Netflix stock falls on mixed results and ongoing US shutdown

Major US equity indices fell after Netflix reported mixed third-quarter results and as trade tensions between the United States and China escalated. The US federal government shutdown persists after Democrats rejected the most recent Republican proposal, now making it the second-longest in US history.

Netflix shares declined c. 10 per cent after earnings per share missed analysts’ forecasts, signalling a quarter-on-quarter deterioration.

Major US indices fell in parallel, with the S&P 500, Dow Jones and Nasdaq-100 all closing lower on the day.

The US government shutdown continues, becoming the second longest such lapse on record.

Brent and WTI futures rose c. 4.94 per cent and 2.20 per cent respectively, supported by a weekly inventory draw and sanctions on Russian energy firms.

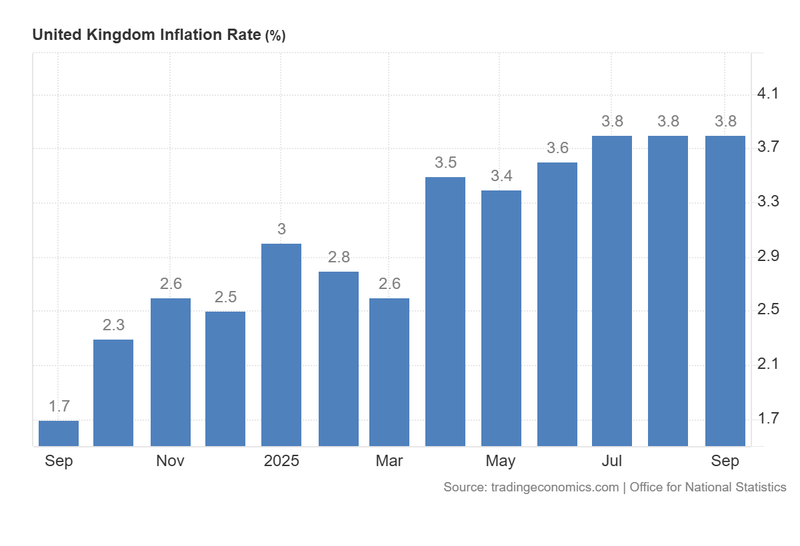

UK inflation data surprised to the downside: core inflation moderated to 3.5 per cent and headline inflation held at 3.8 per cent, prompting markets to price more BoE easing.

Netflix shares fall after mixed third-quarter results

Netflix shares fell approximately 10 per cent at the close, trading near $1,116.37 (see Figure 1), after the company delivered a mixed set of third-quarter results. Revenue of $11.51 billion matched consensus and represented a quarterly increase of 3.88 per cent and a year-on-year rise of 17.20 per cent. By contrast, earnings per share (EPS) of $5.87 underperformed the expected $6.96, implying a quarterly EPS decline of about 18.3 per cent despite an 8.7 per cent year-on-year increase.

Market sentiment was further weighed by comments from President Donald Trump that a planned meeting with President Xi Jinping in South Korea might not occur as expected, raising concerns that trade negotiations could be delayed. The White House has also reportedly considered restrictions on Chinese software exports in response to recent rare-earth export controls, adding to near-term geopolitical uncertainty.

Major US indices closed lower: the S&P 500 fell 0.53 per cent to 6,699, the Dow Jones declined 0.71 per cent to 46,590, and the Nasdaq-100 lost 0.99 per cent to 24,879.

Figure 1. Netflix share prices (Year-to-Date). Source: Data from Nasdaq Exchange. Analysis conducted via TradingView.

US shutdown becomes the second longest in history

CNBC reports that the federal funding lapse is now the second longest government shutdown in US history, trailing only the c. five-week lapse during the first Trump administration in December 2018. Negotiations remain deadlocked: Democrats seek additional spending on healthcare and other priorities, while House Republicans have resisted incorporating those measures into the funding bill.

The shutdown’s continuation has material consequences for data flow: some official statistics — notably certain employment and other macroeconomic releases — have been delayed or curtailed. This is particularly consequential given the proximity of the next Federal Reserve meeting on 29 October, when policymakers will assess incoming data to inform decisions on monetary policy.

Oil prices rise on inventory draw and sanctions on Russian firms

The US Energy Information Administration reported a weekly decline in crude inventories of 0.961 million barrels, compared with analysts’ expectations of a 1.2 million-barrel build. The smaller-than-expected draw was interpreted as evidence of higher demand on near-term oil market conditions.

Separately, Reuters reported that the United States has imposed sanctions on Russian energy firms including Rosneft and Lukoil, part of broader efforts to pressure Russia over its conflict in Ukraine. US policy initiatives, together with discussions of reduced Russian crude purchases by some trading partners, have added to supply-side concerns.

Brent futures (BRNZ5) rallied about 4.94 per cent to $64.35 per barrel, while WTI futures (CLZ5) rose c. 2.20 per cent to $58.50 per barrel.

Figure 2. Brent oil prices (Year-to-Date). Source: data from the ICE-EUR Exchange. Analysis conducted via TradingView.

UK inflation prints temper BoE outlook

The Office for National Statistics reported that UK core inflation slowed to 3.5 per cent year-on-year (from 3.6 per cent), while headline inflation remained unchanged at 3.8 per cent, below forecasts that had pointed to a rise towards 4.0 per cent. The headline rate has now been 3.8 per cent for three consecutive months.

Market participants interpreted the moderation in core inflation and the stabilisation of headline inflation as increasing the likelihood of more Bank of England easing later in the year. This shift in expectations exerted modest downward pressure on sterling, which traded around $1.3353, while the FTSE 100 rallied 0.93 per cent to 9,515 as a lower-for-longer rate outlook tends to support equity valuations.

Figure 3. United Kingdom Inflation Rate (year-on-year). Source: data from the Office for National Statistics. Analysis obtained from Trading Economics.

If you're interested in trading indices, foreign exchange, shares, or commodities, consider exploring the CFD contracts offered by Equiti Group. Please note that trading leveraged derivatives involves a high level of risk and may not be suitable for all investors.