Apple’s market value nears $4 trillion while Trump seeks rate cuts

Apple’s market capitalisation approached US$4 trillion as investors anticipated robust iPhone 17 revenues and the company’s resilience amid US–China commercial tensions. At the same time, President Donald Trump intensified public pressure on the Federal Reserve to adopt a more aggressive easing stance ahead of this week’s policy decision.

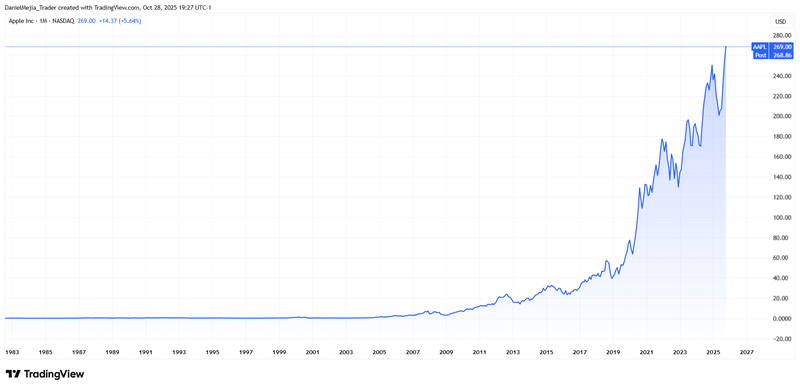

Apple shares traded near US$269, implying a market capitalisation of about US$3.99 trillion and a year-to-date gain of c. 10.5%.

President Trump publicly criticised Fed Chair Jerome Powell and urged more forceful rate cuts ahead of the Federal Reserve’s meeting.

Brent and WTI fell more than 2% as markets reassessed the risk to Russian oil supplies and the prospect of increased OPEC+ output.

PayPal reported Q3 revenue and EPS above consensus, supporting a near 4% rise in its share price.

Apple nears US$4 trillion market capitalisation

Apple’s share price rose to about US$269 at the close, implying a market capitalisation of roughly US$3.99 trillion and a year-to-date performance of c. 10.5 per cent. The stock’s strength has been supported by early demand indicators for the iPhone 17 and by the firm’s relative resilience to geopolitical trade tensions; sales in Greater China account for an important share of Apple’s revenue stream (approximately 17.1 per cent of total revenue, by the company’s reported metrics).

Market consensus, as summarised by analysts polled ahead of the company’s results, anticipates total revenues of c. US$102.17 billion (an annual increase of about 7.6 per cent) and earnings per share of c. US$1.78 (an anticipated rise of around 8.5 per cent year-on-year). Apple is scheduled to publish its third-quarter results on Thursday, 30 October; investors will focus on whether iPhone 17 sales and services growth meet or exceed expectations.

Figure 1. Apple stock price: historical overview (1983-2025). Source: Figure obtained from TradingView.

Trump pressures the Federal Reserve to ease policy

President Donald Trump publicly criticised the performance of Federal Reserve Chair Jerome Powell, describing it as “deficient”, and indicated he has a list of potential replacements ahead of the end of Powell’s term in May 2026. The remarks come one day before the Federal Open Market Committee’s policy decision, at which markets are heavily discounting a 25-basis-point cut: the CME Group’s FedWatch Tool currently assigns an extremely high probability to such a move for this week’s meeting.

Trump’s public intervention highlights political scrutiny of monetary policy and raises issues about perceived central-bank independence. Market participants will scrutinise both the Fed’s rate decision and Chair Powell’s accompanying communication for indications of the committee’s reaction function to incoming data and to political commentary.

Oil prices declined as supply concerns eased

Oil benchmarks retreated amid a reappraisal of near-term supply risks and reports of potential incremental OPEC+ production. Brent futures fell c. 2.79 per cent to US$63.85 per barrel, while WTI declined c. 2.05 per cent to US$60.15 per barrel. These moves followed Western sanctions on Russian energy firms announced last week and subsequent commentary suggesting some market participants expect the practical impact on global supply to be limited.

Reports that Lukoil may sell international assets and commentary from OPEC+ that production could be marginally increased in December (according to Reuters’s information) contributed to the softer price reaction; however, uncertainty about the ultimate effects of sanctions on Russian output remains a key risk to watch.

PayPal posts a Q3 beat

PayPal reported third-quarter revenue of US$8.42 billion, ahead of consensus of US$8.22 billion, and diluted earnings per share of US$1.34 versus an anticipated US$1.21. The results represent year-on-year revenue growth of c. 7.3 per cent and an EPS increase of c. 11.7 per cent. Following the announcement, PayPal’s shares rose approximately 3.94 per cent to close near US$73.02.