Eurozone inflation rises to 2%, still within ECB comfort zone

Eurozone inflation returned to the European Central Bank’s 2% target, lifting the euro to a near four-year high, as traders brace for escalating US trade tariffs and mixed signals from the Federal Reserve.

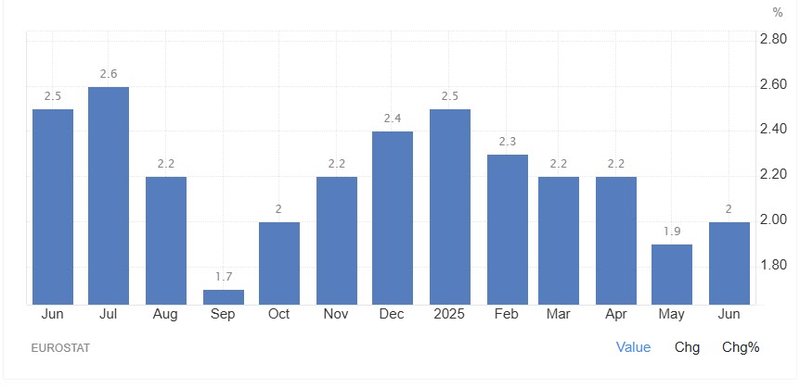

Eurozone inflation rose to 2% in June, with core inflation holding at 2.3%

Euro climbs above $1.180, its strongest since August 2021

US Treasury signals higher tariffs coming for nations missing next week’s trade deadline

Fed’s Goolsbee rules out stagflation but warns of simultaneous job and inflation risks

Euro rises as inflation edges to 2%, but ECB remains in control

The euro surged past $1.180 for the first time since August 2021 after Eurozone inflation data confirmed a return to the ECB’s 2% target. Headline inflation rose to 2% in June from 1.9% in May, meeting consensus expectations and marking the second straight month at or below the central bank’s benchmark.

The rise was mainly driven by higher services inflation, while energy prices continued their downward trend and food, alcohol, and tobacco cost increases slowed. Core inflation, which strips out volatile food and energy prices, remained steady at 2.3%, suggesting underlying price pressures remain contained but not yet fully subdued.

Markets took the data as a sign that the ECB will likely hold rates steady in the near term, especially with policymakers recently suggesting that further rate cuts would be highly data-dependent. Bond yields across the region slipped modestly as traders scaled back expectations for aggressive easing.

Washington signals tariff escalation as trade deadline looms

Across the Atlantic, trade tensions escalated as US Treasury Secretary Scott Bessent warned that Washington is prepared to impose higher tariffs on nations failing to reach trade deals before next week’s looming deadline. The temporary 10% baseline tariff, implemented as part of a 90-day pause, is set to expire, potentially reverting to levels as high as 50%, initially announced in April.

President Donald Trump amplified the pressure on trade partners through social media, criticizing Japan for its longstanding restrictions on US rice imports, calling it an example of “spoiled” trade behavior. The White House confirmed that countries unwilling to engage “in good faith” would face the full scale of US trade retaliation.

European leaders responded with strong language. French President Emmanuel Macron labeled the US tariff strategy as “blackmail,” accusing Washington of undermining transatlantic unity at a time when it simultaneously demands increased European defense spending.

The renewed trade tensions come at a critical moment for global markets, with several major economies already grappling with slower growth and fragile external demand.

Fed’s Goolsbee plays down stagflation, but flags twin risks

On the monetary policy front, Chicago Fed President Austan Goolsbee pushed back against fears of a 1970s-style stagflation scenario. Speaking overnight, Goolsbee highlighted that with unemployment still near 4% and inflation trending below 2.5%, comparisons to past stagflation episodes are not appropriate.

However, he struck a more cautious tone on the outlook for both growth and inflation, acknowledging that simultaneous deterioration in employment and price stability is a real possibility. Goolsbee emphasized that the Fed remains watchful for signs that current shocks—particularly from tariffs and supply chain reconfiguration—could prove more persistent than expected.

His comments come as market pricing continues to lean toward a September rate cut from the Fed, with futures showing an 85% probability. Traders will now look toward this week US labor data.