ADP jobs beat expectations while tariffs stir fresh concerns

Private payrolls unexpectedly rose more than analysts had forecast, tempering near-term expectations of Federal Reserve easing, while the US Supreme Court heard arguments that could curtail the White House’s authority to impose tariffs.

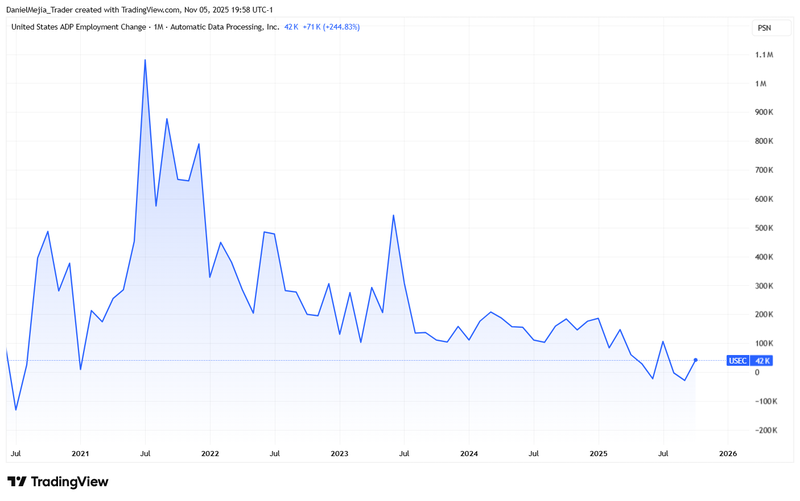

ADP reported a gain of 42,000 private payrolls in October, above the consensus forecast of 25,000.

The CME Group’s FedWatch Tool trimmed the market-implied probability of a 25bp cut in December to c. 62per cent (from c. 69per cent).

The US Supreme Court heard arguments on the White House’s tariff-making powers under the IEEPA; a final ruling could take months.

EIA data showed a weekly crude-stock build of 5.20 million barrels (versus a 0.6 million-barrel consensus), weighing on Brent and WTI.

ADP employment change beats expectations

The Automatic Data Processing (ADP) employment report showed a rise of 42,000 non-farm private payroll positions in October, exceeding the consensus estimate of 25,000. ADP indicated that the largest gains were in trade and transportation, while professional services and information registered declines. Although ADP is a private-sector series and not a substitute for official government data, it is widely used by markets as a timely indicator of labour-market momentum.

In consequence, market pricing adjusted: the probability of a 25-basis-point Federal Reserve cut in December, as measured by CME Group’s FedWatch Tool, fell from roughly 69 per cent to about 62 per cent. Investors now await official Bureau of Labor Statistics (BLS) data, including non-farm payrolls and the unemployment rate, but those releases remain vulnerable to disruption from the ongoing US shutdown.

Longer-term commentators note structural shifts in the labour market, including continued use of automation and artificial intelligence by some large employers, which may compress hiring in certain white-collar segments.

The ADP series nevertheless points to modest net job creation in the private sector at present; however, the trend has remained bearish since the 2021 high (see next figure).

Figure 1. United States ADP Employment Change (2021–2025). Source: ADP (Automatic Data Processing). Figure obtained via TradingView.

Supreme Court hearing raises questions about tariff authority

The US Supreme Court convened a hearing to consider whether the White House may lawfully impose tariffs under the International Emergency Economic Powers Act (IEEPA). While IEEPA grants the president broad authority to regulate economic transactions following a declared national emergency, the specific question of tariff imposition was contested by counsel and could require months of additional briefing and deliberation before a final judgment.

A ruling that restricts presidential tariff powers would carry significant fiscal and market consequences. Customs duties have been an important revenue source: CNBC reports that the United States collected approximately US$195 billion in customs receipts in fiscal 2025. If previously imposed tariffs were invalidated and rebates were required, estimates suggest the fiscal cost could approach US$100 billion, with implications for the federal budget and for import-dependent sectors. Markets have not yet reacted strongly given the protracted timeline to a definitive ruling, but volatility may increase once legal outcomes become clearer.

Oil softens after sizeable EIA inventory build

Energy markets reacted to a larger-than-expected weekly crude-stock accumulation reported by the US Energy Information Administration (EIA). Analysts had anticipated a modest build of c. 0.6 million barrels, but headline crude inventories rose by 5.20 million barrels — a signal of weaker near-term demand or a transient mismatch in the supply chain. In response, Brent futures (BRNF6) closed down c. 1.43 per cent at US$63.52 per barrel and WTI (CLZ5) fell c. 1.54 per cent to US$59.63 per barrel.

Offsetting the crude build, gasoline inventories declined by approximately 4.73 million barrels versus an expected 1.1 million-barrel draw. The gasoline draw suggests continued downstream demand or refined-product logistics effects, which moderated the severity of the oil-price reaction.