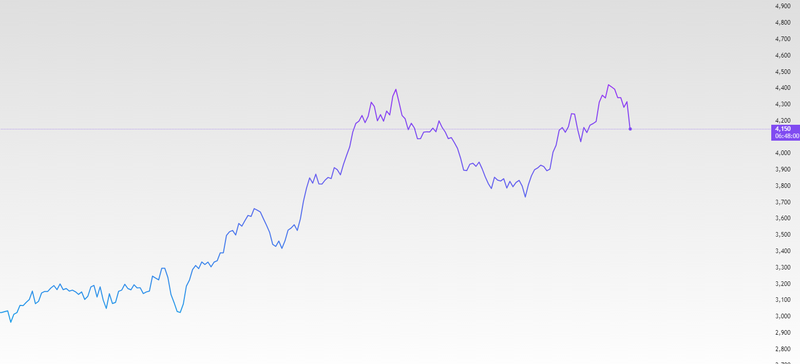

FTSE 100 falls as investors uncertainty on Central Bank decisions

FTSE 100 fell to its lowest level since November 25. Investors are cautious ahead of important central bank meetings that could signal tighter monetary policies in 2026.

British American Tobacco (BAT) led the fall, dropping almost 5%.

Defense companies gained across Europe, with UK names like BAE Systems (+2.1%), Babcock (+2%), and Rolls-Royce (+1.1%) leading the way.

The outlook for 2026 will likely depend on interest rate decisions, economic growth, and the ability of companies to manage costs and competition.

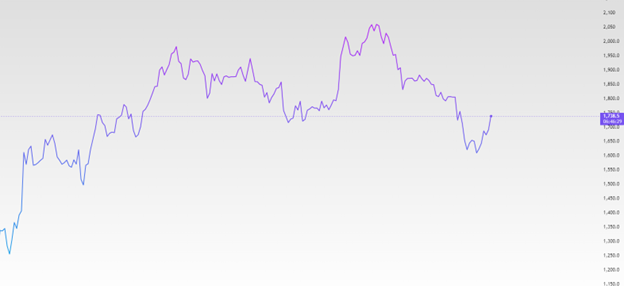

BAT falling nearly 5%

British American Tobacco (BAT) was the biggest loser of the day, falling nearly 5%. The company said it expects trading in 2026 to be at the lower end of its medium-term goals. Rising regulations and strong competition in the tobacco industry are putting pressure on the business. Ashtead Group also saw a decline of 0.5% after reporting second-quarter profits that fell short of analyst expectations. On the other hand, some sectors performed well. Defense companies gained across Europe, with UK names like BAE Systems (+2.1%), Babcock (+2%), and Rolls-Royce (+1.1%) leading the way. The gains followed news that Germany is preparing to approve record defense orders worth €52 billion, creating strong demand for European defense manufacturers.

Source: Trading View

Approved record defense orders worth €52 billion

Defense companies gained across Europe, with UK names like BAE Systems (+2.1%), Babcock (+2%), and Rolls-Royce (+1.1%) leading the way. The gains followed news that Germany is preparing to approve record defense orders worth €52 billion, creating strong demand for European defense manufacturers. Frasers Group rose 0.6% after completing the acquisition of the Swindon Designer Outlet. The deal expands the company’s property investment strategy, focusing on retail and commercial real estate.

Source: Trading View

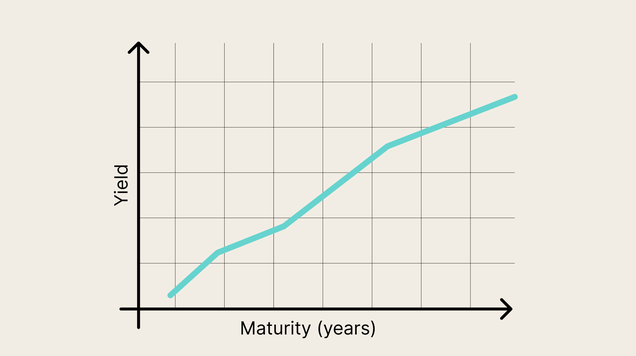

More hawkish stance into 2026

The market showed a mixed picture. While sectors such as defense and property investments benefited from strong demand and strategic deals, other companies, particularly those facing regulatory challenges and missing profit targets, weighed on the FTSE 100. Investors remain cautious as they wait for signals from central banks, especially in the UK, US, and Europe. The outlook for 2026 will likely depend on interest rate decisions, economic growth, and the ability of companies to manage costs and competition. Investors continue to exercise caution as they await guidance from central banks in the UK, the US, and Europe. Interest rate decisions, inflation trends, and economic growth forecasts are all expected to play a key role in shaping market sentiment. A tighter monetary policy could slow corporate earnings and affect consumer demand, while a more accommodative stance may support equity markets and risk-taking.