US Q4 2025 outlook

Slower growth and sticky inflation challenge the Fed

The US enters the final quarter of 2025 with growth slowing below trend. High-tech investment is keeping activity from stalling, but households face weaker incomes, rising costs and tighter credit. Tariff-driven inflation is complicating the Fed’s easing path, limiting its ability to respond as the labour market softens.

Growth slows as spending weakens

The US economy is heading into Q4 with momentum clearly fading. After above-trend growth last year, GDP

is set to slow to 1.9% in 2025 from 2.8% in 2024. On a quarterly basis, output is expected to grow by only

1.0–1.5% in Q4, almost a full percentage point less than the previous year. The slowdown reflects weaker consumer spending, subdued housing activity and fiscal restraint despite summer budget support.

Households remain the weak link. Real disposable incomes are at cycle lows, with the resumption of student loan payments and higher borrowing costs weighing heavily. Consumer sentiment has turned pessimistic, pointing to a cautious holiday season. Housing also remains stuck: most mortgages are fixed below 5%, limiting the impact of Fed easing and keeping turnover low.

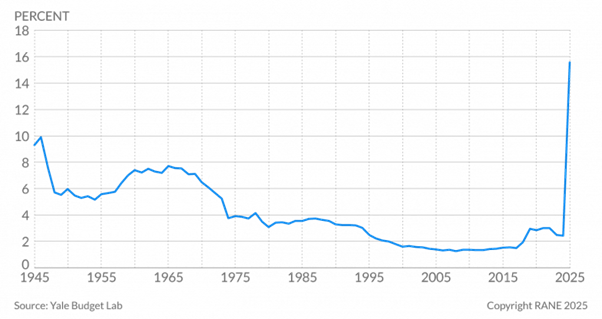

Tariffs add to inflation pressures

Inflation is proving harder to contain. Headline CPI is projected to average 2.7% this year, but core measures remain sticky near 3%, with tariffs now a key factor. The effective US tariff rate has climbed to about 17% in 2025, up sharply from 2.3% in 2024. As a result, goods prices, which had previously helped to bring inflation down, are once again adding to it.

The staggered rollout of new tariffs and substitution away from Chinese goods has temporarily delayed the full impact, but that cushion is fading.

Firms cannot absorb higher import costs indefinitely, and many industries are still unable to adjust supply chains quickly. Services inflation has also stopped easing, adding to the Fed’s challenge.

Labour market weak but stable

Employment growth is slowing, but the labour market has not broken. The unemployment rate has risen to 4.3% from 4.0% at the start of 2025. Job creation is now concentrated in health care and social assistance, while goods-producing sectors are shedding jobs.

Immigration curbs are worsening supply constraints, driving up wages in labour-intensive sectors such as agriculture and construction while reducing the economy’s potential growth rate. Net migration has dropped to near zero since 2024, a drag that may explain up to half of the GDP slowdown between 2024 and 2025.

No easy path for the Fed

After the Federal Reserve cut interest rates by 25 basis points in September as a form of risk management, in Powell’s words, markets quickly priced in two more 25 basis point cuts before year-end, followed by a further 50 basis point reduction by late 2026.

Expectations for aggressive easing in the fourth quarter, however, look overstated and may not align with the Fed’s cautious, data-driven stance. A potential government shutdown also threatens to disrupt the flow of key economic data.

Unless labour market conditions weaken sharply or inflation slows faster than anticipated, the Fed is unlikely to speed up its cutting cycle. The risk is that cutting too quickly while inflation remains above target would raise doubts about its credibility and fuel fears of recession. In this context, one or two additional cuts could cement the perception that the Fed is steering towards a hard landing.