Bullion and oil prices retreat following US–Iran de-escalation

Precious metals and crude oil prices declined following a temporary de-escalation in tensions between Washington and Tehran, as both nations announced forthcoming negotiations in Oman this Friday. A diplomatic resolution would likely mitigate the risk of a broader regional conflict and reduce the geopolitical risk premium that has recently bolstered safe-haven assets and energy prices.

Precious metals saw a significant pullback during the session, led by a sharp decline in silver, as news of the Oman talks dampened safe-haven demand.

Oil prices retreated as the reduced threat of military confrontation eased concerns regarding potential supply bottlenecks in the Strait of Hormuz—a critical maritime corridor for approximately 20% of the global oil supply.

US stock indices declined amid mounting scepticism over the immediate returns on AI-related capital expenditures, despite outperforming results from technology giants such as Alphabet and AMD.

US–Iran tensions show signs of easing before Oman talks; Oil and bullion prices fall

According to reports from Reuters, precious metals and oil prices dropped in tandem following the announcement that the United States and Iran will hold talks in Oman this Friday. Market participants interpreted this development as a significant de-escalation that could avert a blockade of the Strait of Hormuz. Analysts and hedgers noted that a diplomatic path reduces the geopolitical risk premium by lowering the probability of a direct confrontation evolving into a wider Middle Eastern conflict, thereby cooling the demand for safe-haven assets.

Furthermore, traders are pricing in a potential increase in Russian crude exports to China—the world’s largest oil importer—anticipating a shift in Indian demand. India and the US recently announced a trade agreement in which New Delhi committed to reducing its reliance on Russian energy in favour of increased US crude imports.

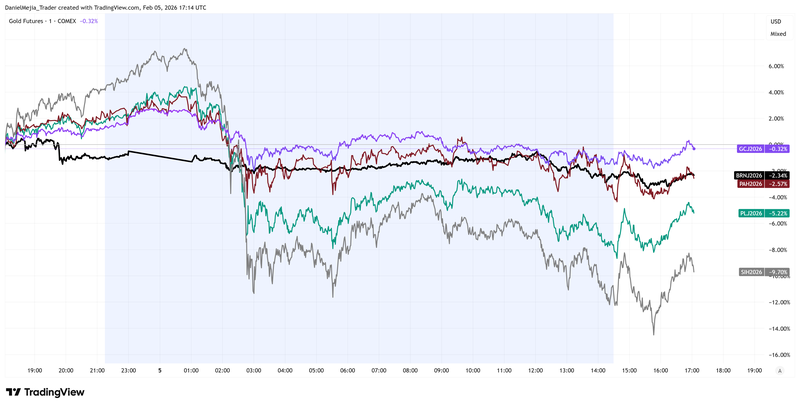

In the energy markets, the Brent crude contract (BRNJ26) fell 2.34% to $67.80 per barrel, while the West Texas Intermediate (WTI) contract (CLH26) decreased 2.41% to $63.57. Simultaneously, the bullion market faced substantial selling pressure: the silver contract (SIH26) plummeted 9.70% to $75.90 per ounce, platinum (PLJ26) fell 5.22% to $2,060, and palladium (PAH26) dropped 2.57% to $1,690. Gold (GCJ26) also depreciated, losing 1.27% to settle at $4,888 per ounce.

Figure 1. Daily performance of Brent, Gold, Silver, Platinum, and Palladium futures contracts. Source: Data from the COMEX and ICE-EUR Exchanges; Own analysis conducted via TradingView.

US stock markets decline amid uncertainty over artificial intelligence return

US equity markets retreated in a coordinated fashion as uncertainty grew regarding the long-term profitability of AI infrastructure. Although Alphabet and Advanced Micro Devices (AMD) reported quarterly financial results that surpassed analyst expectations, investors exerted downward pressure on share prices due to concerns over the "real" return on investment for AI. While both the public and private sectors have committed vast capital to AI development over the past year, concrete clues of realised returns are only expected to emerge in 2026.

Alphabet (GOOGL), for instance, comfortably exceeded estimates for both revenue and earnings per share (EPS) in Q4 2025. The company reported total revenue of $113.83 billion, surpassing the $111.33 billion forecast, with an EPS of $2.82 against an estimated $2.63. These results represent a robust year-on-year growth rate of 18% in revenue and 31% in EPS. Nevertheless, Alphabet’s shares depreciated by 2.50% to approximately $324.80 as investors remained wary of high capital expenditure.

Regarding broader market performance, the S&P 500 index dropped 1.15% to 6,803 points, the Dow Jones Industrial Average decreased 1.11% to 48,945, and the Nasdaq 100 fell 1.13% to close at 24,610 points.