Australia's Q4 outlook 2023

The RBA may ease policy and possibly cut rates in 2024 to counter the impact of previous monetary tightening on domestic consumption.

The Reserve Bank of Australia's (RBA) pause in rate hikes has slightly improved the economic outlook, but the anticipation of higher mortgage costs poses a risk of reduced household spending.

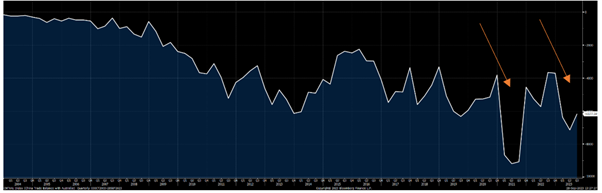

Australia, reliant on China for trade, faces risks as any slowdown in Chinese economic activity could negatively impact Australian exports of raw materials.

Downbeat market sentiment towards China, a significant trading partner for Australia, adds pressure on the AUD, especially if Chinese economic activity continues to slowdown.

Household sector to pose an ongoing concern

Australia’s GDP grew by 0.4% in Q2, predicated primarily on a strong performance in the export sector. However, an overall annual expansion of 2.1% represents a slight dip from the previously revised figure of 2.4%. While this outcome strengthens the Reserve Bank of Australia’s (RBA) confidence in being able to steer the economy towards a controlled deceleration, it also highlights a growing concern for it: namely the potential for a significant fall in aggregate domestic consumption as households cut spending in the face of higher mortgage costs.

Australia has seen a slight improvement in the economic outlook since the RBA paused its rate-hiking cycle in favour of holding the official cash rate at 4.10%, with upticks seen in both business confidence and retail sales. However, with the full impact of the RBA’s monetary tightening yet to be fully felt (12 hikes), the outlook for domestic consumption moving into 2024 looks much less bright and this is driving market expectations for the RBA to begin easing policy early next year.

The AUD/USD

AUD/USD has lost momentum since the start of 2023, falling from 0.7153 to around the 0.6430 level. We expect this weakening trend to continue going forward, potentially falling to the 0.6200 level against the backdrop of a more dovish RBA but still hawkish Fed.

Despite the Australian dollar typically showing a strong correlation with the price of oil, the recent rally in global oil prices has not yet provided any support for the Aud, perhaps suggesting a lack of market conviction that the current oil price rally will be sustainable beyond the short term.

However, possibly the greater force bearing down on the Aud as the moment is the downbeat market sentiment being expressed towards China. As a major Australian trading partner and key destination for Australian exports of raw materials, any slowdown in Chinese economic activity can be expected to impact negatively on Australia.

The trade balance chart highlights the interconnectedness, emphasizing that downbeat sentiment towards China has implications for Australia's economic well-being.

The future of the Australian dollar is closely intertwined with forecasts for China's economic performance