ADP jobs growth slows, misses estimates; Oil rises on lower US inventories

The latest ADP National Employment Report revealed a notable deceleration in private-sector hiring, suggesting persistent weakness in the United States labour market. Concurrently, crude oil benchmarks—Brent and WTI—advanced following a sharper-than-anticipated draw in US inventories, exacerbated by severe winter storms. Meanwhile, shares in Advanced Micro Devices (AMD) retreated significantly, despite the semiconductor firm reporting financial results that surpassed analyst estimates.

Private-sector job creation slowed from a revised 37,000 in December to just 22,000 in January, falling short of market forecasts.

Crude oil prices rallied as US stockpiles fell more than expected, with production and refinery operations hampered by extreme weather conditions.

Despite a record quarter in revenue and earnings, AMD shares faced aggressive selling pressure as investors weighed a cautious Q1 2026 revenue outlook.

ADP private employment data decelerates and misses analyst forecasts

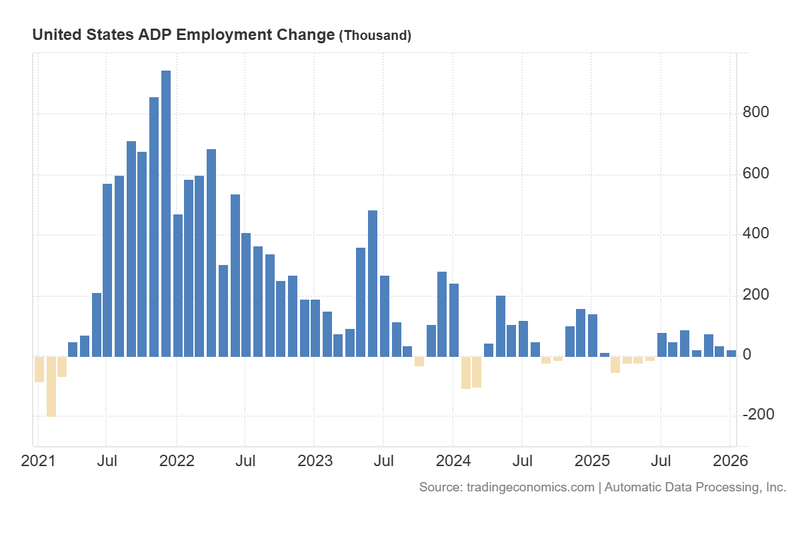

According to data from Automatic Data Processing (ADP), private-sector employment growth in the United States slowed to 22,000 in January, down from a revised 37,000 in December and significantly below the consensus estimate of 48,000. Sectoral data highlighted a sharp divergence: Education and Health Services added 74,000 positions, while Professional and Business Services saw the largest contraction, shedding 57,000 jobs.

Furthermore, the US Bureau of Labor Statistics (BLS) has announced that the official January non-farm payrolls report—originally scheduled for this Friday—will be delayed until 11 February due to the ongoing partial government shutdown. This delay, coupled with the tepid ADP figures, has introduced additional volatility into the equity markets as investors grapple with a cloudier macroeconomic picture.

Market reaction was mixed, reflecting a clear divergence among the three major indices. The S&P 500 declined by 0.33% to approximately 6,894 points, and the Nasdaq Composite fell 1.31% to 25,007 points. In contrast, the Dow Jones Industrial Average gained 0.61%, closing at 49,543 points.

Figure 1. US ADP Employment Change (2021–2026). Source: Data from Automatic Data Processing; Figure obtained from Trading Economics.

Oil prices rise amid lower US inventories

Data released by the US Energy Information Administration (EIA) showed that weekly crude oil inventories fell by 3.455 million barrels, a significantly larger draw than the 2 million barrels anticipated by analysts. The EIA attributed the decline to a severe winter storm that disrupted production and refinery runs across several regions. Consequently, both Brent and WTI futures appreciated in tandem. The Brent contract (BRNJ26) rose 3.16% to $69.46 per barrel, while the WTI contract (CLH26) gained 1.88% to settle at $64.40 per barrel.

Adding to the upward pressure are the sustained geopolitical tensions between the United States and Iran. According to reports from Reuters, Washington remains at an impasse regarding Tehran's proposed venue for renewed negotiations, stalling potential de-escalation efforts. Market participants remain wary of potential supply chain disruptions in the Strait of Hormuz, maintaining a high-volatility environment for energy prices.

AMD surpasses analyst expectations, but shares fall aggressively

Shares in Advanced Micro Devices (AMD) plummeted by approximately 16% during the session, closing at $202.53, despite the company delivering a robust fourth-quarter performance. The semiconductor giant reported record quarterly revenue of $10.27 billion, exceeding the $9.64 billion forecast. Furthermore, earnings per share (EPS) reached $1.53, surpassing the estimate of $1.32. These results represent a 34% year-on-year (YoY) increase in revenue and a 40% surge in EPS. Despite these strong headline figures, investor sentiment turned bearish following the company’s forward guidance.