Apple earnings in focus as memory costs threaten margins

Apple Inc. heads into its earnings report under pressure, with investors increasingly focused on how a sharp and sustained rise in memory prices is eating into margins. The stock has fallen more than 10% from its December peak, making it the weakest performer among the largest US technology companies as concerns mount over cost inflation heading into 2026.

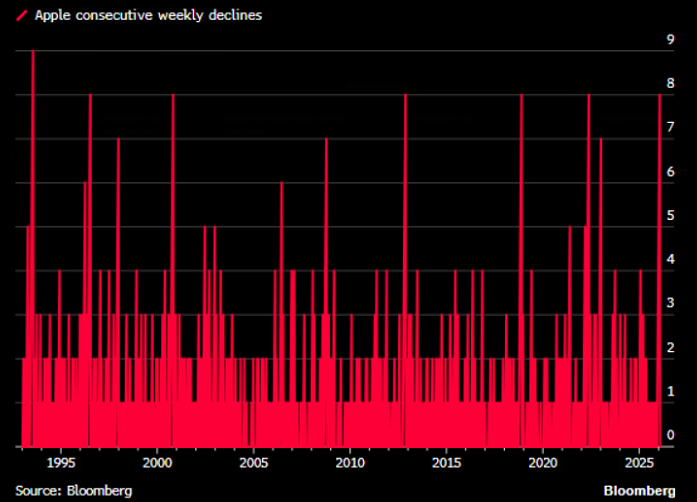

Apple shares are down more than 10% since early December, the longest weekly losing streak since 1993

DRAM spot prices have surged nearly 400% since September, driven by AI-related demand

Memory now accounts for up to 20% of smartphone production costs

Investors are watching earnings for clarity on margin pressure and pricing power

Shares slide as cost fears overshadow AI optimism

Apple’s recent selloff reflects growing unease over rising memory costs, a critical input for iPhones, iPads and other devices. Since reaching a high in early December, the stock has recorded eight consecutive weekly declines, its longest such stretch in more than three decades. The drop has made Apple the largest drag on the S&P 500 by index points over that period.

Source: Bloomberg

While enthusiasm around Apple’s artificial intelligence strategy has improved following its multi-year partnership with Google, that optimism has been eclipsed by worries that higher component costs could weigh on profitability just as supply contracts begin to reset in the second half of 2026.

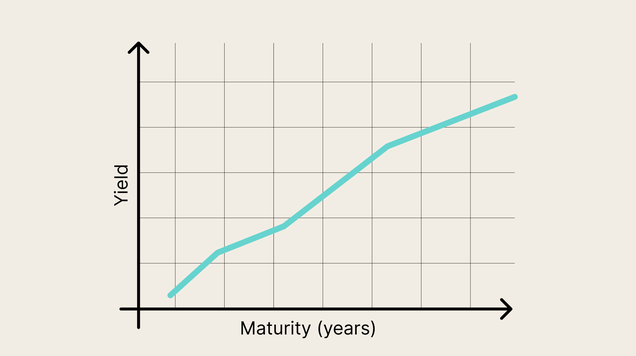

Memory prices surge amid AI-driven demand

The pressure stems largely from an extraordinary rally in memory prices. Spot prices for DRAM chips have climbed almost 400% since late September, reflecting tight supply and booming demand from data centers built to support artificial intelligence workloads. Suppliers have warned that pricing and availability constraints are already affecting production plans across the industry.

Memory is estimated to represent between 10% and 20% of the cost of building a smartphone, according to IDC. With prices rising at this pace, the firm has described the situation as a “crisis” for hardware manufacturers.

Limited room to absorb higher costs

Apple’s scale gives it leverage with suppliers and some ability to pass higher costs on to consumers, particularly as demand for premium devices remains resilient. Even so, analysts say the company has limited options. Raising prices risks dampening demand, while absorbing costs would compress margins.

Investors are therefore looking to this earnings report for guidance on how much of the memory inflation Apple can offset through pricing, product mix, or supplier negotiations.

Valuation leaves little margin for disappointment

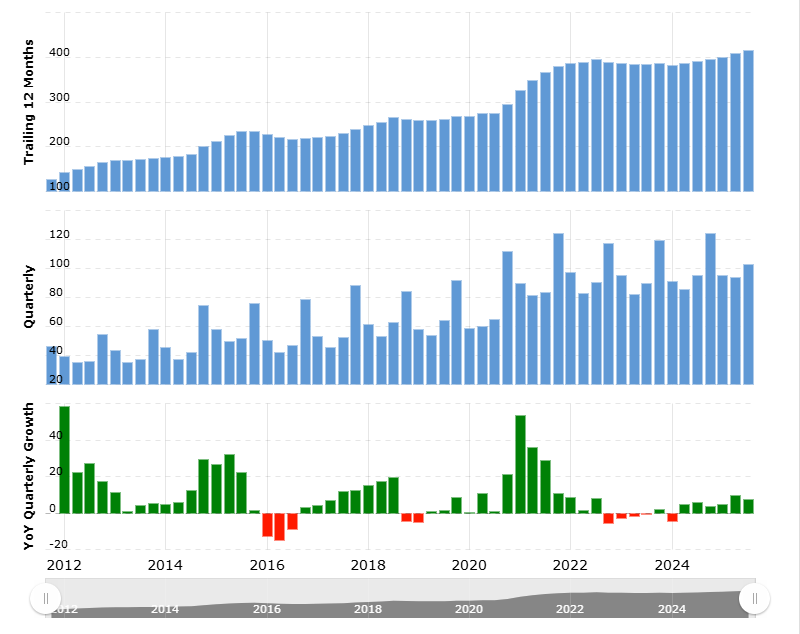

For now, Wall Street estimates for Apple’s 2026 revenue, margins and net income have barely moved, suggesting analysts are waiting for clearer signals from management. The stock trades at around 30 times forward earnings, well above its 10-year average of about 22 times, leaving little room for negative surprises.

Revenue is expected to grow about 8.7% in fiscal 2026, the fastest pace since 2021, but still well below the broader technology sector’s projected growth. That puts added pressure on Apple to demonstrate that rising input costs will not derail its earnings resilience.

Source: Macrotrends

Still seen as a defensive anchor in tech

Despite near-term concerns, many investors continue to view Apple as a relative safe haven within the technology sector. Its large installed base, recurring services revenue and strong cash flow provide stability at a time when volatility is rising elsewhere in markets.

The earnings release will be closely watched not just for headline numbers, but for management’s commentary on memory pricing, supply contracts and the outlook for margins in an environment where AI demand is reshaping the global semiconductor market.