Crypto outlook Q2 2025

Crypto markets cool off after years of rapid growth

Bitcoin surged to over $109,000 after Trump took office, but later tumbled nearly 25% as tariff fears and global risk aversion pressured crypto markets.

Meme coins and Solana initially rode high on Trump’s executive order for a strategic crypto reserve, but gains reversed by quarter-end amid renewed macro uncertainty.

XRP outperformed following its SEC settlement, gaining momentum as a potential challenger to Ethereum amid rising institutional interest and regulatory clarity.

The cryptocurrency market is emerging from a turbulent first quarter of 2025, marked by wild swings in Bitcoin and shifting sentiment under the influence of politics and policy. Bitcoin, the world’s largest digital coin, surged to an all-time high of just over $109,000 on January 20 when US President Donald Trump took office.

Bitcoin rallies on Trump hype, then tumbles with the market

Investors piled in on expectations of favourable regulation and institutional adoption. However, the euphoria proved short-lived. By mid-March, Bitcoin had fallen below $80,000 - down nearly 25% from its peak - as broader market sentiment deteriorated. Global equities came under pressure, and fears over renewed US tariff policies weighed on risk assets across the board. The sharp reversal highlighted Bitcoin’s role as both a beacon of digital asset optimism and a proxy for global risk appetite.

Bitcoin faces Trump tariffs

As global markets reel from Trump's sweeping tariff escalation, Bitcoin’s composed response is drawing fresh attention. While equities falter under pressure, the leading cryptocurrency has held its ground, showing neither the volatility of tech stocks nor the refuge appeal of gold or the yen.

Bitcoin is carving out a new identity: not a safe-haven, but a “risk-dynamic” asset. It moves independently resilient when growth stocks crash, yet agile enough to benefit from liquidity waves.

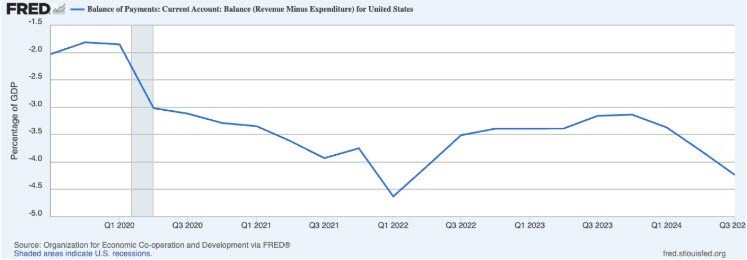

If Trump's tariffs curb foreign appetite for US Treasuries, the Fed may be pushed to inject more liquidity into the system. That shift could weigh on the dollar, while simultaneously positioning Bitcoin as a viable alternative store of value in an increasingly fractured macro landscape.

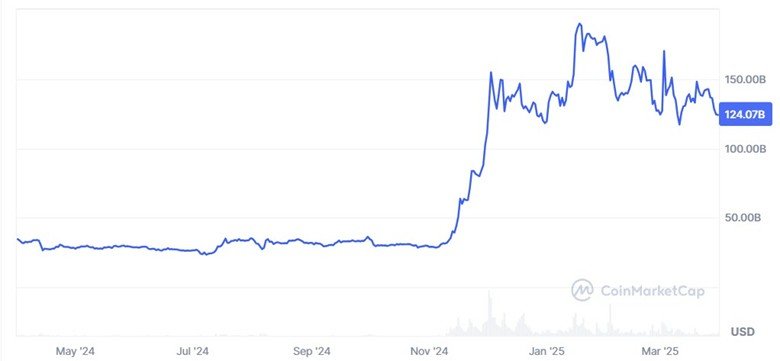

Meme tokens and Solana ride the wave

In early Q1, Trump’s executive order establishing a “strategic crypto reserve” sparked sharp rallies. Bitcoin neared $95,000, Ether jumped over 10%, and meme tokens like $TRUMP surged past $70 with a $10B market cap. Solana also hit a record $294, supported by meme coin hype.

But gains unravelled by late quarter. Talk of tariffs and paused rate cuts revived risk aversion - Bitcoin slipped to $80,000, Ether dropped 25%, and $TRUMP fell below $20. The episode underscored that macro forces still drive the crypto narrative.

XRP’s rise stirs flippening talk – is it the right time?

Amid the turbulence, XRP emerged as a standout performer. The settlement between Ripple Labs and the SEC in March removed years of legal uncertainty. With a favourable outcome and no admission of wrongdoing, XRP gained significant institutional attention.

In contrast, Ethereum continues to face regulatory ambiguity, particularly around staking and securities classification. That distinction could shape capital flows in the months ahead. I expect XRP could potentially flip Ethereum in market cap this year. Regulatory clarity, renewed momentum and growing institutional interest position XRP as a viable contender for the number two spot in crypto rankings.

As Q2 begins, the market enters a consolidation phase, less euphoric, but more focused. Regulatory developments, global economic conditions and Trump's next moves will likely set the tone for what’s next. XRP is approaching a critical support level at 1.75, and holding above this zone is essential to initiate a potential rebound to the upside. Price stability here could mark the foundation for a new bullish wave.

Key levels to watch for Bitcoin’s next move

Bitcoin’s next leg higher hinges on a clear break above the descending trendline at $87,500. That move could open the door for a retest of key resistance levels at $91,800, $100,000, and potentially $108,000. On the downside, a drop below $78,000 may trigger deeper corrections, with investors eyeing $69,000 and $60,000 as the next major support zones.