US outlook Q3 2025

As Q3 2025 begins, the Fed holds rates steady amid mixed economic data, inflation cooling slowly, and tariff uncertainty clouding the path to potential easing by September.

Inflation is easing, but strong wage growth and a tight labor market are delaying Fed rate cuts.

The Fed faces internal division and rising political pressure over Powell’s leadership.

September may be a key moment for policy change, pending clearer data on inflation and trade.

Fed holds steady as data and tariff effects unfold

Economic signals in the United States are sending a mixed message as the third quarter begins. Disinflation is gradually taking hold, but the labour market remains tight and fresh tariff concerns are adding uncertainty to the policy outlook.

Cautious Fed keeps rates unchanged

Following its decision to keep interest rates steady, the Federal Reserve is weighing mixed signals from the economy.

Headline CPI held at 2.4% year-on-year in May, while core PCE, the Fed’s preferred inflation measure, dipped to 2.3%, edging closer to the 2% target. Yet the job market shows little sign of slack and unemployment remains at 4.1%, with wage growth continuing to outpace inflation.

With the federal funds rate unchanged at 4.25–4.50%, Chair Jerome Powell told Congress on 25 June that policymakers need further evidence on whether the latest round of tariffs will trigger a lasting inflation resurgence before making any dovish shift.

Markets responded, with more investors now expecting a rate cut in September, as the Fed remains cautious and focused on incoming data.

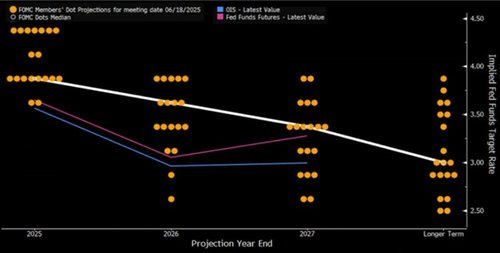

Divided views on policy path

The second half of 2025 opens with a clear policy divide within the Federal Reserve. While the median forecast still points to 50 basis points of rate cuts by year-end, officials are increasingly split on the timing and rationale for easing.

One camp sees softening growth momentum as justification for pre-emptive action, while others remain cautious, warning that the inflationary effects of the summer tariff wave may still be unfolding.

Powell’s recent remarks reflect this internal tension. He acknowledged that, if not for tariff-related price pressures, rates would likely already be lower.

But with just one CPI report due before the 30 July meeting, the Fed may lack the data needed to justify a policy shift. Until then, officials appear in no rush, choosing to wait as they monitor inflation’s trajectory and assess the broader economic fallout.

In addition, mounting political pressure is casting a long shadow over the Federal Reserve’s credibility.

Persistent rhetoric from allies of the President Donald Trump, along with veiled signals suggesting a desire to replace Chair Powell, is beginning to erode the perception of central bank independence.

That perception is not just symbolic; it anchors market expectations for inflation and interest rates, supporting the Fed’s ability to implement effective policy.

Although there has been no formal action, speculation about leadership changes can undermine public trust and add volatility to rate markets. Even the hint of political influence could make the Fed seem driven by politics rather than data, making it harder to steer the economy through uncertainty.

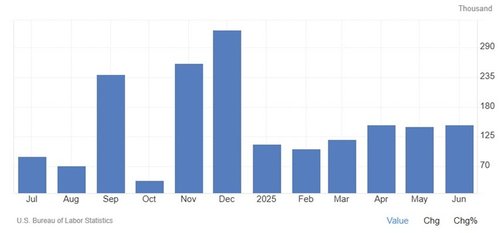

Inflation cools, but job gains and pay growth persist

The US labour market is gradually losing steam but remains a key pillar of household consumption. Non-farm payrolls rose by 147,000 in June, keeping the unemployment rate steady at 4.1%.

Meanwhile, wage growth remains strong at 3.7% year on year, outpacing both headline CPI at 2.4% and core CPI at 2.8%. This dynamic is preserving real income gains and helping to cushion demand.

GDP signals are mixed. The Bureau of Economic Analysis (BEA) reported in its third estimate that output fell at an annualised rate of 0.5% in Q1, largely due to a surge in imports early in the year ahead of anticipated tariff hikes.

More timely data from the Atlanta Fed’s GDPNow model puts Q2 growth at 2.9% as of 27 June, down from 3.4% the previous week but still pointing to a modest rebound.

Will September be the time to cut?

Taken together, the data suggest a controlled deceleration, not a downturn. Wage-driven demand, easing but sticky inflation and cautious business sentiment all support a soft-landing narrative.

Unemployment is still well below recession levels, making a July rate cut unlikely. September, with fresh inflation data, labour market updates and greater clarity on trade policy, could mark a turning point for the Fed.