Gold and silver reach records as US–Europe tensions rise

Gold and silver futures have surged to record highs as geopolitical friction intensifies between the United States and several European nations over the disputed status of Greenland. Failure to reach a diplomatic resolution threatens to ignite a cross-continental trade conflict with the potential to destabilise multiple economic sectors.

Gold appreciated by 1.81% to settle at $4,678, while silver rose by 5.92% to reach $93.83 as investors pivoted toward safe-haven assets.

Major European stock indices retreated amid concerns regarding the implementation of proposed US tariffs.

This week, market volatility is expected to persist as fourth-quarter results from firms such as Netflix are released, alongside the upcoming PCE Price Index data.

US–Europe tensions drive gold and silver to new record highs

Gold and silver futures contracts have once again achieved record peaks amidst escalating geopolitical tensions between the United States and its NATO allies. Over the weekend, US President Donald Trump announced the possible implementation of incremental tariffs. These are scheduled to commence at 10% on 1 February, rising to 25% by 1 June, targeting nations that oppose the American annexation of Greenland. According to presidential statements, the affected countries include Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland.

While European governments have issued diplomatic communiqués expressing a desire for a peaceful resolution to the Greenlandic territorial dispute, there remains a significant possibility of retaliatory tariffs. Such measures would represent a direct response to American economic coercion, further exacerbating trade frictions between the two regions.

Consequently, gold and silver—assets traditionally utilised as a hedge against geopolitical and economic instability—have reached new historic highs. This regional dispute compounds existing global anxieties regarding tensions in Latin America, Iran, and Ukraine.

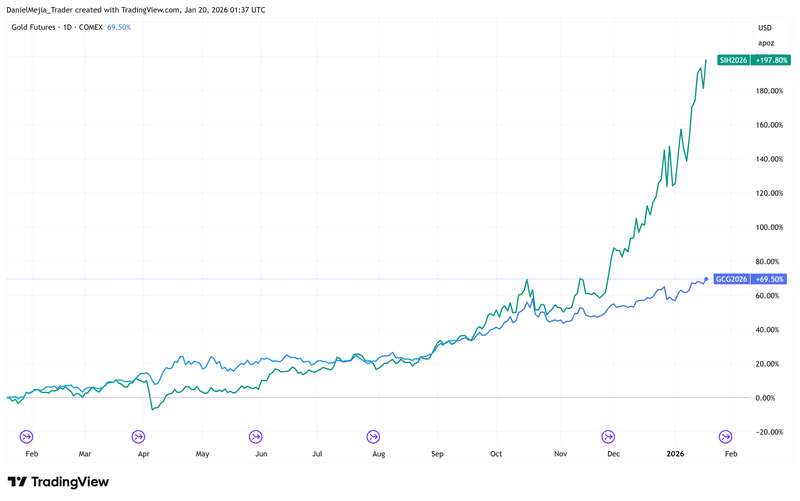

The gold futures contract (GCG26) concluded the session up 1.81% at $4,678 per ounce. Simultaneously, the silver futures contract (SIH26) saw a sharp appreciation of 5.92%, reaching $93.83 per ounce.

Figure 1. Gold and Silver futures contracts (2025-2026). Source: Data from the COMEX Exchange; Own analysis conducted via TradingView.

European stocks retreat on fears of US tariffs over Greenland dispute

European equity markets closed lower following the announcement of potential US tariffs on several key European trading partners. These proposed tariffs, that would start at 10% in February and scaling to 25% by June, would be superimposed upon existing trade barriers. Currently, tariffs of 10% are applied to the United Kingdom, with a 15% rate applied to the European Union.

Should a diplomatic impasse persist and these tariffs be enacted, the deep economic integration of these regions suggests that supply chains across various sectors will suffer significant disruption. In response, the European Union may deploy its "Anti-Coercion Instrument" (ACI). As reported by CNBC, this policy tool could allow the EU to restrict US suppliers from participating in public tenders within the bloc. Furthermore, the measure could impose stringent restrictions on the import and export of goods and services, alongside limits on foreign direct investment (FDI) originating from the United States.

In reaction to the heightened rhetoric, the French CAC-40 depreciated by 1.78% to 8,112 points, the German DAX-40 fell 1.34% to 24,959, and the UK's FTSE 100 declined by 0.39% to 10,195 points. The automotive and luxury goods sectors were among the most severely impacted by the market downturn.

Q4 US financial results

The fourth-quarter earnings season continues this week. The following key institutions are scheduled to report, which may contribute to further volatility in US equity markets:

Tuesday

- Netflix (NFLX)

- 3M Company (MMM)

Wednesday

- Johnson & Johnson (JNJ)

- The Charles Schwab (SCHW)

Thursday

- GE Aerospace (GE)

- Procter & Gamble Company (PG)

- Intel Corporation (INTC)

- Abbott Laboratories (ABT)

Key economic events this week

Monday

- China: Industrial Production (YoY)

- China: Retail Sales (YoY)

- Canada: Inflation Rate (YoY)

Tuesday

- United Kingdom: Unemployment Rate

- Germany: Economic Sentiment Index

Wednesday

- United Kingdom: Inflation Rate (YoY)

- Japan: Balance of Trade

Thursday

- US: Core PCE Price Index

- US: Personal Income & Personal Spending

- US: EIA Crude Oil Stocks Change

- Japan: Inflation Rate (YoY)

Friday

- Japan: BoJ Interest Rate Decision

- United Kingdom: Retail Sales

- Germany: Manufacturing PMI