Japanese yen slides after softer-than-expected GDP

Japan’s fourth-quarter (Q4) 2025 GDP data revealed that the economy narrowly avoided a technical recession, though the expansion fell short of market forecasts. Despite expectations for a robust recovery driven by new government initiatives, both the Japanese yen and the Nikkei 225 index retreated following the release of the subdued growth figures. Simultaneously, global oil prices advanced as geopolitical uncertainty intensified ahead of critical diplomatic talks between the US and Iran.

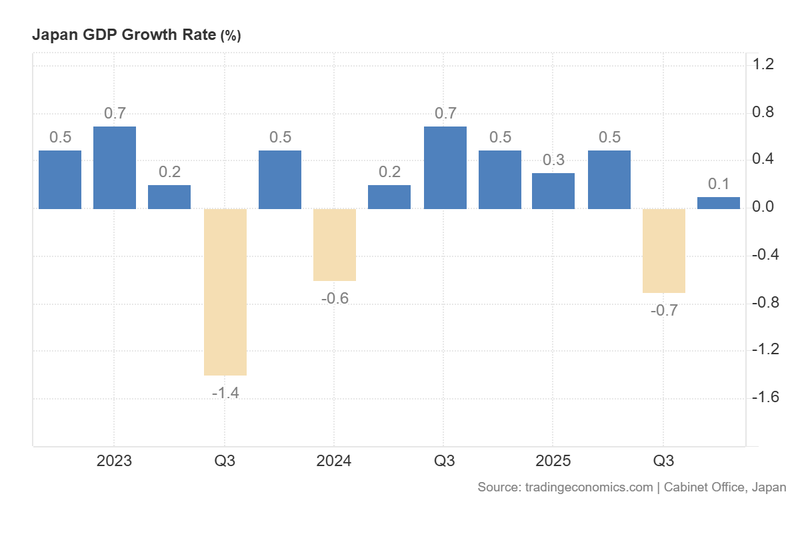

Japan’s GDP growth rate improved from –0.7% in Q3 to 0.1% in Q4 2025, successfully averting a technical recession—defined by two consecutive quarters of economic contraction.

Market participants remain optimistic regarding future growth, considering Prime Minister Sanae Takaichi’s aggressive economic initiatives and potential joint bilateral projects with the United States.

Oil prices rose by more than 1%, underpinned by a persistent geopolitical risk premium as markets await the outcome of renewed US–Iran negotiations this week.

Q4 2025 data averts technical recession but underwhelms analysts

According to preliminary data released by the Cabinet Office of Japan, the GDP growth rate for the final quarter of 2025 rose to 0.1% from a revised –0.7% in the previous period, thereby avoiding a technical recession. However, the result trailed analyst estimates, which had anticipated an expansion of 0.4%. The report highlighted that the most resilient segment was business investment, which recovered from a –0.3% contraction in Q3 to a 0.2% expansion. Conversely, private consumption—a vital economic driver—decelerated from 0.4% to 0.1% as households grappled with persistent cost-of-living pressures, particularly rising food prices. On an annualised basis, the Japanese economy grew by 0.2%, a significant improvement over the –2.6% recorded in Q3, yet far below the 1.6% consensus forecast.

In response to the data, the Japanese yen depreciated by 0.53%, trading at ¥153.47 against the US dollar. Similarly, the Nikkei 225 index slipped by 0.24% to close at 56,806 points.

While the avoidance of a recession is a positive development, the underlying data suggests a fragility that has concerned investors. Nonetheless, market sentiment is buoyed by expectations that the government will bolster growth through increased federal spending. Prime Minister Sanae Takaichi has consistently signalled her intent to reflate the economy, and analysts are closely monitoring potential industrial collaborations with the United States. According to reports from CNBC, Japan’s defence industry is projected to see a significant investment surge, potentially reaching 2% of GDP, with ancillary benefits expected for the factory automation, shipbuilding, and industrial manufacturing sectors.

Figure 1. Japan GDP Growth Rate (2023–2025). Source: Data from the Cabinet Office, Japan; Figure obtained from Trading Economics.

Oil prices rise ahead of US–Iran talks: geopolitical risk premium persists

Global oil benchmarks, Brent and WTI, rose in tandem as markets weighed the impact of US–Iran tensions against a potential production increase by OPEC+ members. The Brent futures contract (BRNJ26) advanced by 1.33% to $68.65 per barrel, while West Texas Intermediate (WTI) (CLH26) climbed 1.34% to $63.73 per barrel.

Investor focus remains on the second round of diplomatic talks scheduled for Tuesday in Geneva. According to Reuters, high-level envoys will discuss Iran’s nuclear programme in an effort to reach a comprehensive agreement. While Iranian officials have expressed a desire for a deal that offers mutual economic benefits, the geopolitical risk remains elevated; a failure to reach an accord could lead to a regional escalation. Crude prices have been bolstered by this uncertainty, as any disruption to Middle Eastern supply chains could severely tighten global markets.

Conversely, some downward pressure on prices may emerge if the Organization of the Petroleum Exporting Countries and its allies (OPEC+) follow through on plans to increase production in April to meet anticipated summer demand.

Quarterly US financial results

The corporate earnings season continues this week. The following key institutions are scheduled to report, which may contribute to further volatility in US equity markets:

Wednesday

- Moodys Corporation (MCO)

- Booking Holdings Inc (BKNG)

Thursday

- Walmart Inc. (WMT)

Friday

- Warner Bros Discovery (WBD)

Key economic events this week

During this week, several key economic indicators will be released. Some of the most important are the following:

Monday

- Australia: RBA Meeting Minutes

- United Kingdom: Unemployment Rate

Tuesday

- Germany: ZEW Economic Sentiment Index

- Canada: Inflation Rate

- Japan: Balance of Trade

- United Kingdom: Inflation Rate

Wednesday

- New Zeeland: RBNZ Monetary Policy Decision

- US: Building Permits

- US: Durable Goods Orders

- US: Housing Starts

- US: FOMC Minutes

Thursday

- Japan: Inflation Rate

- United Kingdom: Retail Sales

- Germany: Manufacturing PMI

Friday

- United Kingdom: S&P Global Manufacturing PMI

- US: PCE Price Index

- US: GDP Growth Rate

- US: Personal Spending