Japan outlook Q3 2025

Japan enters Q3 2025 facing stubborn inflation and fragile growth, leaving the Bank of Japan in a holding pattern as it struggles to balance economic risks ahead of key political events.

Inflation remains above target at 3.7%, driven by wages, tariffs, and food prices.

GDP stagnation and falling real wages signal weak consumer demand and export pressure.

The BOJ is expected to hold rates steady through summer amid trade and political uncertainty.

BOJ cornered by inflation and fragile growth

The Bank of Japan enters the third quarter of 2025 at a critical policy crossroads. After delivering its first rate hike in 17 years, raising the short-term policy rate to 0.50%, the central bank now appears reluctant to move further. June’s decision to hold rates steady and slow the pace of government bond sales was presented as a sign that markets had “absorbed” April’s tightening. But beneath the surface, the BOJ’s dilemma is becoming harder to ignore.

What’s keeping inflation high

Inflation is proving far stickier than the Bank of Japan anticipated. Core CPI climbed to 3.7% year-on-year in May, marking the fastest pace in over two years. Headline CPI stood at 3.5%, remaining well above the BOJ’s 2% target for yet another month. A closer look at the data reveals three distinct forces driving this trend:

- Demand-push inflation, supported by solid wage growth following the strongest spring pay round since the 1990s

- Cyclical pressures, largely stemming from US tariff policies that are distorting trade flows and raising import costs

- Domestic supply shocks, especially food inflation, with rice and fresh produce prices pushing higher

The BOJ has made it clear that any additional rate moves will depend on how these three forces develop, and more importantly, which of them proves the most persistent.

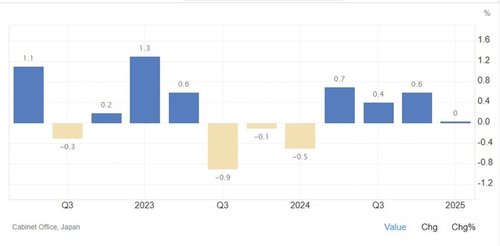

Growth is the missing piece in the BOJ’s puzzle

On the growth front, the picture is far from reassuring. Japan narrowly avoided contraction in Q1 after GDP was revised from negative to flat, but the underlying data point to continued softness.

Real wages are still falling, weakening consumer spending power, while exporters remain caught between a weak yen and ongoing uncertainty around US tariffs.

Political risks and trade headwinds

The Ishiba administration, led by Prime Minister Shigeru Ishiba, is unlikely to take any steps that could destabilise Japan’s fragile growth ahead of the upcoming Upper House elections. With the vote seen as a test of public confidence, the government’s appetite for major policy shifts is limited.

Unresolved trade tensions with the United States continue to add a layer of uncertainty, reinforcing the case for caution.

BOJ likely on hold through Q3

Given the current backdrop, the BOJ is likely to remain on the sidelines for the rest of the summer.

Growth risks are mounting, inflation remains sticky but is not accelerating rapidly and geopolitical uncertainty continues to cloud the policy outlook. Unless inflation rises sharply beyond current forecasts, the BOJ is expected to maintain its cautious stance until at least the fourth quarter.

In short, Japan’s monetary tightening story is increasingly a slow-motion balancing act, caught between inflation that is too high to ignore and growth that is too fragile to risk undermining.