Broadcom rallies after OpenAI deal; indices rebound

Broadcom's shares helped US markets recover after a strategic alliance between the semiconductor producer and OpenAI was announced.

Broadcom's shares rose 9.88% after a semiconductor design and production deal between the tech giant and OpenAI was announced.

The price of the gold contract exceeded $4,100 per ounce following the escalation of trade tensions between the US and China.

Chinese exports and imports exceeded expectations, with shipments to countries in Asia and Europe increasing while those to the US declined.

The third-quarter earnings season begins this week, with LSEG expecting a year-on-year increase in earnings for S&P 500 companies of 8.8%.

Broadcom and OpenAI announce collaboration agreement

The companies Broadcom and OpenAI have announced their strategic alliance regarding the design and production of semiconductors. The announcement clarifies that this is a joint effort that has been developing over the past 18 months, rather than a new partnership.

The systems—which include networking, memory, and compute—would help OpenAI cut costs and optimise budgets. In turn, Broadcom's revenues are expected to increase considerably. The deal adds to previously announced alliances between giants Nvidia and AMD with OpenAI, raising growth expectations for a tech industry that is increasingly focused on joint projects.

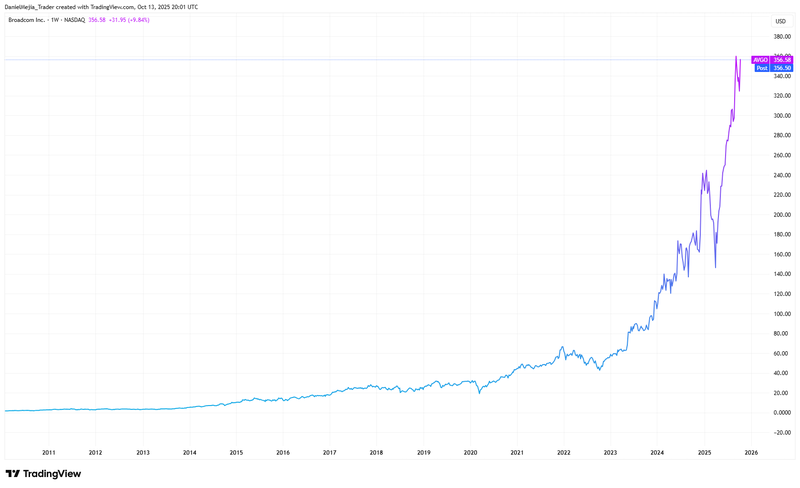

Regarding the market response, Broadcom's share price rose 9.88% at the close of the New York market, reaching a level of $356.70 per share, close to its all-time highs (see Figure 1). Today's market momentum allowed the company to be valued at $1.68 trillion in market capitalisation, making it the seventh most valuable company in the S&P 500 index.

In turn, the main US stock indices had a strong performance, recovering by an average of 1.67%. The S&P 500 rose by 1.56% to 6,654 points. The Dow Jones recovered 1.29%, reaching 46,067 points, while the Nasdaq 100 index rose 2.18%, closing at 24,750 points. The market was lifted by Broadcom's momentum as well as a conciliatory tone from the White House, after a meeting between the leaders of the US and China was confirmed for the end of October in South Korea.

Figure 1. Broadcom's historical share performance (2010-2025). Source: data from Nasdaq Exchange. Figure obtained from TradingView.

Gold hits new all-time highs on safe-haven demand

The gold futures contract (GCZ5) exceeded $4,100 per ounce, rising by 3.29% at today's close and setting a new record for the precious metal. Trade tensions between the US and China have added to global geopolitical uncertainty, which has boosted gold's valuation amid a search for safe-haven assets. In addition, expectations of monetary easing from the Federal Reserve, as well as continued demand from central banks, have allowed gold prices to continue reaching new highs.

Last Friday, President Trump announced a 100% tariff on Chinese imports in response to export controls on products containing rare earth minerals, which were announced by the Chinese government. However, on Sunday (12 October), the US president posted on social media that he does not seek to impact the Chinese or the US economy, suggesting an agreement could be reached. Earlier today, US Treasury Secretary Scott Bessent confirmed that a meeting between Presidents Donald Trump and Xi Jinping will take place at the Asia-Pacific Economic Cooperation forum in South Korea at the end of October.

China's exports and imports increase (YoY)

According to data from China's General Administration of Customs, exports increased more than expected, with the country achieving a year-on-year increase of 8.3% in its latest reading (previous: 4.4%). In turn, imports increased by 7.4% year-on-year, above analysts' forecasts and the previous reading of 1.3%.

According to information from Trading Economics, China has diversified its export destinations, with the largest increases in shipments going to Taiwan (+11%) and Australia (+10.7%). Exports to the European Union and ASEAN regions also increased, by 14.2% and 15.6% respectively. In contrast, exports to the US decreased by 27% due to the tariffs applied by the US. The information is relevant as it comes in a context where trade tensions between China and the US could escalate.

Wall Street's third-quarter reporting season begins

The US third-quarter reporting season is scheduled to begin this week. According to data from LSEG Data & Analytics, earnings for S&P 500 companies are expected to grow by 8.8% from the third quarter of the previous year. As is typical each quarter, the first companies to report their results are the large banks and financial groups. The following companies are notable for their relevance in the US market:

Tuesday

- JPMorgan (JPM)

- Wells Fargo & Co (WFC)

- Goldman Sachs (GS)

- BlackRock (BLK)

- Citigroup (C)

- Johnson & Johnson (JNJ)

Wednesday

- Bank of America (BAC)

- Morgan Stanley (MS)

- Abbott Labs (ABT)

Thursday

- The Charles Schwab (SCHW)

Friday

- American Express (AXP)

Key economic events this week

Monday

- China: Balance of Trade

Tuesday

- Australia: NAB Business Confidence

- United Kingdom: Unemployment Rate

- Germany: Inflation Rate

- US: Fed Chair Powell Speech

Wednesday

- China: Inflation Rate

Thursday

- US: Producer Price Index (PPI)

- US: Retail Sales

Friday

- European Union: Inflation Rate

- US: Building Permits

- US: Housing Starts