Cooling inflation supports steady eurozone growth

The eurozone enters the first quarter of 2026 with cautious optimism. After navigating supply shocks and a period of elevated inflation in recent years, economic growth has stabilised, remaining steady if unspectacular.

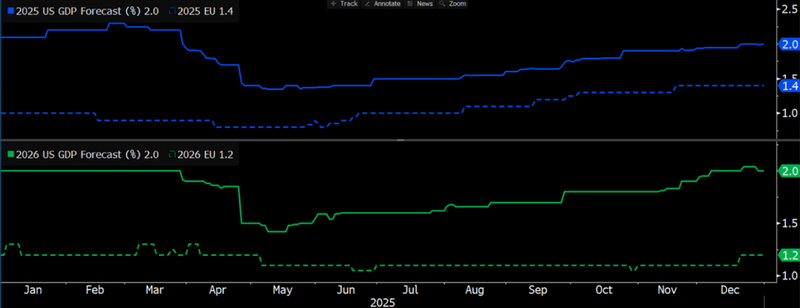

Eurozone GDP is projected to expand by roughly 1.2% in 2026.

ECB deposit rate stands at around 2.0%, with the base case pointing to a prolonged pause following the last rate cut in June 2025.

Leveraged funds have flipped to a net long of +24,505 contracts.

A clear break and daily close below 1.1460 would increase the risk of a deeper corrective move.

Steady growth as inflation eases

Eurozone GDP is projected to expand by roughly 1.2% in 2026, reflecting moderate but stable growth as inflation continues to ease.

Source: Bloomberg

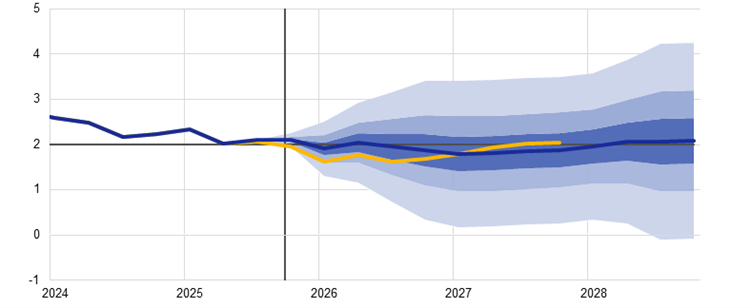

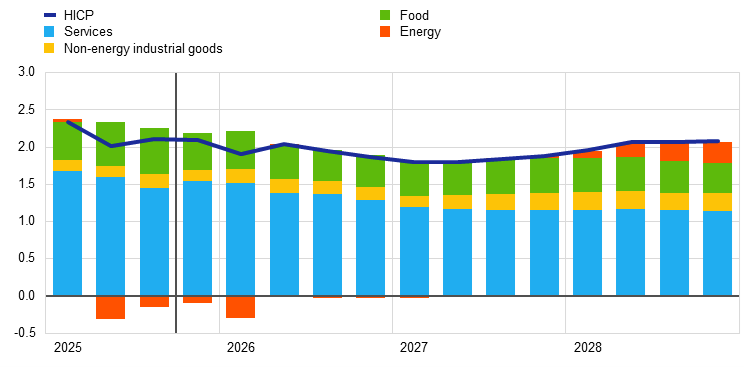

Notably, inflation has moved back towards the European Central Bank’s 2% target, easing pressure on both households and policymakers.

Headline inflation averaged 2.1% at the end of 2025 and 2.0% in the latest reading, and is forecast to ease further to around 1.7–1.8% in early 2026. The moderation reflects lower energy prices, a stronger euro and cheaper imports, marking a clear turnaround from the price surge seen in 2022–2023.

Source: ECB

Recent disinflation has been driven mainly by lower energy and import prices. Energy costs fell in 2025 after the 2022 spike, creating a favourable base effect that pulled headline inflation lower. However, with fuel prices stabilising at still-elevated levels and services inflation remaining firm, policymakers stay cautious about the risk of re-acceleration if domestic pressures fail to cool. In short, inflation is near target, but not yet fully anchored.

Source: ECB

ECB signals stability after June cut

With inflation on target and growth steady, the ECB is widely expected to keep rates unchanged in early 2026.

The ECB deposit rate stands at around 2.0%, with the base case pointing to a prolonged pause following the last rate cut in June 2025. With headline inflation near the 2% target, there is little urgency to raise rates, while still-elevated services inflation argues against further cuts.

That pause, however, is not without debate. If inflation undershoots towards 1.5%–1.7% in Q1 2026, pressure could build for limited easing to support growth. Yet persistent core inflation calls for caution, as easing too early risks reheating domestic prices, while maintaining an overly restrictive stance could weigh unnecessarily on growth.

For now, the ECB’s message is one of stability, with policy set to remain broadly neutral unless incoming data materially alters the outlook. ECB President Christine Lagarde has reinforced this view, stressing that policy will adjust only if conditions change meaningfully.

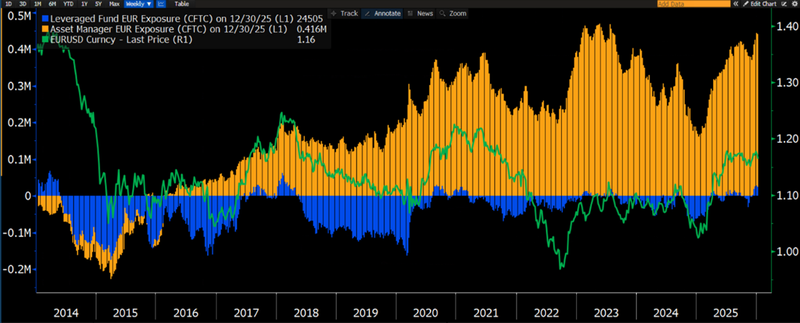

Crowded longs limit EURUSD momentum

EURUSD enters 2026 with a technical profile that looks more like distribution than breakout, with positioning capping upside.

On the flow side, the market is already positioned long. As of 30 December 2025, leveraged funds have flipped to a net long of +24,505 contracts, from -55,231 a year earlier, while asset managers have extended net longs to +416,483 from +161,474.

This matters from a technical perspective because crowded longs tend to limit follow-through above resistance and amplify downside once prices start to slip. When most marginal buyers are already positioned, rallies struggle to extend without a fresh catalyst to draw in new demand.

Source: Bloomberg

On the chart, EURUSD is trading below the broken trendline near 1.17, keeping the near-term bias soft. As long as the pair remains below this former support turned resistance, the path of least resistance points to a retest of the 1.1510–1.1460 support zone. A clear break and daily close below 1.1460 would increase the risk of a deeper corrective move, as stop-losses from crowded long positions are triggered.

In contrast, bulls need to reclaim 1.17 and hold above it, rather than briefly trading through it, to neutralise pullback risk and reopen higher resistance levels. The broader upside case still requires a fresh impulse rather than a slow grind higher.

Source: TradingView