Litecoin (LTC) gears up for rebound after bitcoin’s bounce

After Oct-10 crash Alt market is still trying to recover from it, the total market cap excluding Bitcoin is bouncing from critical trendline aligning with the start of Alt market bounce.

Luxxfolio aims to hold 1 million LTC by 2026.

Three other Litecoin ETFs (Grayscale, CoinShares, REX-Osprey) await SEC approval.

Analysts say LTC could retest $94.5 after bouncing from the support zone.

Institutional commitment to expanding its use cases

Luxxfolio a Litecoin focused public company secured $1 million to fuel its Digital Asset Treasury (DAT). The funds for ecosystem projects like LitVM (a ZK-rollup scaling solution) that collaborate with the Litecoin Foundation. The firm aims to hold 1 million LTC by 2026, betting on Litecoin’s utility in payments and DeFi, bullish for Litecoin as it signals the trust the investors have for the coin.

LTC bullish movement waiting for new liquidity

Three other Litecoin ETFs (Grayscale, CoinShares, REX-Osprey) await SEC approval. U.S government previous shutdown has temporarily halted the SEC review of these final S-1 filings, the coin weak performance suggests institutional, and retail participants see limited opportunities in Litecoin exposure compared to the alternative opportunities. But SEC approval will change this perspective as investors will be looking for new liquidity that will improve the performance, weak demand at the Litecoin ETF is connected to Bitcoin after the latest correction the fear was the main thig investors felt but after the Fed probability rose to 83% December rate cut, investors will regain trust of transfer liquidity into the Alt market again.

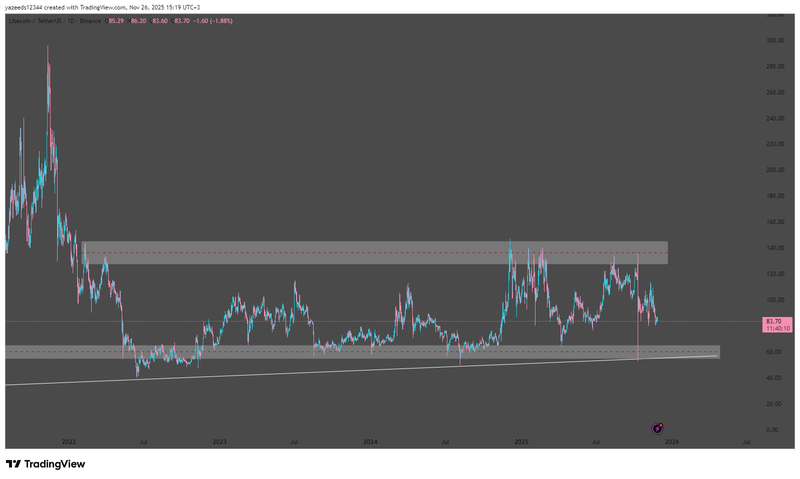

Technical overview

Litecoin accumulating range started in May,2022 but the consolidation range is moving upwards forming higher highs and higher lows, even when the market crash in October LTC kept above the psychological zone $40.00 area and analysts saw that as a solid sign that investors saw that this zone is a fair price value for LTC. Price behavior above $78.20 continues to be observed as a technical reference within the current market structure. The $93–$109 zone and the $130 psychological level remain key areas tracked by analysts for structural assessment purposes only.

Source: Trading View