Chinese stocks climb on strong exports, trade balance

Chinese equities advanced after a surprise improvement in the trade balance, driven by stronger-than-expected exports to Europe and Asia. Markets elsewhere were mixed: US equities slipped while 10-year Treasury yields rose as investors awaited the Federal Reserve’s policy decision. Japan’s economy, by contrast, contracted in Q3, underscoring divergent regional dynamics.

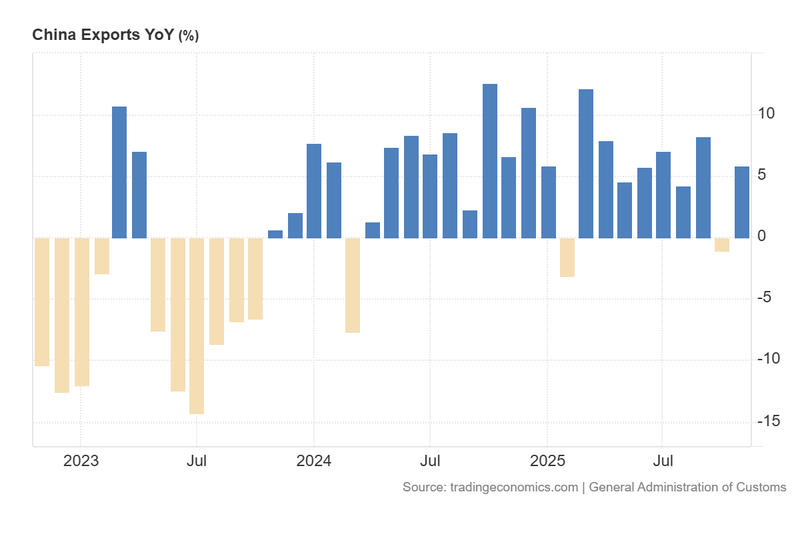

China’s exports rose 5.9 per cent (year-on-year) in November and imports increased 1.9 per cent, leaving a trade surplus of $111.68 billion, well above consensus.

Risk sentiment was cautious in the US: major equity indices fell while the 10-year Treasury yield climbed to 4.17 per cent, reflecting uncertainty ahead of the Fed meeting.

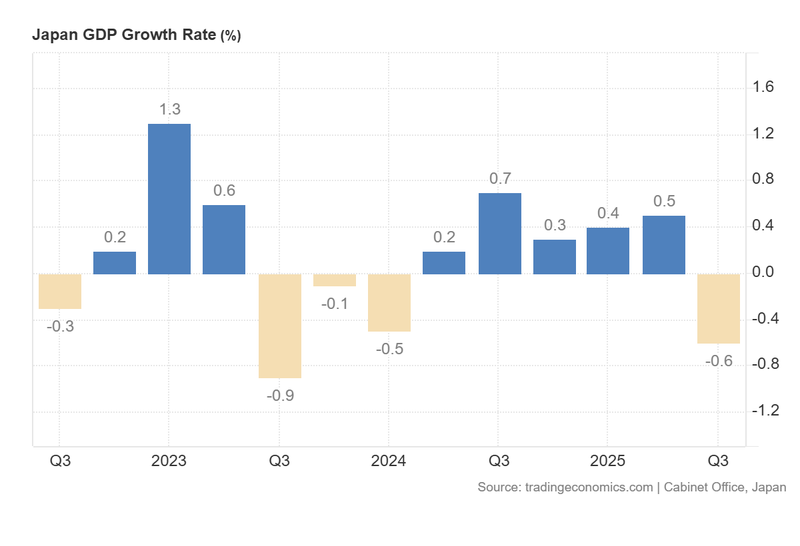

Japan recorded a quarterly GDP contraction of 0.6 per cent, weaker than expected, highlighting domestic demand and trade headwinds.

Market reactions were sector- and region-specific: the FTSE China A50 gained ground on the export surprise, while currency movements (notably the yen) influenced equity flows in Japan.

Chinese exports exceed expectations

Data from China’s General Administration of Customs showed a notable rebound in external demand in November. Exports rose 5.9 per cent year-on-year, reversing the prior month’s decline and comfortably beating the forecast of 3.8 per cent. Imports rose 1.9 per cent, slightly below expectations of 2.8 per cent, leaving a trade surplus of $111.68 billion, up from $90.07 billion previously.

Trading Economics highlights that the export recovery was supported by a deliberate diversification of destination markets: shipments to Australia rose 35.8 per cent, to Taiwan 12.8 per cent, to Japan 4.3 per cent, and to South Korea 1.9 per cent. By contrast, exports to the United States fell sharply (-28.6 per cent), despite the recent bilateral trade accords.

The stronger trade data underpinned a positive move in Chinese equities: the FTSE China A50 closed higher by 0.91 per cent at 15,320 points.

Figure 1. China exports (year-on-year). Source: General Administration of Customs; chart via Trading Economics.

US equity weakness while 10-year yields rise ahead of the Fed

Global investors adopted a cautious stance as attention shifted to the Federal Reserve’s upcoming policy meeting. Although market pricing still tilts towards an easing outcome, uncertainty surrounding the timing and scale of any cut pressured risk assets.

Major US indices fell by an average of 0.35 per cent, while the benchmark 10-year Treasury yield rose three basis points to 4.17 per cent. The divergence between equities and government bonds underscores investor hedging activity: equities price in growth risks, while bond yields reflect shifting expectations for monetary policy and safe-haven demand.

With a busy data calendar and the Fed decision imminent, market participants remain sensitive to any signals on the trajectory of interest rates and the outlook for growth.

Japan records sharper-than-expected contraction in Q3

Japan’s Cabinet Office reported a quarter-on-quarter GDP contraction of 0.6 per cent in Q3, deeper than the consensus forecast of -0.4 per cent and following a +0.5 per cent expansion in Q2. This represents the first quarterly decline since Q1 2024 and highlights ongoing fragility in domestic demand.

Net trade was a key drag: average monthly trade balances in July–September deteriorated by roughly ¥198 billion. The impact of tariffs and weaker external demand — including a notable exposure to the US market, which accounts for about 20 per cent of Japan’s exports — has weighed on the manufacturing and export sectors.

Market reaction was mixed. The yen weakened about 0.39 per cent against the US dollar to approximately ¥155.90, a depreciation that provided some support to exporters; the Nikkei 225 nonetheless ticked up 0.27 per cent, partly reflecting the currency effect making equities cheaper for foreign buyers.

Figure 2. Japan GDP growth (quarter-on-quarter). Source: Cabinet Office, Japan; chart via Trading Economics.

Key economic events this week

Monday

- China: Balance of Trade

Tuesday

- Australia: RBA Interest Rate Decision

- Germany: Balance of Trade

- US: JOLTs Job Openings

Wednesday

- China: Inflation Rate

- Canada: BoC Interest Rate Decision

- US: Fed Interest Rate Decision

- US: FOMC Economic Projections

Thursday

- Switzerland: SNB Interest Rate Decision

Friday

- United Kingdom: GDP Growth Rate (MoM)