Dollar's decline: rate cut bets, Fed reshuffle, and data controversy

Soft nonfarm payrolls elevate September rate-cut expectations to 80%, while internal Fed reshuffling and controversy over BLS data raise fresh doubts about U.S. monetary and fiscal credibility.

Friday’s weak jobs report dropped dollar sentiment sharply, pushing markets to price in an 80% likelihood of a September rate cut by the Fed.

Adriana Kugler's resignation—effective August 8—creates a vacancy for a likely dove, potentially influencing future dissent against Powell’s policy direction.

The firing of the Bureau of Labor Statistics head amid accusations of data manipulation sows uncertainty about U.S. economic statistics.

The Bank of England is expected to cut rates by 25bp, but internal splits and rising inflation keep future easing decisions in flux.

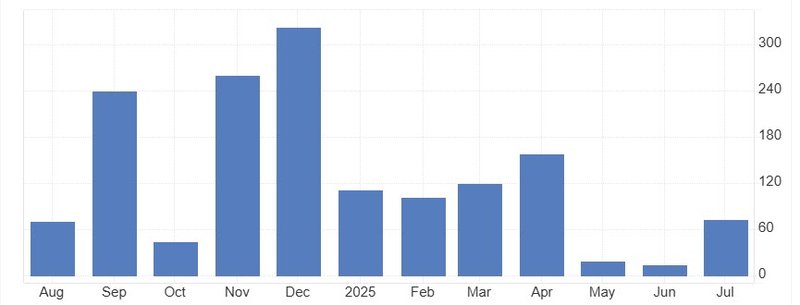

Jobs disappointment boosts rate-cut bets and dents dollar

Friday’s nonfarm payroll report delivered a shock to markets, with weaker-than-expected job gains softening the case for near-term tightening. In response, futures now assign an 80% probability of a policy rate cut as early as September—a stark shift from even a week ago.

Market watchers will be listening closely to comments from FOMC voters due Wednesday and Thursday, including Susan Collins, Lisa Cook, and Alberto Musalem, to gauge whether dissent votes may signal a broader shift in tone ahead of the September meeting.

Fed turnover stirs speculation ahead of Powell’s term-end

Fed Governor Adriana Kugler announced her resignation over the weekend, effective August 8. Her early exit—before her term ends in January—sets up a nominee who may align more dovishly than Powell, widely seen as a possible future Chair replacement.

Such a move would likely add another dissenting voice within the FOMC at a critical juncture, potentially emboldening other dovish-aligned governors and increasing internal pressure ahead of mid‑2026.

U.S. data credibility under scrutiny after BLS shakeup

Compounding policy uncertainty, President Trump fired the head of the Bureau of Labor Statistics, accusing her of manipulating jobs data for political agenda. The shakeup cast a pall over U.S. economic reporting and prompted concerns about reduced trust in macro indicators.

On the fixed income front, $125B in upcoming Treasury auctions (3-, 10-, and 30-year notes) adds another layer of risk. Investors may demand higher yields if confidence in data remains shaky.

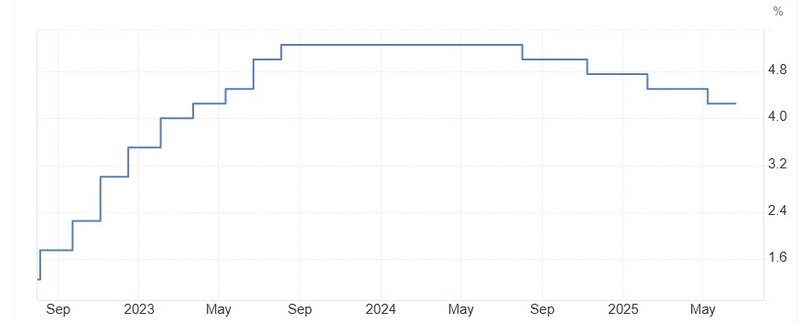

Bank of England likely to ease but faces split

The Bank of England is expected to deliver a 25 basis point rate cut this week, reducing the Bank Rate to 4.00%. According to Reuters, 62 of 75 economists expect two more cuts in 2025—taking policy to around 3.75% by year-end.

But internal divisions remain: hawks warn of stubborn inflation, now at 3.6% in June, while dovish board members emphasize the need to support a cooling labor market. If the BoE revises its inflation forecast above 4%, that may limit the pace and scale of future easing.

Here are some highlights for the week:

- Tuesday: BoJ minutes, China Caixin PMI services, Eurozone PMI services final, UK PMI services final, Canada trade balance, US trade balance, ISM services.

- Wednesday: New Zealand employment, Eurozone retail sales.

- Thursday: China trade balance, Swiss foreign currency reserves, unemployment rate, BoE rate decision, US jobless claims, Canada Ivey PMI.

- Friday: BoJ summary of opinions, Canada employment.