Major US banks miss expectations, markets retreat

The US earnings season commenced with mixed data from leading financial institutions, precipitating a shift toward pessimistic market sentiment as investors found the results lacked sufficient momentum. Concurrently, gold surged to a new all-time high as geopolitical tensions between the United States and Iran escalated.

Bank of America surpassed analysts' expectations for both revenue and earnings per share (EPS); however, its share price declined, weighed down by broader market apprehension regarding global geopolitical instability.

Wells Fargo and Citigroup failed to meet revenue estimates despite reporting EPS figures above forecasts; consequently, both stocks experienced downward pressure.

Gold prices reached a new record high amid heightened tensions between Washington and Tehran, following reports of a potential US intervention in the internal Iranian conflict.

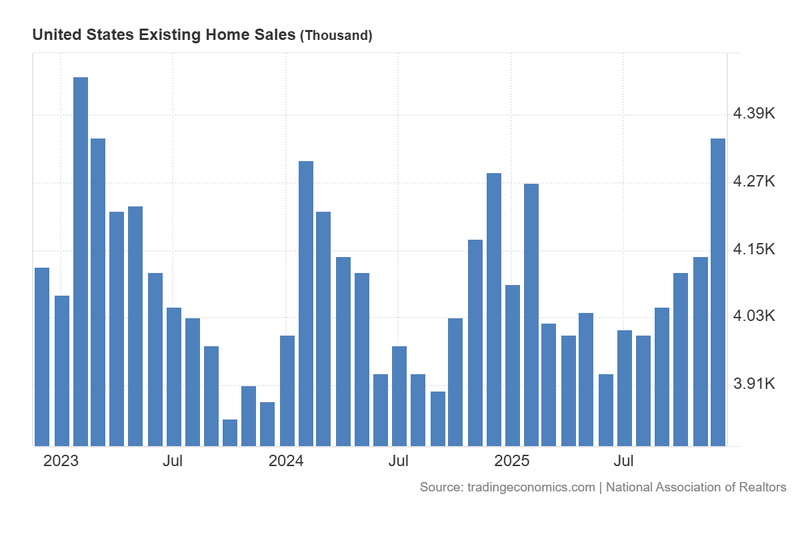

US home sales saw a considerable increase in December, buoyed by the gradual decline in mortgage reference rates during the final quarter of 2025.

Bank of America surpasses forecasts, while Citigroup and Wells Fargo exhibit mixed results

The reporting season for the fourth quarter of 2025 is underway. Initial releases from Bank of America, Wells Fargo & Co., and Citigroup have revealed a mixed performance across the banking sector.

Bank of America successfully exceeded market expectations. Fourth-quarter revenue reached $28.4 billion, outperforming the projected $27.55 billion. Similarly, reported earnings per share (EPS) stood at $0.98, above the consensus estimate of $0.96. Year-over-year (YoY) revenue growth was recorded at 11.9%, while EPS growth reached approximately 19%. Despite these robust fundamentals, the share price concluded the session with a 3.78% loss, closing at $52.48, as market sentiment remained constrained by acute geopolitical uncertainty.

In contrast, Wells Fargo failed to meet revenue targets but outperformed on profitability. The firm reported revenue of $21.29 billion, missing the $21.64 billion estimate. Regarding EPS, the company posted $1.76, surpassing the $1.66 expected by analysts. YoY revenue growth showed a modest 4.4% increase, while YoY EPS growth reached 13%. Consequently, the share price depreciated by approximately 4.61%, closing at $89.25.

Citigroup also faced a failure on revenue targets but outperformed profitability. The institution generated $19.9 billion in revenue, falling short of the $20.55 billion forecast. Conversely, EPS reached $1.81, exceeding the $1.70 anticipated by analysts. While YoY revenue grew by 1.5%, EPS saw a year-over-year decline of 11.2%. As a result, Citigroup’s share price fell by 3.34% to $112.41.

While corporate results were inconsistent, the major stock indices retreated simultaneously under the pressure of increased supply against limited demand. The S&P 500 fell 0.53% to 6,926 points, the Dow Jones Industrial Average decreased 0.09% to 49,149, and the Nasdaq-100 depreciated by 1.07% to 25,465 points.

Gold futures reach record highs amid rising risk premiums and social instability in Iran

Gold futures contracts attained a new all-time high, driven by the escalation of tensions between the US and Iran, alongside market expectations of monetary easing by the Federal Reserve this year. The gold contract (GCG26) traded on the COMEX appreciated by 0.76% to $4,634, marking a historic peak.

Regarding the volatility in Iran stemming from intensifying civilian protests, the Iranian government has warned of retaliatory strikes against US bases in neighbouring countries should Washington intervene directly in the internal conflict.

Furthermore, diplomatic friction persists in the West as US President Donald Trump continues to exert pressure on the Danish government regarding Greenland. Representatives from both nations are scheduled to meet in the coming days; however, the lack of an immediate resolution maintains a climate of gradual uncertainty.

US existing home sales rise considerably as inventory declines

According to data from the National Association of Realtors (NAR), sales of existing homes rose from 4.14 million in November to 4.35 million in December, surpassing the analyst consensus of 4.21 million. This represents an approximate 5% month-on-month increase and marks the highest level of activity since April 2023.

The housing report highlighted that the reduction in long-term mortgage rates during the final quarter of 2025 catalysed this surge in sales. This increased demand contributed to an 18% month-on-month decline in the inventory of units available for sale.

Figure 1. US Existing Home Sales (2023-2025). Source: Data from the National Association of Realtors; Figure obtained from Trading Economics.