Brent and Copper slip as Dollar stability and supply concerns shape markets

Brent crude and copper both moved lower yesterday after recent gains, as a steadier U.S. dollar and supply-side developments weighed on sentiment. Brent prices softened amid concerns about ample global supply and cautious demand outlooks, while copper pulled back as traders reassessed positions following a strong rally. The U.S. dollar’s stability reduced appetite for dollar-priced commodities, adding pressure across the complex as markets headed into thin year-end trading conditions.

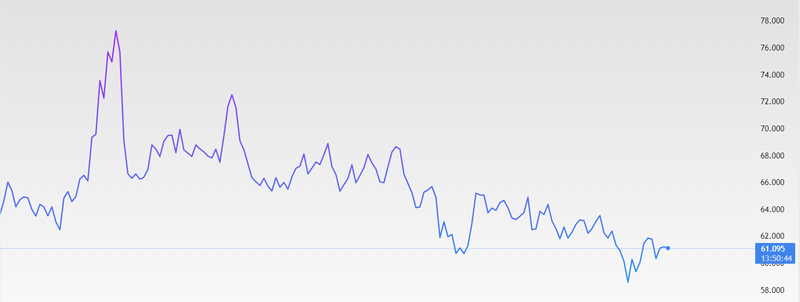

Brent eased as supply concerns and inventory expectations capped gains.

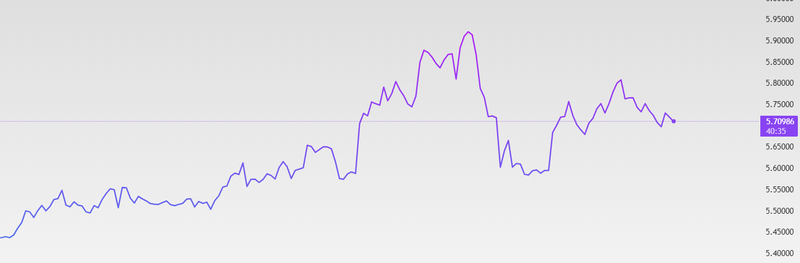

Copper pulled back on profit-taking after recent highs and softer demand signals.

Dollar stability pressured commodities, limiting upside across energy and metals.

Brent pressure from supply outlook

Brent traded lower after struggling to hold recent gains, reflecting ongoing concerns about global supply levels. Despite geopolitical risks remaining in focus, the market continues to be priced in ample supply from major producers. OPEC+ output increases and steady non-OPEC production have added to expectations that the market may remain well supplied heading into early 2026. Traders also remained cautious ahead of upcoming inventory data, particularly after recent reports showed mixed signals on demand. While seasonal demand typically offers support toward year-end, refinery margins and fuel consumption indicators have not shown a strong acceleration. As a result, rallies in Brent have met resistance, with sellers emerging as prices approach key levels. Geopolitical tensions, including developments in Eastern Europe and the Middle East, continue to provide intermittent support. However, without a clear disruption to supply, these risks have struggled to push prices meaningfully higher, keeping Brent in a tight range.

Source: Trading View

Copper profit-taking after strong rally

Copper prices pulled back after reaching multi-month highs earlier this month, as traders locked in profits amid slowing momentum. The metal had been supported by expectations of stronger demand from the energy transition and infrastructure spending, particularly in China. However, recent data pointed to uneven industrial activity, prompting a reassessment of short-term demand strength. Supply conditions remain relatively tight, with disruptions at some mines and limited new capacity coming online. Despite this, near-term price action has been dominated by positioning rather than fundamentals. Funds that accumulated long positions during the rally began reducing exposure as prices stalled, contributing to yesterday’s decline. Copper’s sensitivity to global growth expectations means it remains closely tied to economic data. With markets awaiting clearer signals from China and the U.S., price movements are likely to remain volatile in the short term.

Source: Trading View

U.S. dollar reaction to Fed minutes

The U.S. dollar remained steady but sensitive to policy signals after the release of the Federal Reserve’s December meeting minutes. The minutes highlighted a clear division within the 19-member policymaking committee over what poses the greater risk to the U.S. economy: a weakening labor market or inflation that remains stubbornly above target. This internal debate has kept currency markets cautious, particularly in thin year-end trading conditions. Most policymakers agreed that additional interest rate cuts would be appropriate if inflation continues to ease as expected over time. However, the minutes also revealed that some officials believe rates should remain on hold for some time following the December meeting. Even among those who supported the recent rate cut, several expressed reservations, noting that the decision was finely balanced and that they could have supported leaving rates unchanged. Importantly, the minutes suggest that while differences exist, the split may not be as deep as markets initially feared. Policymakers broadly acknowledged the need to move toward a more neutral policy stance, with most participants noting that easing financial conditions could help prevent a sharper deterioration in labor market conditions. At the same time, lingering concerns about inflation have limited expectations for rapid or aggressive easing. For the dollar, this mix of views has resulted in range-bound trading rather than a clear directional move. The absence of strong consensus on the policy path has reduced volatility, but it has also kept the dollar influential for commodity markets. A stable dollar continues to act as a headwind for dollar-priced assets such as Brent and copper, particularly in a market already cautious about demand and global growth.