Nikkei reaches new peak on Japan’s stimulus optimism

A combination of rising expectations of expansionary policy in Japan and stronger-than-expected Chinese economic data propelled the Nikkei 225 to a record closing high. Chinese third-quarter GDP, industrial production and retail-sales figures exceeded analysts’ forecasts, supporting broader Asian equities.

The Nikkei 225 reached a record high, rising 3.37 per cent on the day and registering a year-to-date gain of 24 per cent on hopes of policy stimulus.

Chinese macro data surprised on the upside: Q3 GDP, industrial production and retail sales all beat consensus.

An extended AWS outage disrupted the operations of many global companies, underscoring dependence on major cloud providers.

The United States and Australia announced a critical-minerals and rare-earths agreement worth around US$8.5 billion to strengthen supply chains.

Nikkei at record highs amid stronger Chinese data and stimulus expectations

The robust economic performance in China has underpinned gains across Asian markets, including Japan’s benchmark Nikkei 225 index. Investors are showing confidence in the resilience of the Chinese economy, maintaining positive expectations despite a global economic backdrop in which the United States continues to pursue coercive trade negotiations with other countries, including China.

Political developments in Japan were a further catalyst. Market participants have interpreted the rising prominence of Sanae Takaichi within the Liberal Democratic Party as increasing the probability of a pro-stimulus policy stance should she attain the premiership. Investors commonly view such a stance as positive for equity markets and negative for the yen.

The Nikkei 225 closed up 3.37 per cent at 49,185 points — a record high — while the yen weakened modestly, trading near ¥150.70 to the US dollar. The index’s year-to-date performance stands at approximately 24 per cent.

Figure 1. Japan’s Nikkei Index (1950-2025). Source: Figure obtained from TradingView.

Chinese economic data beat forecasts

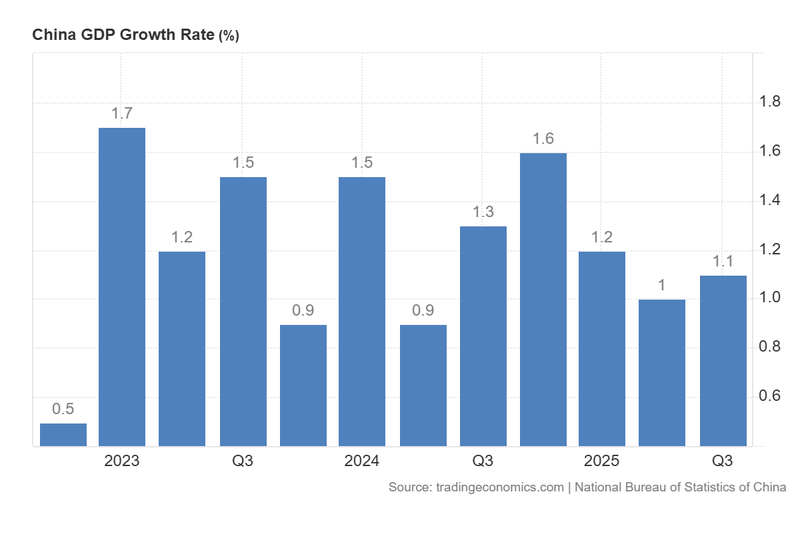

Data from China’s National Bureau of Statistics showed industrial production accelerating to 6.5 per cent year-on-year, ahead of the prior 5.2 per cent reading. Retail sales rose 3.0 per cent year-on-year, slightly above consensus, and third-quarter GDP expanded by 1.1 per cent quarter-on-quarter, marginally higher than forecasts and the previous quarter’s 1.0 per cent. (See Figure 2.)

While the upside surprises provided reassurance after a period of weak domestic consumption and subdued consumer confidence, commentators noted that a broad-based recovery has not yet been fully established. Market participants nonetheless remain attentive to potential additional stimulus from the People’s Bank of China and fiscal authorities, which could reinforce the recovery.

Chinese equity indices responded modestly to the data: the CSI 300 rose 0.53 per cent to 4,538, the Hang Seng gained 1.42 per cent to 26,232, and the FTSE China A50 advanced 0.37 per cent to 15,043.

Figure 2. China’s GDP growth rate (2023-2025). Source: Data from National Bureau of Statistics of China. Figure obtained from Trading Economics.

AWS outage highlights cloud-service concentration risk

A significant outage at Amazon Web Services (AWS) disrupted services for many companies worldwide for a period exceeding 12 hours. Amazon later reported the issue resolved, but the incident affected high-profile firms including United Airlines, Robinhood, Reddit, Snapchat, The New York Times, McDonald’s and Disney, and also disrupted certain government sites.

For technology and operations specialists, the episode underscored the systemic risk associated with high concentrations of critical infrastructure in a small number of cloud providers. Despite the operational impact, Amazon’s share price rose 1.61 per cent to US$216.48 on the day, suggesting investor confidence in the company’s longer-term fundamentals.

US–Australia critical-minerals agreement

The United States and Australia announced a strategic agreement on critical minerals and rare earths valued at approximately US$8.5 billion, according to CNBC. The accord — publicly endorsed by President Donald Trump and Prime Minister Anthony Albanese — is intended to bolster supply-chain resilience and reduce reliance on a single dominant supplier. The initiative will focus on near-term implementation over the next 6 to 12 months.

Rare earths and critical minerals are central inputs for semiconductors, electric vehicles, defence systems and other advanced technologies. Australia is notable as one of the limited number of non-Chinese processors of certain rare-earth elements, albeit at a smaller scale than China.

Wall Street: third-quarter reporting week

This week is significant for U.S. corporate earnings, with several major companies set to release their financial reports. Two members of the “Magnificent Seven” group are scheduled to present their results. In addition, a large number of firms will report their third-quarter earnings to investors. Some of the most notable, due to their market capitalization and public interest, include the following:

Tuesday

- Netflix (NFLX)

- GE Aerospace (GE)

- Coca-Cola Company (KO)

- Philip Morris (PM)

- 3M (MMM)

Wednesday

- Tesla (TSLA)

- IBM (IBM)

- AT&T (T)

Thursday

- Intel (INTC)

- Ford Motor (F)

Friday

- Procter & Gamble (PG)

Key economic events this week

Monday:

- China: Industrial Production

- China: Retail Sales

- China: GDP Growth Rate

Tuesday:

- Canada: Inflation Rate

- Japan: Balance of Trade

Wednesday:

- United Kingdom: Inflation Rate

- US: EIA Crude Oil Stocks Change

Thursday:

- Japan: Inflation Rate

- Mexico: Inflation Rate

- US: Initial Jobless Claims

Friday:

- United Kingdom: Retail Sales

- Germany: HCOB Manufacturing PMI

- United Kingdom: S&P Global Manufacturing PMI

- US: Inflation Rate

If you're interested in trading indices, foreign exchange, shares, or commodities, consider exploring the CFD contracts offered by Equiti Group. Please note that trading leveraged derivatives involves a high level of risk and may not be suitable for all investors.