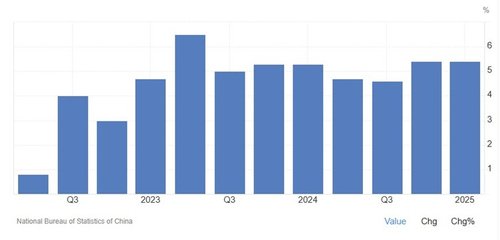

China's Q3 2025 outlook: deflationary pressures and cautious growth

China’s economy heads into Q3 2025 under pressure from deflation risks, weak manufacturing, and a struggling property sector, with only cautious stimulus deployed to meet its 5% growth goal.

Economic momentum has slowed, with PMI below 50 and real estate dragging down recovery.

The PBoC eased policy cautiously, avoiding aggressive stimulus to prevent asset bubbles.

Trade tensions with the U.S. persist despite a limited deal, weighing on export outlook.

China’s economy confronts deflation

After a strong first quarter, China’s economy is under renewed pressure from weakening manufacturing, deflation risks and a sluggish property market. While the government remains committed to its 5% growth target, stimulus efforts have been targeted rather than broad.

The outlook now depends on whether current policies can restore momentum, boost domestic demand and manage ongoing trade tensions with the US.

Is stimulus enough to meet growth targets?

China’s economy grew by 5.4% in the first quarter of 2025, supported by a rebound in exports and stronger domestic spending. However, momentum has slowed in the second quarter. Manufacturing indicators – particularly the official PMI – reflect weakening activity, while the property sector remains under pressure and global demand continues to soften.

Despite these challenges, the government is sticking to its 5% annual growth target. Rather than broad stimulus, Beijing is focusing on targeted support for areas like infrastructure and technology.

Still, economists are divided on the outlook for the third quarter. Some expect a recovery, while others warn that growth could slow further if policy support isn’t increased. The IMF forecasts Q3 growth between 4.5% and 5%, depending on whether policymakers can strike the right balance between stimulus and financial stability.

Deflation risks and cautious monetary policy

Deflationary pressures are growing. Domestic demand is still weak and the manufacturing sector has shrunk for three straight months.

In June, the manufacturing PMI fell to 49.7, signalling an ongoing decline in output and confidence.

In response, the People’s Bank of China began easing policy in May. It cut the 7-day repo rate to 1.4%, lowered the reserve requirement ratio by 50 basis points – injecting about 1 trillion yuan ($137 billion) – and trimmed the loan prime rate to support credit growth.

However, the easing has been measured. Authorities are avoiding aggressive rate cuts or large-scale stimulus, cautious not to create new asset bubbles, especially in the fragile property market.

With inflation in negative territory and no strong signs of industrial recovery, analysts expect further action in Q3 – possibly including additional rate reductions or credit support for key sectors. But policymakers remain wary of stoking new asset bubbles, particularly in the already fragile real estate market.

Property sector continues to weigh on recovery

The property sector continues to weigh heavily on China’s recovery. Despite looser monetary conditions, housing activity is still weak. In June, second-hand home prices fell by 0.75% month-on-month and over 7% compared to the previous year.

Housing demand has dropped sharply. Before the crisis, annual sales exceeded 20 million units. This year, forecasts suggest fewer than 5 million. Real estate investment also fell by 10.7% in the first five months of 2025.

Falling prices and low consumer confidence are delaying a recovery. Although financing conditions have improved, momentum in the sector hasn’t returned. The government may introduce additional support measures such as lower mortgage rates or extended financing programs, but any new measures will likely be cautious to avoid reigniting speculative risks.

Tariff tensions remain despite limited US deal

Externally, trade tensions with the US remain a key concern. In early 2025, President Donald Trump reinstated high tariffs on Chinese goods, with some duties reaching 145%. Beijing responded with tariffs of up to 125% on US exports.

A limited deal later helped ease tensions, with China agreeing to increase rare earth exports and the US softening restrictions on certain high-tech and energy exports. But many of the tariffs remain in place and the agreement appears more like a temporary truce than a lasting solution.

As a result, Chinese exports continue to face challenges. Even if domestic conditions improve, a full recovery is likely to be held back by ongoing trade friction and global uncertainty.