Ethereum faces volatility and ecosystem challenges

Ethereum’s dynamics are drawing fresh attention from both traders and institutional investors, highlighting a mix of price risk, capital inflows, and long-term ecosystem concerns.

Short positions could see $1.29 billion in cumulative liquidations.

SRx Health Solutions has committed $18 million to Ethereum.

Vitalik Buterin has expressed concerns about the broader ecosystem.

Ethereum is likely to trade around the $2,821–$3,200 range.

Price swings could trigger significant liquidations

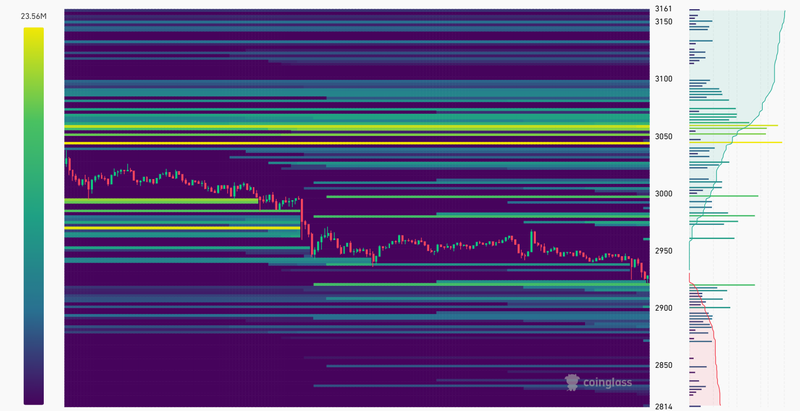

Ethereum’s price action has reached levels where leveraged positions on centralized exchanges are vulnerable to large-scale liquidations. Data from Chain Catcher, citing Coinglass metrics, shows that if ETH rises above $3,093, short positions could see $1.29 billion in cumulative liquidations. Conversely, a drop below $2,821 would put $586 million of long positions at risk.

This suggests that Ethereum’s trading near these critical levels is likely to amplify volatility. A move past either threshold could trigger cascade liquidations, further accelerating price swings a dynamic that traders and market-makers will need to monitor closely.

Source: Coinglass

Institutional adoption continues

On the investment side, SRx Health Solutions has committed $18 million to Bitcoin and Ethereum, signaling that institutional interest in crypto remains alive, even amid volatility. Beyond crypto, the company plans to deploy excess liquidity into gold, silver, and other traditional securities, reflecting a multi-asset strategy that hedges risk while capturing upside from digital assets.

This move highlights an important predictive takeaway institutional participation could support Ethereum’s floor in the short term, especially if additional corporate or ETF inflows emerge. Investors should watch how this capital allocation influences liquidity and price stability over the coming weeks.

Ecosystem challenges

Beyond markets, Ethereum co-founder Vitalik Buterin has expressed concerns about the broader ecosystem. He warned against “meaningless prosperity” in the application layer, where many projects may lack genuine social or economic utility, reducing the network to “toys or casinos.” Decentralized Social Networks applications that allow users to fully own and transfer their data, tackling lock-in effects common in traditional social platforms. Smarter DAOs governance structures that go beyond simple token voting, aligning incentives with real-world organizational goals and encouraging experimentation and diversity. Decentralized stablecoins financial infrastructure designed to support more robust and trust-minimized ecosystems, critical for DeFi and enterprise adoption.

These insights highlight that Ethereum’s long-term health depends as much on ecosystem quality as on price performance. Projects that focus on real utility may see adoption and capital flow, while speculative ventures risk creating short-lived bubbles.

ETFs and market structure

Ethereum ETFs and other regulated products are becoming a significant factor in price discovery. Institutional vehicles allow for large-scale investment without touching the underlying blockchain directly, creating potential correlation with traditional markets. Analysts predict that further ETF approvals or inflows could provide short-term support, while any regulatory pushback might amplify volatility.

Ethereum faces a converging set of forces near-term price-sensitive liquidations, ongoing institutional adoption, and medium- to long-term ecosystem challenges. Predictively, ETH is likely to trade with heightened volatility in the near term, particularly around the $2,821–$3,200 range, while broader adoption and meaningful application development will define its trajectory over the next 12–24 months.

Source: Trading View