ADP report below expectations; market awaits NFP

The ADP showed softer private hiring alongside higher jobless claims, sharpening the focus on Friday’s payrolls. ISM services surprised to the upside, while crude eased on a surprise inventory build and potential OPEC+ supply.

The ADP report showed a drop in aggregate payrolls and an increase in jobless claims; the market is attentive to NFP data.

ISM Services in the U.S. posted a third straight month in expansion at 52.0, above consensus.

Oil benchmarks declined on an unexpected crude build and prospects of higher OPEC+ supply.

ADP signals a notable slowdown, reinforcing labor-market softness

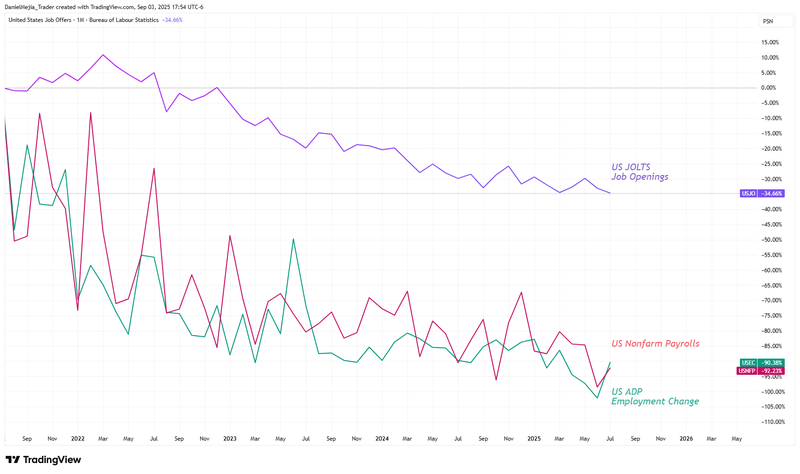

Initial jobless claims printed 237,000 (above expectations), while ADP reported +54,000 private-sector jobs in August, below forecasts and well under July’s +106,000. Together with yesterday’s JOLTS weakness (7.181 million openings; vacancy rate 4.3%), the data suggest that labor demand is cooling and raise the odds that Friday’s NFP will also be soft. Nexr figure below shows the positive correlation between the JOLTS, ADP, and NFP indicators.

CME’s FedWatch tool now assigns a 99% probability to a 25 bps cut in September, 55% to another 25 bps in October, and 48% to a third 25 bps cut by December. However, inflation risks remain: tariff-related pass-through could still spark a price rebound.

ISM services surprises on the upside

ISM Services rose to 52.0 in August from 50.1 in July, beating consensus and staying above the 50 expansion threshold. Beneath the surface, business activity and new orders increased at a faster rate, however, the employment component showed a decline. The print contrasts with the weaker-than-expected ISM Manufacturing PMI earlier this week.

Services has now posted three straight expansionary readings, underscoring the sector’s resilience despite tariff headwinds under the Trump administration. Year to date, ISM Services has remained above 50 in every month except June (49.9).

Oil eases on surprise build and supply risk

Oil (WTI and Brent) slipped about 0.76% on average after a surprise inventory build from the EIA. The consensus looked for a −1.8 million-barrel draw, but the data showed a +2.41 million-barrel increase—an upside surprise after two straight weeks of declines.

Meanwhile, traders are watching this weekend’s OPEC+ meeting. Expectations lean toward higher production targets in the coming months, a supply boost that would pressure prices. For context, OPEC+ has already agreed to raise targets by roughly 2.2 mb/d over April–September.