RBNZ cuts rates while German production weakens

Today's report focuses on relevant economic data. Industrial production in Germany came in below estimates, registering its sharpest drop since August 2021. In turn, the Reserve Bank of New Zealand (RBNZ) surprised the market with an interest rate cut of 50 basis points, larger than analysts had estimated. Meanwhile, crude oil inventories in the US have been rising for two consecutive weeks, indicating a potential supply build-up.

German industrial production fell by 4.3% month-on-month, contracting by 3.9% year-on-year.

The RBNZ surprised with a 50-basis-point cut to its interest rate due to a weakening economic situation.

Brent and WTI benchmarks rose despite a larger-than-expected build in EIA crude inventories.

The Fed's minutes show a committee divided on the risks related to employment and inflation, with the focus now on the government shutdown given the need for economic data.

Germany's industrial production surprises with larger-than-expected contraction

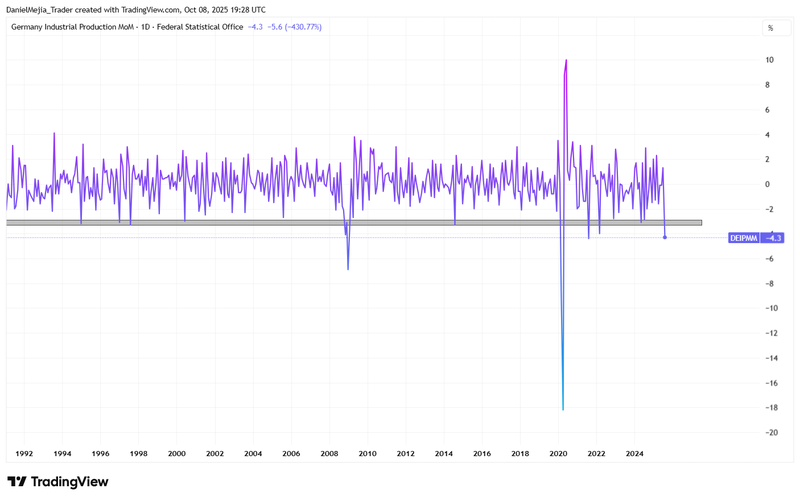

According to data from the Federal Statistical Office of Germany, industrial production registered its sharpest monthly fall since August 2021 (see Figure 1). The figure represents a contraction of 4.3%, larger than the 1% decrease analysts had forecast. As a result, the year-on-year variation of industrial production reflected a contraction of 3.9%, negatively impacting forecasts for the indicator's recovery.

According to Trading Economics, the industries with the greatest negative impact were the automotive industry (a contraction of 18.5%), the pharmaceutical industry (a drop of 10.3%), the manufacturing of machinery and equipment (a decrease of 6.2%), and the manufacturing of computer, electronic, and optical products (a fall of 6.1%).

Although Germany was beginning to show signs of recovery through various economic indicators, this downturn in industrial production reflects underlying weakness in its economic activity. The focus will now be on the next monthly data release, as the recent fall could be an anomaly. However, if monthly movements continue to reflect contraction and the year-on-year data shows greater deterioration, this could be a cause for concern, since the industrial sector currently represents approximately 25% of the country's Gross Domestic Product (GDP).

Regarding the market response, the German benchmark DAX40 index closed with an increase of 0.87% to 24,597 points, setting an all-time high. Meanwhile, the euro depreciated by approximately 0.25% against the US dollar. Germany remains the most significant economy in the European Union, so any notable impact on its economy would reasonably affect the strength of the euro.

Figure 1. Germany's Industrial Production, Monthly Change (1992-2025). Source: data from the Federal Statistical Office of Germany. Proprietary analysis conducted on TradingView.

RBNZ surprises with 50-basis-point cut to its interest rate

The Reserve Bank of New Zealand (RBNZ) delivered a surprise 50-basis-point cut, which was larger than the 25-basis-point reduction forecast by the analyst consensus. Consequently, the benchmark rate was reduced to 2.5% from 3.0%, its lowest level since July 2022. According to Trading Economics, the RBNZ justified the cut due to moderate domestic activity among households and companies, as well as broader economic weakness amid global political uncertainty. This marks the eighth interest rate cut by the central bank since the rate peaked at 5.5% in July 2024.

While inflation in New Zealand remains relatively subdued (2.7% year-on-year), employment data and economic activity are showing weakness. The unemployment rate is at a three-year high of 5.2%, following a 0.9% GDP contraction in the second quarter of 2025. This situation may be pressuring the RBNZ to adopt expansionary measures to support the country's economic recovery.

In foreign exchange markets, the New Zealand dollar depreciated against the US dollar by approximately 0.27%.

EIA crude oil inventories on the rise for a second week

According to the US Energy Information Administration (EIA), crude oil inventories showed a weekly build of 3.715 million barrels, larger than the consensus forecast of a 2.25 million barrel increase. While the direction of the change was anticipated, the magnitude of the increase was surprising, as the data was 65% above the forecast.

Despite the inventory indicator reflecting a momentary supply build-up, the Brent (BRNZ5) and WTI (CLX5) oil futures contracts did not see a corresponding downward price movement. The Brent benchmark rose by 1.22% at the close of the market to $66.25 per barrel, while WTI increased by 1.34% to a level of $62.55 per barrel.

Currently, oil traders are focusing more on OPEC+ supply forecasts, which came in below estimates, as well as on ongoing geopolitical risks. Direct attacks on fields or refineries in Russia, Ukraine, and the Middle East keep traders on alert due to potential impacts on already-affected energy supply chains.

Fed minutes show a committee divided on its next decisions

The Fed's minutes revealed a divided committee, as some members are concerned about the growing weakness in the labour market, while others remain cautious about the risk of a rebound in inflation. Although there appears to be a greater consensus favouring continued cuts, the government shutdown is a critical issue, since members of the FOMC have been emphatic that their decisions will be based on incoming economic data.

At present, the probability of a 25-basis-point cut remains above 90%, according to the CME Group's FedWatch tool. Analysts are weighing private reports, such as the ADP employment change indicator, which showed a contraction in its latest assessment. The focus is now on monitoring the government shutdown because, the longer it continues, the more data the Fed will have to forgo. The next relevant data release is the inflation report, which is scheduled for 15 October.