Dollar bounce catches short sellers off guard across markets

The dollar’s rebound to two-month highs is upending one of this year’s most popular trades: betting against the greenback. Despite the U.S. government shutdown and expectations of multiple Fed rate cuts, the dollar has strengthened as global peers weakened, Treasury yields stayed firm, and investors sought safety.

Dollar Spot Index is up ~2% since mid-year.

Hedge funds have shifted to bullish dollar options across G-10 currencies.

Dollar strength pressures emerging-market assets and exporters.

Global peers weaken amid Japan’s political shifts and euro-area strains.

Dollar strength surprises global markets

For much of the year, shorting the dollar was viewed as a consensus trade. Analysts expected the combination of easing U.S. inflation, dovish Fed expectations, and a broadening global recovery to weigh on the greenback. Instead, the opposite has happened. Dollar Spot Index has climbed nearly 2% since July, as relative growth and yield advantages kept capital anchored in U.S. assets.

Source: Bloomberg

The surprise has forced investors to reconsider their assumptions about Fed policy and the dollar’s structural role. Despite political noise from Washington, including a federal shutdown, the U.S. currency remains the world’s primary haven — a status reinforced each time uncertainty rises abroad.

Shifting sentiment and short squeeze dynamics

In recent weeks, traders have been forced to unwind dollar-bearish positions as the euro and yen weakened sharply. Derivatives data show that hedge funds and asset managers are now paying a premium for bullish dollar structures — a sign of shifting conviction. The spread between call and put options on major currency pairs has swung to its most dollar-positive reading since April, reflecting a full-scale reversal in positioning.

The pain has been most acute among macro funds that built large short positions earlier in the year, expecting broad depreciation tied to Fed rate cuts. With inflation still sticky and labor markets proving resilient, the prospect of rapid monetary easing has faded. The recalibration has fueled a classic “pain trade,” where consensus bets turn costly as price momentum flips.

Source: Bloomberg

Resilience of the U.S. economy fuels divergence

The dollar’s strength is not happening in isolation. Recent Fed commentary has highlighted caution about cutting rates too quickly, underscoring the economy’s durability despite tighter policy. That message, combined with fading momentum overseas, has reignited flows into U.S. assets — from Treasuries to megacap equities.

In contrast, growth headwinds in Europe and Japan have weakened their currencies. Political uncertainty in France has weighed on the euro, while Japan’s leadership transition and renewed stimulus talk have pushed the yen toward its weakest level since February. The divergence in outlooks reinforces the dollar’s comparative advantage: it remains, in relative terms, the “least weak” among major currencies.

Broader ripple effects across global markets

A stronger dollar carries global consequences. For commodity importers, higher dollar-denominated prices increase inflationary pressure, constraining policy flexibility. For emerging markets, dollar gains tighten financial conditions and amplify debt burdens, especially where foreign-currency liabilities are high.

The move also disrupts portfolio flows. Equity and bond markets that benefited from earlier dollar weakness — particularly in Asia and Latin America — now face outflows. Meanwhile, U.S. exporters feel the pinch from a firmer currency, even as investors find renewed appetite for defensive U.S. assets.

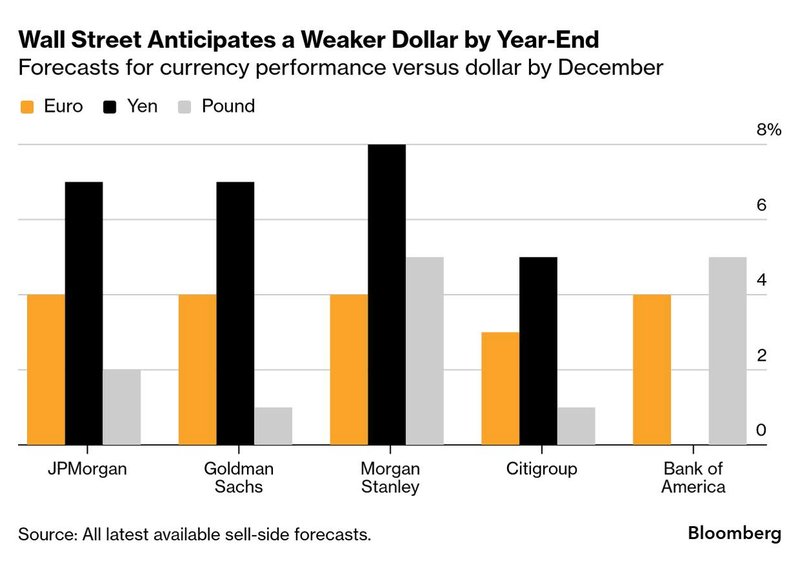

Looking ahead: Policy, politics, and positioning

The dollar’s trajectory will ultimately hinge on the Fed’s next moves. Markets continue to price in two quarter-point cuts by year-end, yet policymakers’ latest minutes suggest hesitation amid mixed signals on inflation and employment. If data stay firm, the Fed may slow the pace of easing — a scenario that could extend dollar strength into 2026.

Still, not everyone expects the rally to last. Some analysts argue that once U.S. data cool and fiscal tensions resurface, the “short dollar” narrative could return. Until then, currency traders face a difficult reality: the big dollar short has turned into a global stress test for anyone betting on a weaker United States.

Source: Bloomberg