Markets uneasy as long-term yields rise despite Fed cut

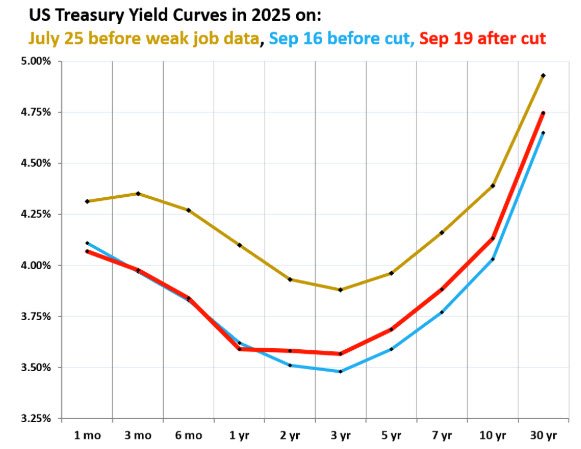

The Federal Reserve’s latest rate cut pushed the effective federal funds rate lower, but long-term Treasury yields and mortgage rates moved sharply higher. The steepening yield curve shows bond investors are more focused on inflation risks and heavy supply than on short-term policy guidance.

Fed trims policy rate by 25 bps to 4.0%–4.25%, lowering the EFFR to 4.08%.

10-year Treasury yield climbs to 4.14%, reversing early-week lows.

30-year yield rises to 4.75%, diverging from short-term yields.

Yield curve steepens as long bonds react to inflation and supply fears.

Mortgage rates surge to 6.35%, outpacing Treasury moves.

Fed cuts, but long-term yields rise

The Federal Reserve’s 25-basis-point cut last week lowered the effective federal funds rate to 4.25%, down from 4.50%. But instead of falling, long-term yields climbed, signaling investor unease. The 10-year Treasury yield ended Friday at 4.14%, up from 4.01% earlier in the month. The 30-year yield jumped to 4.75%, a 10-basis-point rise from pre-meeting levels.

This counterintuitive move recalls last year, when aggressive rate cuts spooked markets into demanding higher yields to compensate for inflation risk. While Chair Jerome Powell struck a more cautious tone this time, bond markets still saw reasons to price in higher long-term borrowing costs.

Yield curve steepens at the long end

The yield curve continues to steepen as longer maturities react more to inflation expectations and the supply of new debt. Since the Fed’s decision:

- 2-year yields rose by 7 bps.

- 5-year yields climbed 10 bps.

- 10-year yields added 10 bps.

- 30-year yields increased 10 bps.

Meanwhile, the six-month yield, closely tied to Fed policy expectations, points to another 25-bps cut in the next two months, diverging further from the surging long bond.

This un-inversion began in late 2024 as short-term yields followed rate cuts lower while long-term yields surged. Now, the steepening curve signals investors see risks of stickier inflation and greater bond issuance ahead.

Source: Tresury Dep.

Mortgage rates climb faster than Treasuries

The shift in long-term yields has spilled over into housing finance. The average 30-year fixed mortgage rate jumped by 22 bps in the days following the cut, from 6.13% to 6.35%, nearly double the increase in the 10-year Treasury yield.

While rates in the 6%–7% range are historically normal, they now bite harder because home prices rose more than 50% between mid-2020 and mid-2022, inflated by ultra-cheap credit during the Fed’s pandemic-era policies. That legacy has left buyers facing affordability strains even as today’s rates return to long-term averages.

Inflation remains the bond market’s concern

The divergence between policy rates and long-term yields highlights the bond market’s priorities. Short maturities reflect expectations of Fed cuts, but the long end is driven by fears that services and goods inflation could accelerate. Heavy Treasury issuance compounds the concern, pushing yields higher even as the Fed loosens policy.

If inflation data worsen in the months ahead, markets may again push yields and mortgage rates higher, undermining the intended stimulus from Fed easing.