US yields rise as market uncertainty builds

Gold dipped on Tuesday after U.S. Treasury yields rebounded, with markets taking a defensive position ahead of key economic indicators and the Federal Reserve’s policy announcement.

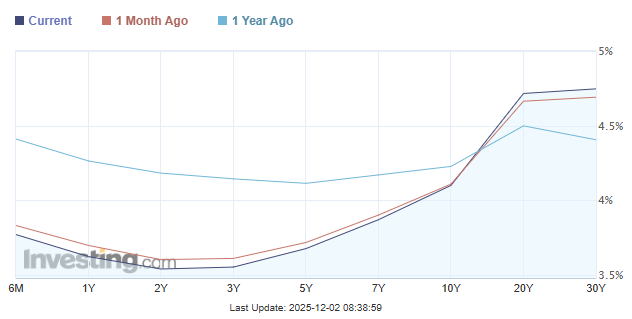

10-year Treasury yields hovered near a two-week high.

Silver hitting record high of $59.44.

Investors seek safety in precious metals while demanding higher returns on government debt.

Future path of monetary policy

Investors continued the fear of inflation risks, fiscal concerns, and the future path of monetary policy. The recent rise in yields reflects growing caution in bond markets, with traders demanding higher compensation to hold long-dated US debt amid uncertainty over when the Federal Reserve might begin easing policy and how persistent inflationary pressures may remain. Stronger data in parts of the US economy, along with heavy government borrowing needs, have added upward pressure on yields, reinforcing the view that the era of low yields may not return quickly.

Key question is no longer how high rates need to go, but how long they will need to stay at aggressive levels. Policymakers stressed that any future rate cuts will depend strictly on incoming data, especially inflation, employment, and GDP growth. As a result, markets are now highly sensitive to every major economic release and central bank communication, quickly adjusting expectations for rate cuts, current yields are higher than both one month ago and one year ago, especially on the 20- and 30-year maturities. This reflects growing demands for higher long-term returns amid persistent inflation concerns and increased government borrowing.

Source: Investing.com

Silver long-term industrial growth

Silver climbed to a record high of $59.44, the sharp rally in silver has been fueled by a mix of safe-haven demand and strong industrial consumption, the renewable energy and electric vehicle sectors. With inflation concerns resurfacing and geopolitical risks still elevated, investors have increasingly turned to silver not only as a hedge against uncertainty, but also as a strategic asset tied to long-term industrial growth.

Production faces problems keeping pace with demand due to the struggle in mining, with limited new supply coming online in the short term, the market remains tight, making silver more sensitive to demand shocks and speculative flows.

From technical point of view silver is also known for its explosive momentum once key technical levels are broken. After spending long periods consolidating, silver historically tends to move in sharp, fast rallies when investor positioning shifts.

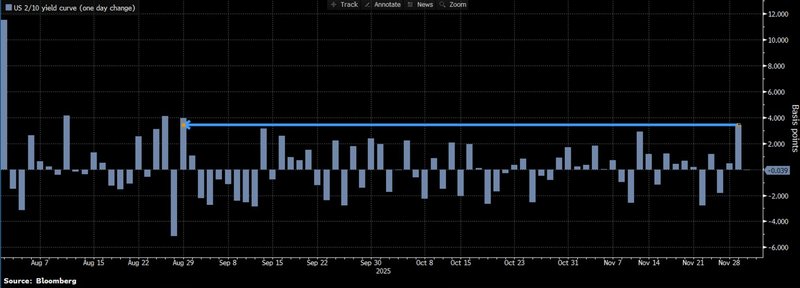

Investors demanding higher returns on government debt

Bond market is sending signal that investors are demanding higher yields on government debt to compensate for a growing set of risks, heavy government borrowing needs, sticky inflation, and uncertainty over how long interest rates will remain restrictive have all contributed to upward pressure on bond yields. Unlike earlier periods when falling yields signaled confidence in Fed ability to control inflation, today rising yields reflect investor caution toward fiscal sustainability and monetary credibility. Buyers of long-term government bonds now require a higher return to offset both inflation risk and the possibility that rates may remain higher for longer. Market is between fears of economic slowdown and concerns that inflation could reassure. Until Fed meeting this pattern is likely to persist, investors will continue to balance their portfolios between safety and yield. The daily change in the US 2-year / 10-year Treasury yield spread shows widening of the spread, a shift toward a steeper yield curve, as long-term yields rise faster than short-term yields. growing concerns about inflation, fiscal risks, and heavy government borrowing, while markets continue to reassess the timing and scale of potential rate cuts.

Source: Bloomberg