How do inflation-protected bonds work?

Bonds are a popular asset class.

Most bonds are vulnerable to high inflation.

Inflation-protected bonds address the risk of high inflation by guaranteeing that their principal value stays in step with changing rates.

This makes inflation-protected bonds a valuable, lower-risk asset class for diversification.

Diversifying your portfolio to include a range of trading products is crucial for stable and long-term investment returns. Bonds can be useful for diversification. This asset class is seen as a reliable and lower-risk option compared to stocks.

Bonds are vulnerable to high inflation, but there is a way to overcome this problem. Let’s explore how you can protect your portfolio with inflation-protected bonds.

What are bonds?

In simple terms, bonds represent a loan to an organisation. When a bond reaches maturity, the issuer will repay the bond’s initial value and, in the meantime, the issuer will make regular interest payments known as coupons. Bonds are available individually or through bond mutual funds, exchange-traded funds (ETFs), or other investment vehicles.

Issuers of bonds include:

- Corporations

- Governments

- Local governments

- Government agencies

Buying bonds

Buying bonds on financial markets is one of a range of options open to investors. You can either buy primary bonds issued directly from companies or governments, or buy secondary bonds. Secondary bonds are previously-issued bonds that are now being traded by other investors.

Understanding inflation

Inflation is the rate at which goods and services increase in price. If you see that inflation is currently at 4%, it means that the price of everyday goods has risen by 4% over the last twelve months. Statistical agencies measure inflation using consumer price indices, which track changes in the cost of a representative basket of goods and services..

It’s the role of central banks to keep inflation as steady as possible. A degree of inflation is healthy in a stable economy and central banks aim to keep it around 2%. Anything significantly over this target for a sustained period is considered problematic. High inflation is bad news for you as a consumer because it means the purchasing power of your income is decreasing. But it’s also often bad news for your investments.

Inflation can hurt stocks because it causes consumer spending to drop. Also, unless your investments are growing faster than inflation, their real worth is falling.

Bonds and high inflation

Inflation can cause negative outcomes for bonds. This is because inflation is eating away at the purchasing power of the fixed income they provide. Unless the agreed rate of interest is the same or higher than inflation, their real worth is actually decreasing over time despite their face value remaining constant.

This is where inflation-protected bonds come into play. Let’s learn more about them.

How inflation-protected bonds can protect your investment

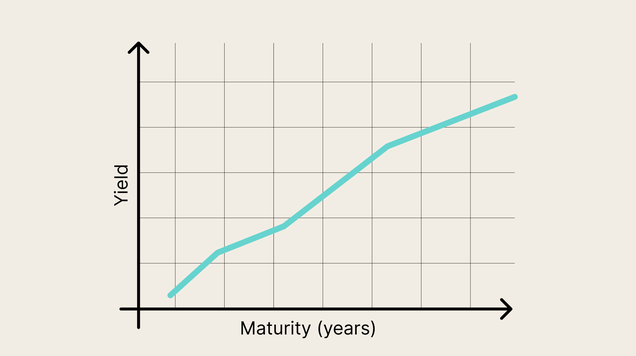

Not all bonds are the same. For example, some issuers may offer short-dated bonds that reach maturity in under three years, whereas others may offer long-dated bonds with a maturity date ten years away. Less stable organisations may offer high rates of interest to compensate for a higher risk to investors. Stable organisations, often governments, sometimes offer inflation-protected bonds.

Inflation-protected bonds are bonds that do exactly as their name suggests. These bonds are designed to protect investors over the long period it takes for their bonds to reach maturity, no matter whether inflation skyrockets or not.

Inflation-protected bonds are usually known as treasury inflation-protected securities (TIPS) in the US and inflation-linked or index-linked bonds in the UK. Let’s look at what happens to an inflation-protected bond between its issue and maturity.

<h3> The life of inflation-protected bonds

- The investor buys bonds for a principal amount with a set maturity date.

- The principal is adjusted for inflation, increasing with rising prices and decreasing if prices fall.

- Meanwhile, interest is also applied to the principal amount. Because interest coupons are paid on the current principal sum, coupon payments will increase with inflation.

- The bond reaches maturity, so the principal is repaid. This is now larger to reflect inflation-linked rises.

Can inflation-protected bonds lose value?

When an inflation-protected bond reaches maturity, the issuer will either pay the investor the inflation-linked value or the initial value, whichever is greater. This means that this kind of financial product is low risk.

The role of inflation-protected bonds in a diverse portfolio

These bonds can earn a place in a diverse portfolio by being a stable, low-risk product. They will help you mitigate against periods of high inflation, helping you protect the overall value of your portfolio.

Bonds rarely offer high returns, however, so you should balance this type of product with a higher-risk but higher-return asset class.

How to learn more about bonds and how to diversify your portfolio

With Equiti’s online resources, you can learn to trade in bonds and other financial products with confidence. Immerse yourself in our resources to study the basics of trading and creating a diverse portfolio.

Next, our demo account will help you hone your investment style and strategy with an opportunity for simulated, risk-free trading on live global markets.

When you’re ready, you can start online trading with Equiti. Our secure trading platforms can offer you access to global markets. Why not get started now?