Tokyo’s trillion debt is lowering yields

Instead of a "fiscal dove" sell-off. The 10-year Japanese Government Bond yield has retreated to 2.19% a one-month low as the market bets that Takaichi’s supermajority actually provides the political stability needed to manage Japan's gargantuan debt without a total meltdown.

Yields peaked near 2.38% on fears of "unfunded" populism.

Yen is rallying nearly 3% since the election results were finalized.

Japan’s total debt hit a record ¥1.34 quadrillion.

Expect a rapid hike to 1.0% by April 2026.

JGB market, a sigh of relief

Japanese yields were climbing in January, briefly nearing 2.38%, as investors worried that aggressive fiscal plans would worsen an already heavy debt load. The concern was that stimulus without credible funding would push the debt trajectory into dangerous territory.

Markets are now giving Takaichi the benefit of the doubt. Investors appear to believe that targeted tax cuts and infrastructure spending could lift domestic growth enough to stabilize the debt-to-GDP ratio. The extreme debt-risk scenario has, for now, been priced out.

Bondholders aren’t ignoring Japan’s fiscal reality they’re betting that stronger growth and political execution will keep it manageable.

Source: Trading economics

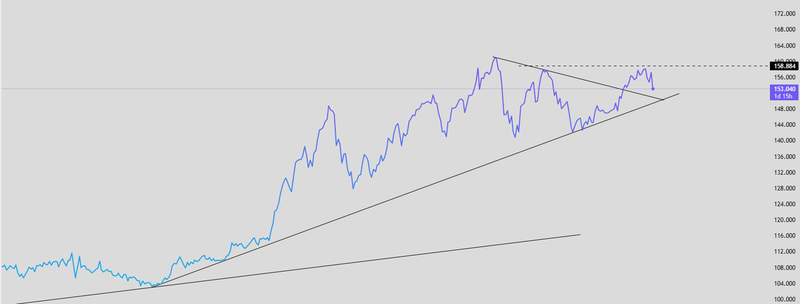

The yen fights back

The yen is staging its strongest rebound in months, pushing back through 153 per dollar and gaining nearly 3% since the election outcome became clear.

Tokyo’s currency officials, led by Atsushi Mimura and Finance Minister Satsuki Katayama, have stepped up their warnings, keeping markets on notice. But this time, rhetoric carries more weight. With a renewed political mandate, investors believe the government is far more willing and able to intervene directly if the yen weakens again.

Verbal intervention only works when markets think action will follow. Right now, traders aren’t testing that resolve.

Source: Trading View

The risk on Takaichi is Japan’s total debt

Optimism aside, Japan’s fiscal reality is heavy. As of December 2025, total government debt has climbed to a record ¥1.34 quadrillion, and the draft 2026 budget calls for ¥29.5 trillion in new bond issuance.

The bigger concern isn’t just the size of the debt it’s the cost of carrying it. With interest rates finally lifting off the floor, debt-servicing expenses are projected to reach a record ¥31.2 trillion.

Japan is entering a delicate phase: borrowing costs are rising after years of ultra-cheap funding. That means the economy now has to grow fast enough to outpace the compounding cost of interest. If growth underperforms, fiscal space narrows quickly.

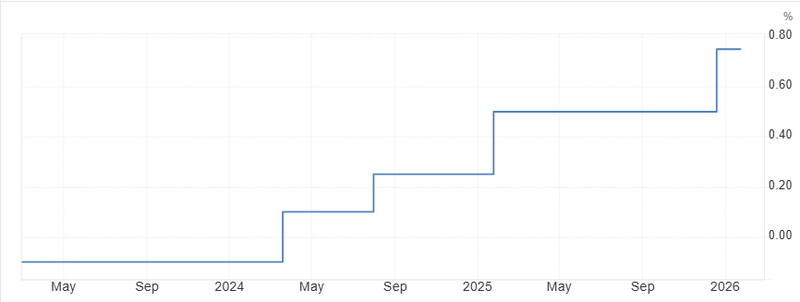

The road to hike rates

The Bank of Japan is watching the currency as closely as it watches inflation. The message forming in markets is straightforward: if USD/JPY pushes back toward 160 and stays there the era of cautious, incremental tightening could end abruptly.

In that scenario, the BoJ would likely move faster than it has signaled, with rates potentially reaching 1.0% by April 2026 and further hikes following later in the year. A weaker yen would force its hand, not because of optics, but because of imported inflation and credibility.

Takaichi may be enjoying the election wins, but markets are less sentimental. Investors are giving her the benefit of the doubt for now. Record-high debt-servicing costs leave no buffer for policy mistakes. If growth fails to show up by mid-year, bond markets will start demanding proof rather than promises. And when that shift happens, it tends to be swift.

Source: Bank of Japan