AMD and Anthropic strengthen their commitment to AI

Technology firms continue to prioritise investment in artificial intelligence infrastructure as they compete for market share. Advanced Micro Devices (AMD) reiterated its focus on AI, with management forecasting strong multi-year revenue growth, while Anthropic announced a substantial multi-year infrastructure spend.

AMD’s management reiterated that substantial AI investment is strategic rather than speculative, and provided multi-year revenue guidance premised on AI demand.

Anthropic committed US$50 billion to build AI infrastructure, beginning with data centres in Texas and New York and accompanied by significant job creation.

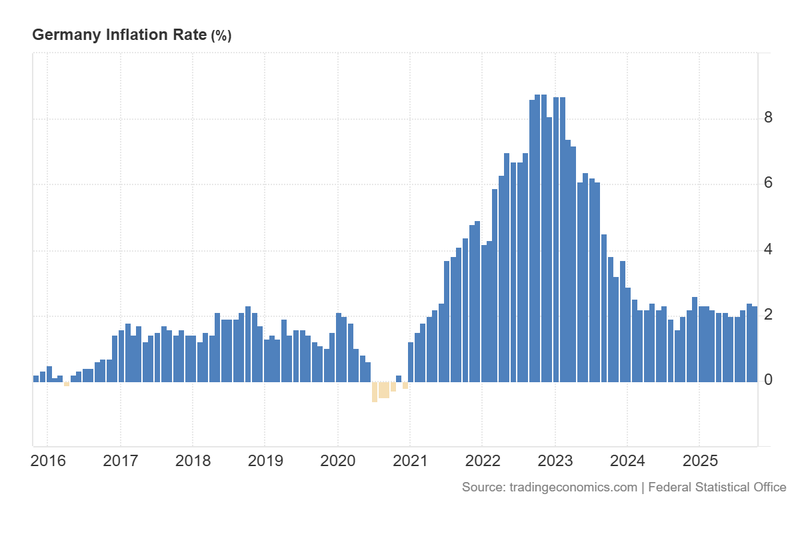

The German headline inflation eased slightly to 2.3 per cent, in line with the analysts’ expectations.

AMD rises amid strong expectations for its AI segment

AMD shares advanced after the company’s chief executive Lisa Su defended heavy spending on AI initiatives. In an interview cited by CNBC, AMD’s CEO remarked, “I don’t think it’s a big gamble, I think it’s the right gamble,” and said the firm expects revenue growth of roughly 35 per cent over the next three to five years. Management framed elevated capital expenditure as necessary to capture expanding AI workloads and to extend the company’s market share.

AMD’s equity rose more than 7 per cent to US$254 per share, approaching its all-time high of US$264. Market participants welcomed the guidance, but analysts and investors will look to the next quarterly results for confirmation that AI investments are translating into durable top-line and margin improvements. Major US indices were mixed on the session: the S&P 500 and the Dow Jones recorded marginal gains of c. 0.06 per cent and c. 0.68 per cent respectively, while the Nasdaq-100 eased c. 0.06 per cent despite AMD’s advance.

Figure 1. AMD’s share price (Year-to-Date). Source: data from the Nasdaq Exchange; Figure obtained from TradingView.

Anthropic announces a multibillion-dollar investment in AI infrastructure

Anthropic disclosed plans to invest US$50 billion in AI infrastructure over the coming years, commencing with two data-centre projects in Texas and New York. The company said the programme is intended to support its enterprise and research ambitions and would generate approximately 800 permanent roles plus 2,000 construction jobs, according to CNBC.

Anthropic framed the investment as both an operational necessity and a broader contribution to scientific and technological advancement. The scale of the commitment signals intensifying competition among AI incumbents and hyperscalers to control cost-efficient, high-performance compute capacity.

German inflation shows a modest deceleration

Germany’s Consumer Price Index edged down from 2.4 per cent to 2.3 per cent year-on-year, broadly in line with market expectations. The moderation was driven primarily by lower food inflation (from 2.1 per cent to 1.3 per cent) and a slightly deeper negative contribution from energy (from −0.7 per cent to −0.9 per cent), while services inflation ticked up to 3.5 per cent.

Equity markets responded positively: the DAX rose c. 1.22 per cent to 24,381, nearing record levels, and the euro appreciated marginally against the US dollar to about US$1.1590. The underlying macro picture remains mixed — GDP growth is effectively flat (Q3 at c. 0.0 per cent) and the unemployment rate remains elevated at c. 6.3 per cent — suggesting that the observed disinflationary signal does not yet imply a broad-based cyclical recovery.

Figure 2. German inflation rate (2016-2025). Source: data from the Federal Statistical Office of Germany; Figure obtained from Trading Economics.