Institutional investments bolster crypto market during economic uncertainties

Bitcoin remains resilient above $85,000 amid growing institutional investment, but a sudden 98% collapse in MantraDAO’s OM token sends shockwaves through the DeFi sector.

Bitcoin trades steadily above $85,000, reflecting market resilience amid economic uncertainties.

Major institutions like MicroStrategy and BlackRock increase Bitcoin holdings, signaling strong institutional interest.

Altcoins exhibit varied performance; Ethereum rises while Solana experiences slight decline.

Major cryptocurrency prices (as of April 15, 2025):

- Bitcoin (BTC): $84,545.35 ↑ 0.36%

- Ethereum (ETH): $1,633.57 ↓ 0.24%

- XRP: $2.14 ↓ 0.48%

- Solana (SOL): $130.14 ↓ 2.72%

- Litecoin (LTC): $78.46 ↓ 0.99%

- Cardano (ADA): $0.6431 ↓ 0.06%

- Dogecoin (DOGE): $0.1597 ↓ 3.80%

Bitcoin holds firm amid macroeconomic challenges

Bitcoin's price stability above $85,000 demonstrates the cryptocurrency's resilience in the face of ongoing economic uncertainties. Despite fluctuations in global markets due to shifting U.S. tariff policies, Bitcoin's value has remained relatively steady, indicating investor confidence in its long-term potential.

Institutional investments bolster market confidence

Significant investments by major institutions have played a crucial role in supporting the cryptocurrency market. MicroStrategy, now operating as Strategy, recently acquired 3,459 Bitcoins for approximately $285.8 million, bringing its total holdings to 531,664 BTC. This acquisition was funded through the sale of nearly 960,000 shares of common stock, reflecting the company's continued commitment to Bitcoin as a primary treasury asset.

Similarly, BlackRock has disclosed holdings of $48 billion in Bitcoin and $1.9 billion in Ethereum, showcasing significant institutional conviction in the cryptocurrency market.

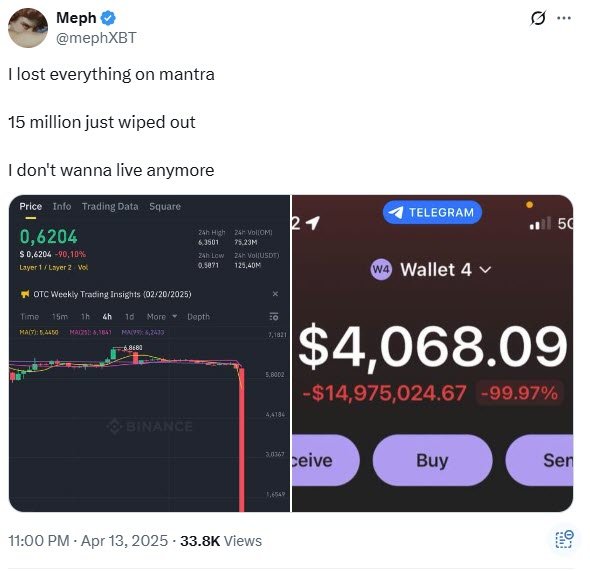

MantraDAO implodes: $6B vanishes in DeFi’s latest cautionary tale

On April 13, the Mantra OM token collapsed by a staggering 98% in under an hour—plummeting from nearly $6 to $0.57. The flash crash wiped over $6 billion in market cap and triggered massive liquidations across several DeFi platforms.

The most devastating story came from a trader known as MephXBT, who tweeted: “I lost everything on Mantra. 15 million just wiped out. I don’t wanna live anymore.” The post went viral and triggered a broader debate on mental health in high-stakes crypto trading.

Adding fuel to the fire, the Mantra founder posted seemingly tone-deaf tweets about luxury travel and “Wi-Fi issues” mid-crash—further enraging the community. The event has become a case study in how quickly speculative projects can unravel and serves as a grim reminder of the thin line between DeFi hype and financial ruin.

Altcoins exhibit varied performance

The altcoin market displayed mixed results, with Ethereum experiencing a modest gain of 1.64%, while Solana saw a decline of 2.72%. This divergence highlights the nuanced dynamics within the cryptocurrency space, where individual assets respond differently to broader market trends and investor sentiment.

Regulatory developments influence market dynamics

Recent policy changes, including the U.S. government's decision to adjust tariff policies, have had a notable impact on the cryptocurrency market. These developments have contributed to increased volatility, as investors assess the implications of regulatory shifts on digital asset valuations and market stability.

Outlook: cautious optimism amid evolving landscape

While the cryptocurrency market faces ongoing challenges due to economic and regulatory factors, the sustained interest from institutional investors and the resilience of major assets like Bitcoin provide a foundation for cautious optimism. Market participants will continue to monitor policy developments and institutional activities to gauge the future trajectory of digital assets.