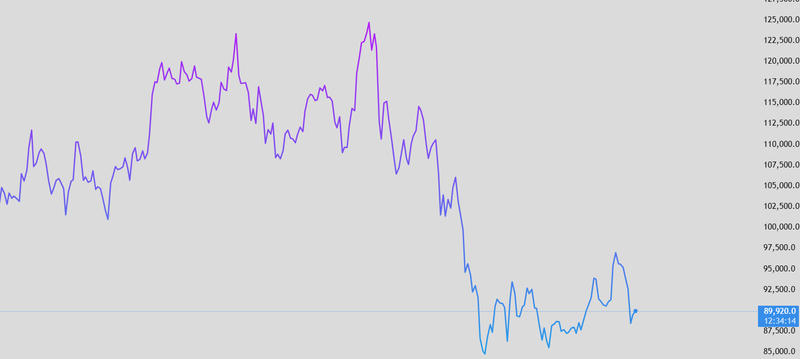

Bitcoin’s drawdown since Trump’s election looks more like a reset than a collapse.

Reality vs expectations

Since Donald Trump’s election, the crypto market has moved sharply against early optimism. Bitcoin is down roughly 13%, while Solana has lost nearly 50%, a stark contrast to the bullish narrative that followed Trump’s pro-crypto rhetoric during the campaign. Markets initially priced in a friendlier regulatory environment and faster institutional adoption, but price action suggests that investors are reassessing those assumptions. The selloff reflects not just political disappointment, but also tighter financial conditions, fading speculative demand, and growing concern that policy change will be slower and more complex than anticipated.

From a macro perspective, crypto has struggled to reclaim its role as a “Trump trade.” Higher real yields, stronger dollar dynamics, and reduced liquidity have weighed on risk assets broadly, with high-beta tokens like Solana absorbing the largest drawdowns. Bitcoin’s relative resilience compared to altcoins suggests capital is rotating defensively within crypto rather than exiting entirely.

Source: Trading View

SEC legislation as a market catalyst

The next major inflection point for crypto may not come from elections, but from regulation. The SEC is expected to advance new legislative and enforcement frameworks aimed at clarifying the legal status of digital assets, exchanges, and staking models. While parts of the industry hope for relief under a Trump administration, markets appear to be bracing for a more structured and possibly restrictive regulatory environment.

This upcoming legislation could act as a double-edged sword. In the short term, stricter rules may pressure prices by limiting speculative activity and increasing compliance costs. However, from a longer-term investment perspective, regulatory clarity could unlock institutional capital that has remained on the sidelines due to legal uncertainty. Bitcoin may ultimately benefit from this shift, given its decentralized nature and commodity-like profile, while many altcoins could face further downside if classified as securities.

Market searching for a new narrative

Looking ahead, crypto appears to be transitioning from a politically driven narrative to a policy- and liquidity-driven cycle. If SEC legislation provides clearer rules without choking innovation, Bitcoin could reassert itself as the dominant beneficiary, potentially stabilizing before resuming an upward trend. Solana and other high-growth ecosystems, however, may remain volatile until regulatory risks are better defined.

In this environment, the market is likely to reward simplicity and resilience over speculation. Bitcoin’s drawdown since Trump’s election looks more like a reset than a collapse, while Solana’s deeper losses highlight how fragile sentiment remains in risk-heavy segments of crypto. Until regulation, liquidity conditions, and macro policy align more favorably, crypto markets may continue to trade defensively waiting not for promises, but for proof.