Fed focus swings back to inflation as jobs data lose urgency

With the US labour market showing tentative signs of stabilization, investors and policymakers are turning their attention back to inflation — and this week’s jobs and price data may determine whether interest-rate cuts are delayed further.

Fed concern has shifted from jobs weakness to persistent inflation

January payrolls and CPI will shape expectations for 2026 rate cuts

Unemployment appears stable, reducing pressure for near-term easing

Inflation data now carries greater weight for policy direction

Labour market worries fade, but not entirely

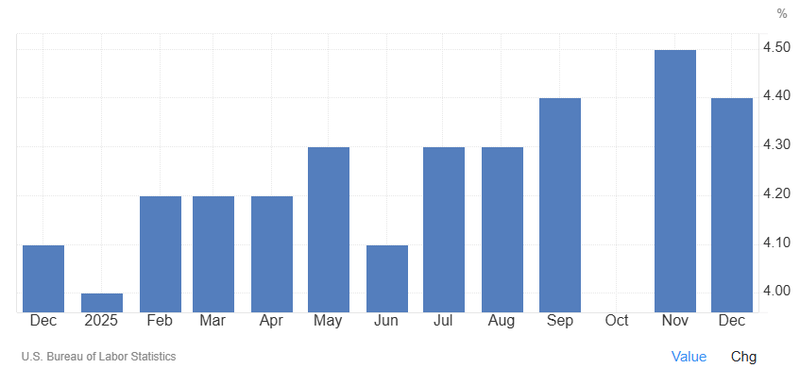

Last autumn, a softening US labour market dominated Federal Reserve thinking. Hiring had slowed sharply and unemployment had climbed to a four-year high, prompting the central bank to cut interest rates three times toward the end of 2025 to prevent deeper damage.

That sense of urgency has eased. Hiring rebounded modestly in the final two months of last year, and the unemployment rate edged down to 4.4% in December. For January, economists expect payrolls to rise by about 55,000, roughly in line with estimates of what is needed to keep unemployment steady.

Source: TradingEconomics

Such an outcome would likely be welcomed in Washington. Policymakers have stressed that the economy does not need strong job creation to remain healthy, as long as unemployment stays contained. Even modest gains are enough to absorb population growth and prevent slack from building.

Fed remains cautious despite stabilization

Still, officials are reluctant to declare victory. Jerome Powell has described recent data as evidence of stabilization rather than a clear turnaround, noting that underlying signals — including a drop in job openings — remain difficult to interpret.

Some economists argue the labour market is weaker than headline numbers suggest, warning that resilience in payrolls may mask slowing demand beneath the surface. That uncertainty helps explain why the Fed voted in late January to keep rates unchanged, ending a brief run of consecutive policy moves.

Inflation back in the spotlight

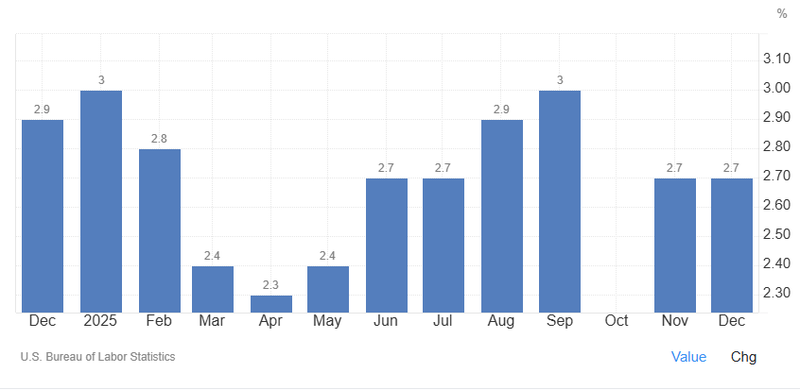

With employment no longer deteriorating, inflation has reclaimed center stage. Price pressures remain stubbornly above the Fed’s 2% target, reinforcing the case for patience.

Economists expect January consumer prices to rise 0.3% on both headline and core measures, with annual inflation easing slightly to around 2.5%. While that would mark progress, it would still leave inflation uncomfortably high for officials wary of easing too soon.

Source: TradingEconomics

The January CPI carries added significance. It is typically the month when companies reset prices for the year, and since the pandemic, seasonal price increases have been larger and more persistent than historical norms. Any upside surprise could unsettle expectations that inflation will continue to drift lower through 2026.

Tariffs, wages and shelter in focus

Supporters of a benign inflation outlook point to slowing rent growth, easing housing costs and moderating wage pressures — all of which have been major contributors to price gains in recent years. They also argue that the impact of tariffs imposed by the Trump administration will be limited and temporary.

Others are less convinced. Some policymakers caution that inflation may have stalled above target, raising the risk that cuts are postponed further if progress proves uneven.

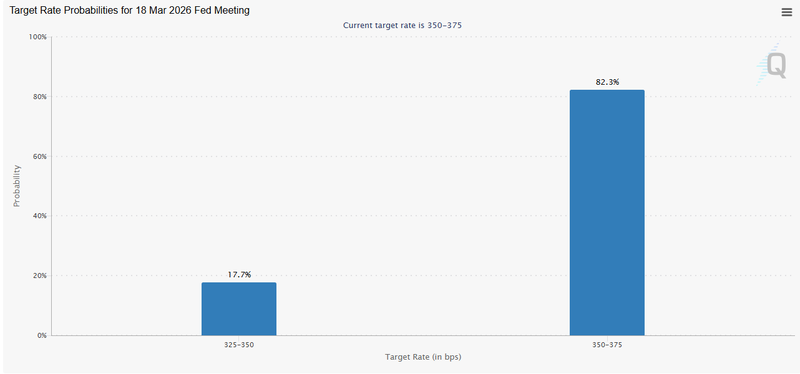

Rate cuts pushed further out

For now, markets see little chance of a near-term move. Expectations center on June at the earliest, when leadership at the Fed is set to change. President Donald Trump has selected Kevin Warsh to succeed Powell when his term ends in May, a transition that could further complicate the policy outlook.

Source: CME Group

Until then, the message is clear: as long as the labour market holds together, inflation — not jobs — will dictate the timing of the next rate cut. This week’s data may not settle the debate, but it will define the boundaries of it.