Goldman, BlackRock, Morgan Stanley gain on solid reports

Major financial institutions Goldman Sachs, BlackRock, and Morgan Stanley provided a boost to US equity markets following the release of strong fourth-quarter results of 2025. Meanwhile, crude oil prices underwent a correction prompted by a substantial increase in US inventories. Simultaneously, the FTSE UK-100 reached a record milestone, underpinned by surprisingly resilient industrial and manufacturing production data from the United Kingdom.

Goldman Sachs and Morgan Stanley achieved record-high share prices, driven by earnings beats and optimistic outlooks for the 2026 fiscal year.

BlackRock recorded a 23% year-on-year (YoY) increase in total revenue, resulting in a share price appreciation of over 5%.

Crude oil benchmarks retreated after the Energy Information Administration (EIA) reported inventory builds that significantly exceeded market expectations.

UK Industrial Production rose by 2.3% YoY, propelling the FTSE UK-100 to a new all-time high despite a slight softening of the pound sterling.

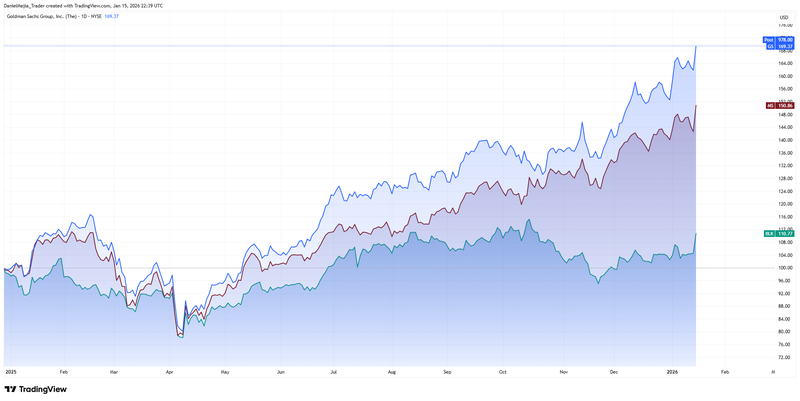

Solid results lift Goldman Sachs and Morgan Stanley to record levels as BlackRock approaches new highs

Financial heavyweights Morgan Stanley and BlackRock outperformed analyst expectations across key metrics. Goldman Sachs also surpassed Earnings Per Share (EPS) forecasts, although it narrowly missed revenue targets. Despite this discrepancy, investor sentiment remained overwhelmingly positive, with all three institutions securing considerable returns by the market close.

Goldman Sachs reported Q4 2025 revenue of $13.45 billion, falling short of the $14.49 billion consensus. However, EPS reached $14.01, significantly outpacing the $11.62 forecast. While revenue contracted by 3% YoY, EPS grew by 17%, signaling robust profitability and disciplined cost management. Furthermore, analysts maintain a bullish outlook for 2026, citing an anticipated strengthens in Mergers and Acquisitions (M&A) activity. Consequently, its share price climbed 4.63% to settle at $975.86, an all-time high.

Morgan Stanley also achieved a record valuation, rising 5.78% to end the session at $191.23. The firm reported quarterly revenue of $17.9 billion against an expected $17.72 billion, with an EPS of $2.68 (surpassing the $2.41 estimate). The bank demonstrated strong momentum with 10% YoY revenue growth and a 20% surge in EPS. Similar to its peers, the positive outlook for Morgan Stanley is bolstered by a projected uptick in M&A volume throughout the coming year.

BlackRock delivered a stellar performance, reporting Q4 revenue of $7 billion, exceeding the $6.75 billion forecast. EPS stood at $13.16, beating the $12.44 estimate. This represents a 23% YoY increase in revenue and a 10% rise in EPS. Investor confidence pushed the share price up by 5.93%, closing at $1,156.65.

The collective strength of these financial giants underpinned broader US market gains. The S&P 500 rose 0.26% to 6,944 points, the Dow Jones Industrial Average gained 0.60% to reach 49,442, and the Nasdaq-100 appreciated 0.32% to close at 25,547 points.

Figure 1. Goldman Sachs, Morgan Stanley, and BlackRock stock prices (2025-2026). Source: Data from the NYSE Exchange; Own analysis conducted via TradingView. Note: Stock prices in the chart are indexed to 100 for comparison.

Oil prices retreat as US inventories surpass expectations

The Brent and WTI benchmarks experienced a sharp downturn after the US Energy Information Administration (EIA) revealed a significant build-up in weekly crude inventories. The EIA reported an increase of 3.391 million barrels, contrasting sharply with analyst projections of a 2.2-million-barrel contraction. This surge in supply, if sustained, is expected to maintain downward pressure on global crude prices.

The Brent futures contract (BRNH26) closed down approximately 4.18% at $63.76 per barrel. Similarly, the WTI futures contract (CLH26) fell 4.76% to $59.11 per barrel. Crude volatility remains high as markets balance the prospects of increased US supply against potential disruptions stemming from escalating geopolitical tensions across Latin America, Europe, and the Middle East.

UK manufacturing and industrial production surpass forecasts

According to the Office for National Statistics (ONS), UK industrial production saw a marked acceleration, rising from 0.4% in October to 2.3% in November—the highest growth rate recorded since June 2021. Manufacturing production also showed significant improvement, shifting from a 0.2% contraction in October to 2.1% growth in November, its strongest performance since April 2024.

This data suggests a meaningful recovery in the industrial sector, providing a necessary counterpoint to the sluggish growth observed elsewhere in the economy. While the services sector has historically remained resilient, the industrial rebound adds a new layer of stability to the British economic landscape.

Despite these positive economic indicators, Pound Sterling depreciated by approximately 0.41% to 1.3363 against the US Dollar. Conversely, the FTSE UK-100 gained 0.54% to reach 10,238 points, marking a new all-time high for the UK’s benchmark index.