Markets correct after core PCE uptick; court ruling clouds Trump tariffs

U.S. and European equities fell as firmer core PCE data stoked concerns that tariffs are feeding into inflation, while a federal appeals court ruling cast doubt over President Donald Trump’s trade program. Risk premia rose across assets as investors weighed a difficult mix of monetary and trade uncertainty.

The PCE Price Index met expectations, but fears of tariff-driven price pressure are rising.

A federal appeals court ruled that most of Trump’s global tariffs are illegal, pending Supreme Court review.

The U.S. ended the tariff exemption for low-value imports, raising costs for e-commerce flows.

PCE data steady, but core pressures build

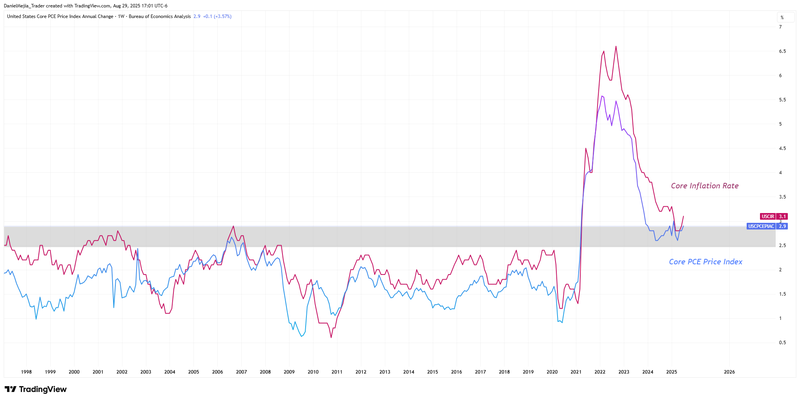

The Commerce Department reported July headline PCE inflation of 0.2% m/m and 2.6% y/y, in line with expectations. Core PCE, however, accelerated to 0.3% m/m and 2.9% y/y, up from 2.8%. The report highlighted persistent firmness in tariff-sensitive categories, raising fears that trade frictions are beginning to pass through into consumer prices.

Market rate expectations were little changed—CME FedWatch still implies two cuts by year-end—but the tone underscored anxiety that tariffs could rekindle inflation momentum. Both core PCE and core CPI appear to have found a floor, tilting higher into H2 2025 and making upcoming data pivotal for Fed policy.

Appeals court strikes at tariff framework

A U.S. federal appeals court ruled that most of Trump’s global tariffs were imposed illegally, finding that the statute he relied on did not authorize such measures—powers that constitutionally rest with Congress. The ruling was stayed until October 14, giving the administration time to appeal to the Supreme Court.

Trump denounced the decision as partisan, writing on his social platform that, if upheld, it would “destabilize the United States economy.” The case adds legal uncertainty to an already tense trade-policy backdrop.

U.S. ends de minimis exemption for low-value parcels

Separately, the U.S. scrapped the “de minimis” tariff exemption for imports under $800. Effective today, U.S. Customs will collect duties on all low-value shipments regardless of origin or transport mode. The policy—previously in place for China and Hong Kong since May—now applies globally.

The move will most directly affect e-commerce and small-scale exporters reliant on cross-border parcels, while also boosting Treasury revenue through broader tariff collections.

Market reaction

U.S. and European equities ended lower as investors weighed firmer core inflation against rising trade-policy risks. The combination reinforced risk premia across rates, FX, and commodities, keeping markets highly sensitive to the balance between prospective Fed easing and tariff-driven inflation pressures.