Diverging UK/US rates expected to offer continued support for cable

OIS swap rates seen moving increasingly in favour of sterling

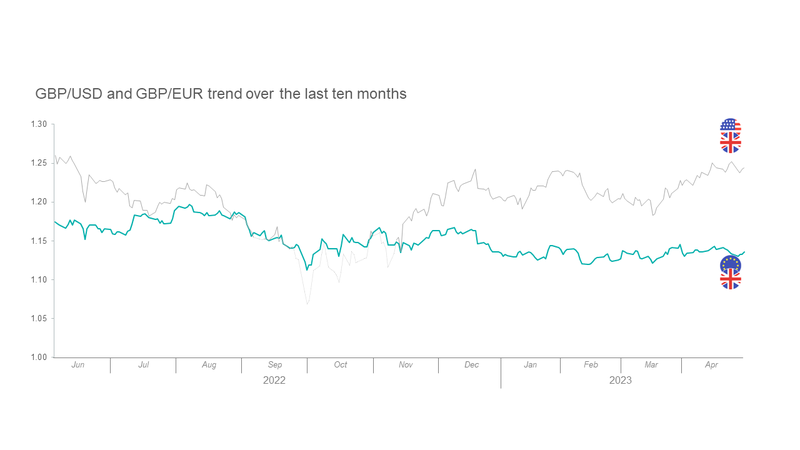

The past six months have been positive for sterling. Against the US dollar, after falling to a low of 1.0350 in September on the back of the Truss/Kwarteng mini budget, its recovery since then has been generally solid. Despite a couple of retracements - most notably over February and early March – momentum over the past month has once again been upwards, the pound appreciating from the 1.1820 level to test recent highs just shy of 1.2550, a level last seen in June 2022.

However, it is notable that this recovery has been against the US dollar only. Against the euro, sterling has weakened since last June, with Gbp/Eur largely trading sideways over the past month. This divergence can clearly be seen in the chart below. Given this sharp contrast compared to the appreciation seen in cable, it is clear that sterling’s strong performance is actually a reflection of dollar weakness, rather than sterling strength.

Usd weakness stemming from numerous sources

This weakness being seen in the Usd stems from a number of sources. Firstly, CPI data is finally suggesting that inflationary pressures are now moving lower on a sustainable basis, something the Federal Reserve (Fed) has consistently been demanding before it will consider a reassessment of its monetary stance. This, in turn, has raised hopes that we may be nearing the end of the current tightening cycle. Second, there are increasing signs that US economic activity is already slowing, to the extent that the economy may already be tipping into recession. Third, the recent banking crisis will almost certainly lead to a curtailment of credit and a tightening in lending criteria, potentially worsening any economic downturn while simultaneously removing some of the pressure on the Fed to keep financial conditions restrictive. And lastly, predicated on these factors, are growing market expectations that interest rates will need to be cut later this year if a damaging recession is to be avoided, despite warnings from various Fed Governors that the battle against inflation has not yet been won and monetary policy might yet need to be tightened further.

UK interest rate outlook looks less dovish

In contrast to the US, the outlook for UK interest rates looks considerably less dovish. The most recent UK CPI release showed inflationary pressures are still stubbornly high, dashing hopes that the Bank of England (BoE) may be nearing the end of its tightening cycle. Indeed, despite the UK economy flirting perilously close with recession (Q4 growth printed at just 0.1%), the BoE is considered more likely to keep monetary policy tighter, for longer, than is the Fed.

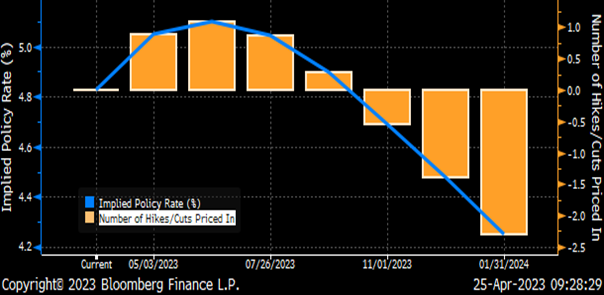

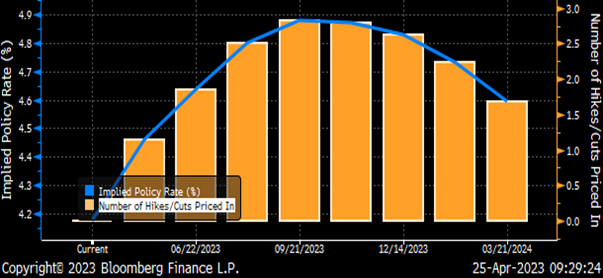

This more aggressive policy stance can be seen in the two charts below, which highlight clearly market expectations for the Fed (top chart) to begin cutting interest rates both sooner, and faster, than the BoE (bottom chart).

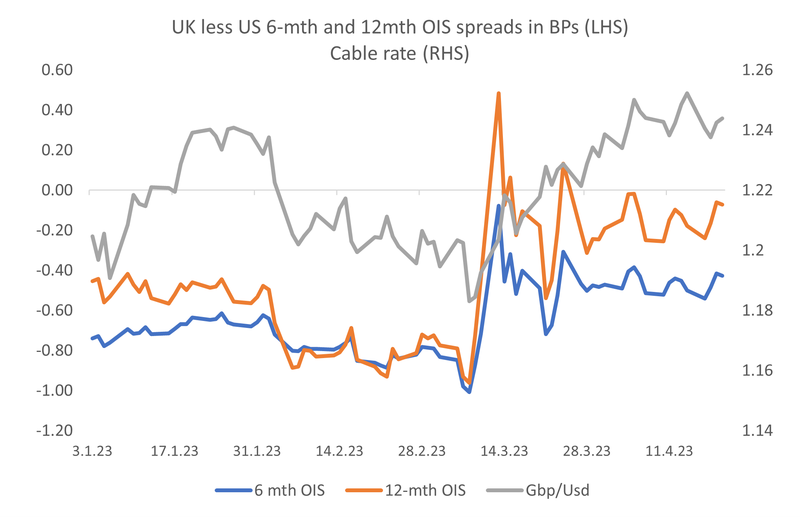

This widening differential between US/UK monetary policy can be seen in the OIS market. Since the start of this year, overnight index rate swap spreads between the UK and US have narrowed, with the 6mth/12mth contracts narrowing by some 30bps and 37bps, respectively. It is no coincidence that this narrowing has coincided with the appreciation seen in cable.

The chart below, displaying the difference between the UK and US 6-mth and 12-mth OIS rates, clearly shows that as OIS spreads have steadily narrowed this year, so cable has appreciated. The implication is that, if market expectations are correct and the differential between UK and US rates widens as expected, so the OIS differential can be expected to continue to provide support to sterling and, by implication, cable.

OIS differential expected to move further in support of cable

The Fed is expected to hike rates again by 25bps at its May meeting, with only a small chance seen of another 25bps hike in June. On balance, June is projected to see rates kept on hold as the evidence of a slowing US economy becomes too large to ignore, worsened by the expected credit crunch caused by the banking crisis and which, in the absence of remedial Fed action, will be sufficient to ensure a recession is triggered. Accordingly, the Fed will respond to this with an abrupt reversal in policy, possibly starting as soon as the September meeting, with 75bps of cuts expected before year end. This scenario is largely in line with current market forecasts. However, the expected outlook for UK monetary policy is considerably more hawkish than that envisaged by the market, the BoE forecast to take a more cautious approach towards loosening monetary conditions.

In line with the Fed, a further 25bps hike is expected in May. However, despite the disappointing retail sales figures for March, the painstakingly slow progress being made in bringing core and services inflation back to target (notwithstanding the improvement being seen in consumer sentiment, wages continuing to grow strongly and survey data pointing to an economy that is expanding rather than succumbing to tightening financial market conditions and soaring costs) point to the BoE being forced to continue to raise the cost of borrowing, with further interest rate rises seen being delivered at both the June and August MPC meetings before the BoE has enough confidence to bring a pause to the current tightening cycle.

But thereafter (and in further contrast to the Fed), interest rates in the UK look set to be kept on hold rather than cut as market pricing currently suggests. The BoE will be required to maintain a more restrictive monetary stance in order to maintain downwards pressure on inflation, which is seen as proving more ‘sticky’ and resilient to monetary tightening than suggested by current BoE forecasts. Accordingly, a first cut in interest rates is not expected until at least end-Q1/early Q2 2024. The implication is that the OIS differential will move further in favour of sterling than is currently priced, in turn providing continued support for cable over the remainder of the year and potentially facilitating a move onto a 1.30 handle.

Risks to the forecast

There are, of course, risks to this forecast, centred mainly on the UK:

- The UK economy is far from healthy, the IMF warning only this month that it will contract by 0.3% this year, accompanied by a large rise in unemployment. If this forecast proves correct it may be sufficient to tilt BoE policy towards supporting growth.

- Despite showing signs of recovery, consumer confidence remains weak, the latest retail sales figures suggesting consumption is finally wilting in the face of soaring prices and providing a further threat to the growth outlook, given that domestic consumption accounts for nearly 2/3rds of GDP.

- The large UK current account deficit will ensure sterling continues to be sensitive to risk appetite among overseas investors, relative to its peers.

- In a similar vein, a US recession can be expected to worsen global risk aversion, with investors favouring safe-haven assets and reducing exposure to higher beta currencies such as sterling.

- The current benign political landscape could worsen as we approach the next general election, required by January 2025 but increasingly seen as likely to take place in 2024. While the taxation and spending policies of the main Conservative and Labour parties are becoming increasingly similar, any suggestions that the election could deliver a hung Parliament is likely to be negative for the pound.

At a minimum, cable should remain supported

Clearly the immediate outlook for cable is uncertain. But it is a picture expected to become much clearer over the next couple of months. While the Fed will be forced to respond to both an expected continued deterioration in economic data and impending credit crunch by loosening policy, the BoE, still battling to bring inflation down, will in contrast be required to look through the potential risks outlined above and maintain its current hawkish stance. Perhaps most significantly for the BoE, having got the ‘transitory’ inflation argument so wrong, it simply cannot afford risking further damage to its credibility from a perceived lack of determination to get the inflation genie back into its bottle, the medicine for which is keeping monetary policy tight.

Accordingly, even though the above risks may present considerable headwinds to further cable appreciation, at a minimum it looks well supported at current levels – and with a move onto a 1.30 handle this year looking eminently achievable.